On Friday, Solana joined above $ 239, extending her net gains in September, while the CEO of Galaxy Digital, Mike Novogratz, described the blockchain as “tailor-made” for the global financial markets and analyst Ali Martinez has drawn a potential path at $ 1,314.

Martinez, a well -known crypto analyst, highlighted Solana’s break that graphic technicians call a cup and hand model, training that often signals the start of a long -term rally.

In his table, Martinez scored $ 1,314.41 as the main technical objective, using Fibonacci’s retraction levels to project the Allusover. The model reflects a multi -year basic structure: the deep decline of Solana in 2022 and 2023 formed the “cut”, while the lateral consolidation of 2024 and early 2025 formed the “handle”.

According to Martinez, the rupture above the resistance almost $ 220 validates the structure and opens the way to much higher levels if the momentum persists.

Novogratz, speaking Thursday on CNBC “Squawk Box”, presented a case of bull for Solana and Crypto more broadly. He started by pointing cash companies linked both to ETH and SOL, which, according to him, collect billions of dollars and bringing “a lot of energy and money” in the digital asset ecosystem.

He then pivoted Bitcoin, predicting the largest cryptocurrency in the world should see a wave towards the end of the year.

But its most detailed remarks focused on Solana and the evolution of the regulatory landscape. Novogratz said that the president of the SEC, Paul Atkins, clearly said that he wanted all the markets to move in a chain, citing a speech earlier in the week when Atkins said: “Chain capital markets and agent finances are on the horizon, and the world looks.”

As part of this backdrop, Novogratz reported the NASDAQ’s proposal to authorize tokenized titles to negotiate directly on the NASDAQ stock market. Combined with the new American framework of Stablecoin, he argued, Crypto finally has technology and regulatory clarity to serve as a financial market infrastructure.

On the technology side, Novogratz underlined Solana’s raw capacity, saying that blockchain can manage 14 billion transactions per day – enough, in its words, “to treat all transactions in shares, fixed income, combined exchange and exchange and exchange products”. He then called Solana a blockchain which is “tailor -made” for the financial markets.

Addition – evolutionary infrastructure, a pro -blockchain regulatory position and billions of new institutional entries – Novogratz concluded that “It is the soil season”, a moment when Solana is positioned to play a leading role while the capital markets move in mind.

Strengths of technical analysis (September 11 3:00 p.m. – September 12, 2:00 p.m. UTC)

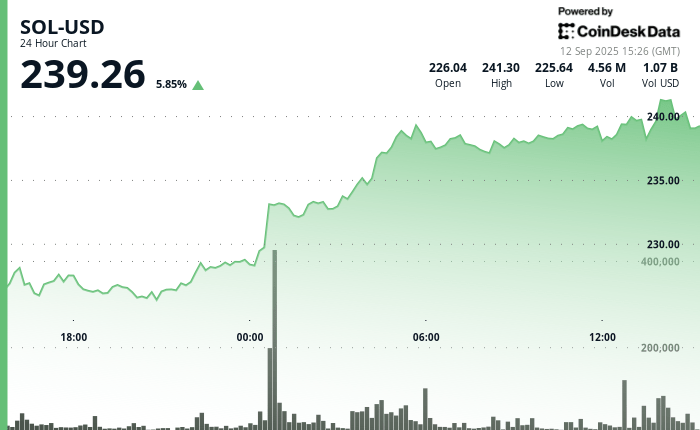

- According to the Technical Analysis Data Model of Coindesk Research, Sol gained approximately 6% during the 24 -hour period, from $ 227.14 to $ 240.02, with negotiation volumes reaching 3.66 million contracts.

- The token broke out above eight months of resistance at $ 220, reaching $ 240 for the first time since January while institutional buyers have added an exhibition.

- The strongest rally occurred in the last hour of negotiation (13: 14-14: 13 UTC on September 12)When Sol increased from $ 239.92 to $ 241.17.

- The most dramatic escape occurred just after midnight UTC on September 12, when the volume increased to 3.66 million contracts – near the triple of the average 24 hours a day by 1.46 million.

- The support was established around $ 225.50 during early consolidation, while the resistance emerged at $ 240.08, where several rallies initially stalled.

- Heavy trading volume at $ 228.78 (3.66 million contracts) confirmed this level as a key support area.

- The busiest trading window was 14: 09–14: 11 UTC, with 214,368 hands -changing contracts – almost six times the typical hourly average.

- A new level of support has now been formed nearly $ 241.17, suggesting that buyers are ready to defend higher prices even after escape.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.