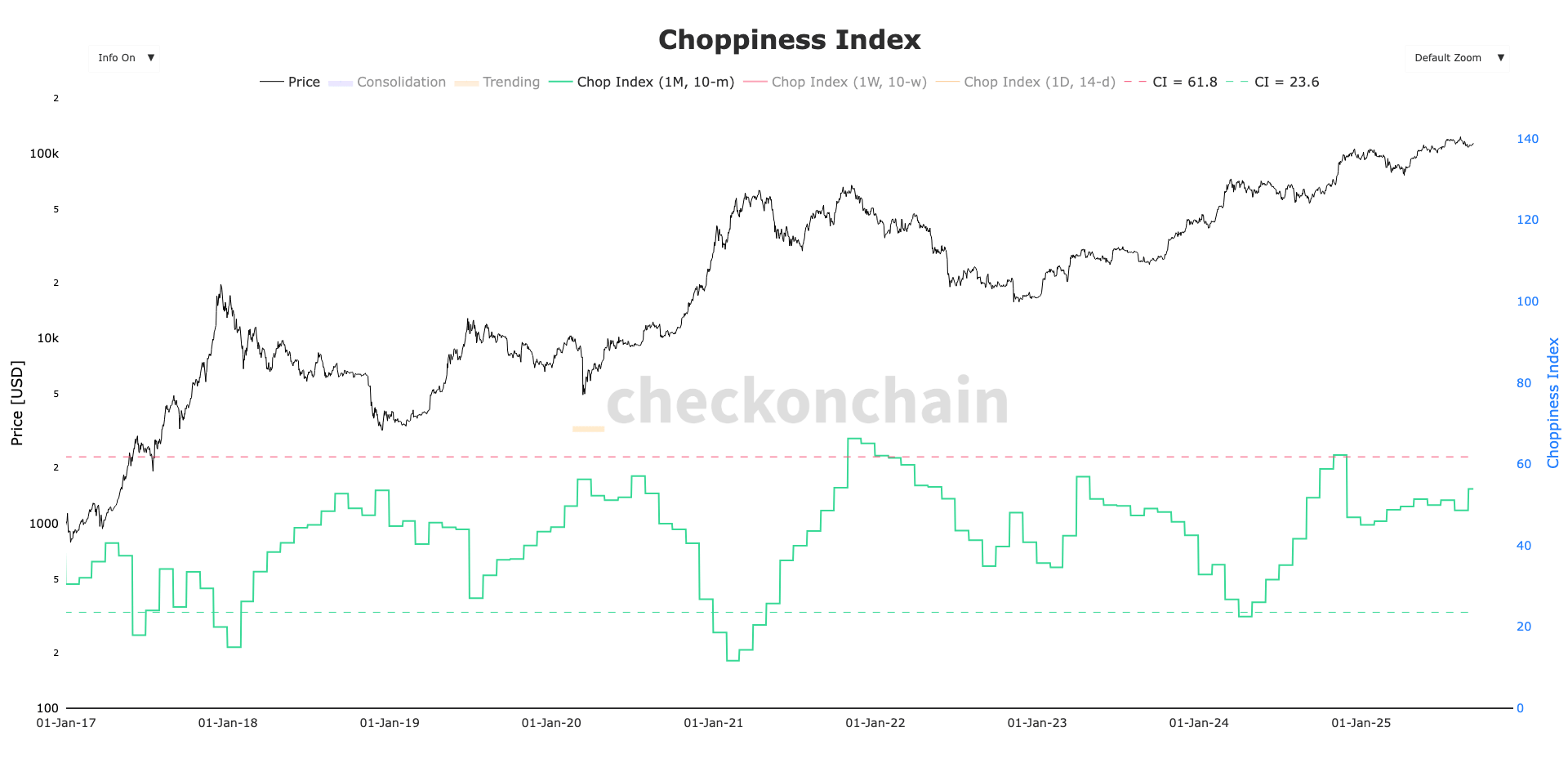

The compression of continuous Bitcoin volatility has intensified with what the CheckMate analyst calls “the choppiness index”, a metric which assesses the consolidation of laterally prices.

The previous research of Coindesk stressed that the implicit volatility of Bitcoin remains in multi -year hollows, which supports the lateral consolidation of the Bitcoin price.

This horror reflects the recent Bitcoin behavior. In recent months, Bitcoin exchanged between $ 110,000 and its $ 124,000 summit, currently oscillating about $ 113,000.

Over the time of one month, according to Checkonchain, the Choppiness index increased to 54. The last time it exceeded this level, it was in early November 2024, just before President Trump’s electoral victory triggered a Bitcoin thrust at more than $ 90,000. At this stage, the index culminated at 64. The previous body before it was at the beginning of 2023, at the beginning of the current bull cycle, when the index was at 57.

This scheme suggests that there can still be a place for additional consolidation, especially since volatility continues to compress.

The next major macroeconomic catalyst is the American consumer price index (ICC)Scheduled for the exit at 12:30 p.m. UTC. This could act as a trigger for a volatility escape or a directional price movement.

Coindesk Research from February also noted an extended period whose drop in prices also preceded the drop in prices which ultimately overflowed in April around $ 76,000.