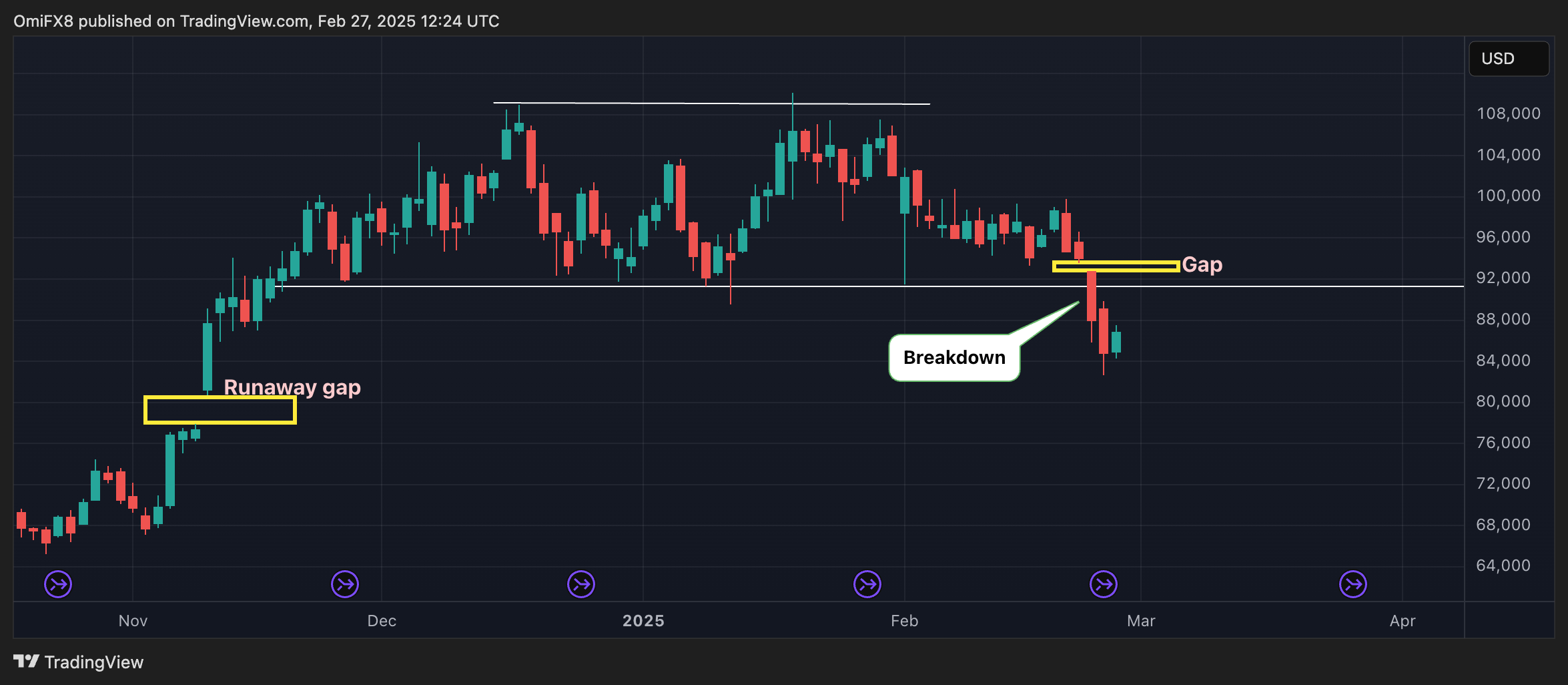

Bitcoin (BTC) dropped by $ 10% to $ 86,300 this week, diving from an extended negotiation period between $ 90,000 and $ 110,000.

The breakdown of the so-called lower range is closely the merchants examining the graphics closely for clues to the place where the sale can generate prices afterwards. One of the key levels under surveillance is the “leaked ditch” in the term contracts on CME Bitcoin less than $ 80,000, which formed three months ago.

A gap is an empty space on an table of prices between the closing price or the high price for a specific day and the next opening price, which means that there was no negotiation activity at prices between the two. When the gap appears in an established trend, it is called a leakage or continuation gap.

Unlike the Bitcoin paper market, open 24/7, CME Bitcoin Futures negotiates 23 hours a day from Sunday to Friday. The market opens at 5 p.m. CT (23:00 UTC) and closes for an hour of maintenance the next day at 4 p.m.

While the Bitcoin rally retired to steam after President Donald Trump’s electoral victory, on November 4, a flight gap appeared in the CME’s term contracts the next day. The prices opened the next day at $ 81,210, clearly above the Summit of the Elections of Elections of $ 77,930.

It is largely judged that the price gaps are ultimately filled, the traders buying and selling the assets in the previously not negotiated area. The process is often considered as natural market behavior, reflecting a return to balance.

“Historically, the CME gaps are ultimately filled, and it is generally difficult to say when,” said Nicolai SONDERGAARD, research analyst in Nansen, in a telegram message. “The recent unexpected events are the most important reasons for which we have seen these big movements downwards and without them, I think we would not really look at CME GAP.”

Nansen’s risk indicators have recently “taken risks”, so it would not be surprising that CME Gap was filled, said Sondergaard

The theory of technical analysis, however, suggests the opposite. He indicates that current gaps, which often occur during regular trade, and exhaustion gaps, which appear during trend reversals, are generally filled quickly. On the other hand, the probability that the flight gaps fill up is relatively low.

It should be noted that a gap formed between February 24 and February 25, prices abandoned prolonged consolidation. Which of these shortcomings will be filled first uncertain.

Update (February 27, 12:51 UTC): Add an abandoned word in the first point.