By Omkar Godbole (all the time and unless otherwise indicated)

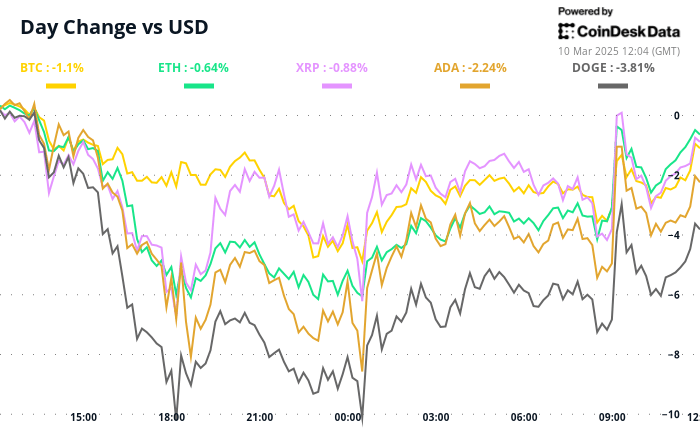

The cryptography market continues to lose ground, motivated by disappointment in the face of the absence of a plan for the US government to buy Bitcoin within the framework of the newly announced strategic reserve plan and in the midst of persistent macroeconomic concerns.

BTC fell at $ 80,000 at the end of Sunday, negotiating below the simple 200 -day mobile average, and Ether took an increased macro trend line with a drop below long -standing support of $ 2,100. Other pieces followed the two majors, displaying greater losses.

“Many investors withdraw from Bitcoin, considering it as a class of risky assets for the first time since Trump took the White House,” said Zach Burks, CEO and founder of the Mintology of the NFT service provider. “He no longer plays his role of reserve of value.

The prices make it more difficult for the Fed to progress with rate drops despite the continuous decrease trend of inflation indicators in real time. Friday, the president of the Fed, Jerome Powell, said that the central bank awaited greater clarity on Trump’s policies before making the next move.

Meanwhile, the rose of the fastest basic wages in Japan in 32 years has strengthened the case for an increase in BOJ rates, pushing the country’s bond yields and the higher Yen. The episodes of force in the currency of paradise generally cause volatility of the disadvantages of risk assets.

However, some observers do not know if market weakness, especially on weekends, could be durable. “Trading volumes during the weekend have been extremely weak, which reduces the value of the lowering signal,” Alex Kuptsikevich, chief analyst of the FXPRO, told Coindesk Alex Kuptsk.

“We note that the sellers lower the price during a low liquidity period, but the price bounces with the arrival of institutional buyers. It seems that large buyers have enough liquidity to buy the withdrawal,” said Kuptsikevich. Stay vigilant!

What to look at

- Crypto:

- Macro

- March 10, 7:50 p.m.: The outings of the office office (final) of the GDP in the second quarter.

- GDP growth has announcing prev. 1.2%

- QOQ GDP growth rate is. 0.7% against Prev. 0.3%

- March 11, 8:00 am: The Brazilian Institute of Geography and Statistics (IBGE) publishes industrial production data in January.

- Industrial production mom prev. -0.3%

- Industrial production yyoy prev. 1.6%

- March 11, 10:00 am: The American Labor Department publishes the JOLTS Report of January (Job openings, hires and separations).

- Employment openings is. 7.71m against prev. 7.6 m

- Job leaves the prev. 3.197m

- March 10, 7:50 p.m.: The outings of the office office (final) of the GDP in the second quarter.

- Gains (Estimates based on facts)

- March 17 (TBC): Bit Digital (BTBT), -0.05 $

- March 18 (TBC): Terawulf (Wulf), -0.04 $

- March 24 (TBC): Galaxy Digital Holdings (TSE: GLXX), C 0.39 $

Token events

- Governance votes and calls

- Unlocking

- March 12: Aptos (Apt) to unlock 1.93% of the supply in circulation worth 62.09 million dollars.

- March 15: Starknet (Strk) to unlock 2.33% of its power supply worth $ 10.25 million.

- March 15: SEI (SEI) to unlock 1.19% of its food in circulation worth $ 10.99 million.

- March 16: Arbitrum (ARB) to unlock 2.1% of its food in circulation worth $ 33.46 million.

- March 18: Fasttoken (FTN) to unlock 4.66% of its supply in circulation worth $ 80 million.

- March 21: immutable (IMX) to unlock 1.39% of the supply in circulation worth $ 13.13 million.

- Token lists

- March 11: Parbit to delimit Bancor (BNT), Paxos Gold (Paxg) and the threshold.

- March 31: Binance to radialize USDT, FDUSD, TUSD, USDP, DAI, AUR, UST, USTC and PAXG.

Conferences

Talk about tokens

By Shaurya Malwa

- Zerebro (Zerebro), formerly an agent agent token, crushed 96% compared to its advanced market capitalization in January more than $ 800 million at only $ 33.5 million.

- The AA agent tokens were among the hottest sectors in October and November, seeing rapid lists by exchanges and promotion by influencers on the story of a confluence between crypto and artificial intelligence.

- Zerebro has created his own music album and offered NFTS to fans, with platforms of a platform that allows chip holders to launch their own AI agents. He reached more than 120,000 subscribers on X in a short period.

- The fundamentals remain strong, however, offering hope to those who seek to invest in AI agent chips. The project was selected as one of the validators in the history of the Blockchain focused on the IP last week, playing a role in a future economy which is entirely led by AI agents and machines.

- A validator is a critical participant in a blockchain network, responsible for the verification and validation of transactions and blocks to ensure the safety and consensus of any network.

- The validators of the history protocol have specific responsibilities adapted to the mission of the intellectual property management and monetization protocol on a blockchain, and the validators are paid in exchange to guarantee the functioning of the network.

Positioning of derivatives

- Perpetual BTC, Sol, ADA, XRP and TRX financing rates have overturned negative, pointing out a bias for shorts when the Wilts market.

- The interest open in the term contracts linked to BNB, Hype, OM and Dot increased in the last 24 hours, a sign of shortening of merchants on a drop in the market.

- On Deribit, traders broke out of $ 85,000 and $ 80,000 strikes while long positions in the $ 75,000 deposited or moved to June.

- The Eths of ETH were also in demand, negotiating a bonus for calls to June Expire.

Market movements:

- BTC is down 4.61% from 4 p.m. HE Friday at 82,373.88 $ (24 hours: -3.21%)

- ETH is down 1.6% to $ 2,101.66 (24 hours: -2.04%)

- Coindesk 20 is down 6.4% to 2,632.12 (24 hours: -3.26%)

- The CESR ether composite pace is down 8 BPS to 3%

- The BTC financing rate is 0.0015% (1.67% annualized) on Binance

- Dxy is down 0.14% to 103.76

- Gold is up 0.15% to $ 2,909.10

- The money increased by 1.14% to $ 32.92 / Oz

- Nikkei 225 closed + 0.38% to 37,028.27

- Hang Seng Closed -1.85% to 23,783.49

- FTSE is down 0.59% to 8,629.02

- Euro Stoxx 50 is down 0.96% to 5,415.85

- Djia closed on Friday + 0.52% to 42,801.72

- S&P 500 closed + 0.55% to 5,770.20

- Nasdaq closed + 0.7% to 18,196.22

- The S&P / TSX composite index closed + 0.71% to 24,758.80

- S&P 40 Latin America closed + 0.73% to 2,361.82

- The 5 -year American treasure rate is down 5 BPS to 4.25%

- E-Mini S&P 500 Term contracts are down 1.16% to 5,709.25

- The term contracts on the NASDAQ-100 E-Mini are down 1.34% to 19,958.25

- E-min dow industrial industrial industrial index indexes is down 0.96% to 42,428.00

Bitcoin statistics:

- BTC dominance: 61.19 (-0.14%)

- Ethereum / Bitcoin ratio: 0.02562 (2.40%)

- Hashrate (Mobile average at seven days): 813 huh / s

- Hashprice (spot): $ 48.2

- Total costs: 4.4 BTC / 371 994 $

- CME Futures open interest: 142 260 BTC

- BTC at the price of gold: 28.2 oz

- BTC vs Gold Bourse Capt: 8.01%

Technical analysis

- BTC plunged under a pennant model, referring to the continuation of the wider drop in the summits of December.

- The rupture strengthened the file for a retest of the old resistance which has become a support for around $ 73,800, the March 2024 summit.

- A pennant is a continuation scheme, representing a triangular consolidation at mid-thumb.

Cryptographic actions

- Strategy (MSTR): closed on Friday at $ 287.18 (-5.57%), down 5.33% to $ 271.87 in pre-commercialization

- Coinbase Global (room): closed at $ 217.45 (+ 1.53%), down 5.36% to $ 205.79

- Galaxy Digital Holdings (GLXY): closed at $ 18.84 C (+ 0.11%)

- Mara Holdings (Mara): closed at $ 16.02 (+ 6.16%), down 4.24% to $ 15.34

- Riot Platform (Riot): closed at $ 8.37 (+ 3.21%), down 4.42% to $ 8

- Core Scientific (Corz): closed at $ 7.78 (-0.89%), down 2.7% to $ 7.57

- Cleanspark (CLSK): closed at $ 8.83 (+ 8.34%), down 3.85% to $ 8.49

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 16.32 (+ 3.29%), down 6.25% to $ 15.30

- Semler Scientific (SMLR): closed at $ 37.19 (+ 3.02%), down 3.47% to $ 35.90

- Exodus movement (Exodus): closed at $ 29.40 (+ 0.34%), up 6.22% in pre-commercialization

ETF Flows

BTC ETFS spot:

- Daily net flow: – 409.3 million dollars

- Cumulative net flows: $ 36.21 billion

- Total BTC Holdings ~ 1,137 million.

ETH ETFF SPOT

- Daily net flow: – 23.1 million dollars

- Cumulative net flows: $ 2.72 billion

- Total ETH Holdings ~ 3.635 million.

Source: Wacky investors

Nightflow

Graphic of the day

- The graph shows that the daily volume of Solana’s decentralized exchange, Raydium, fell to $ 1 billion, the lowest since November 29 and significantly lower than the peak of January 19 of $ 16.4 billion.

- The sharp drop in activity helps explain the price of the price in the Solana soil token.