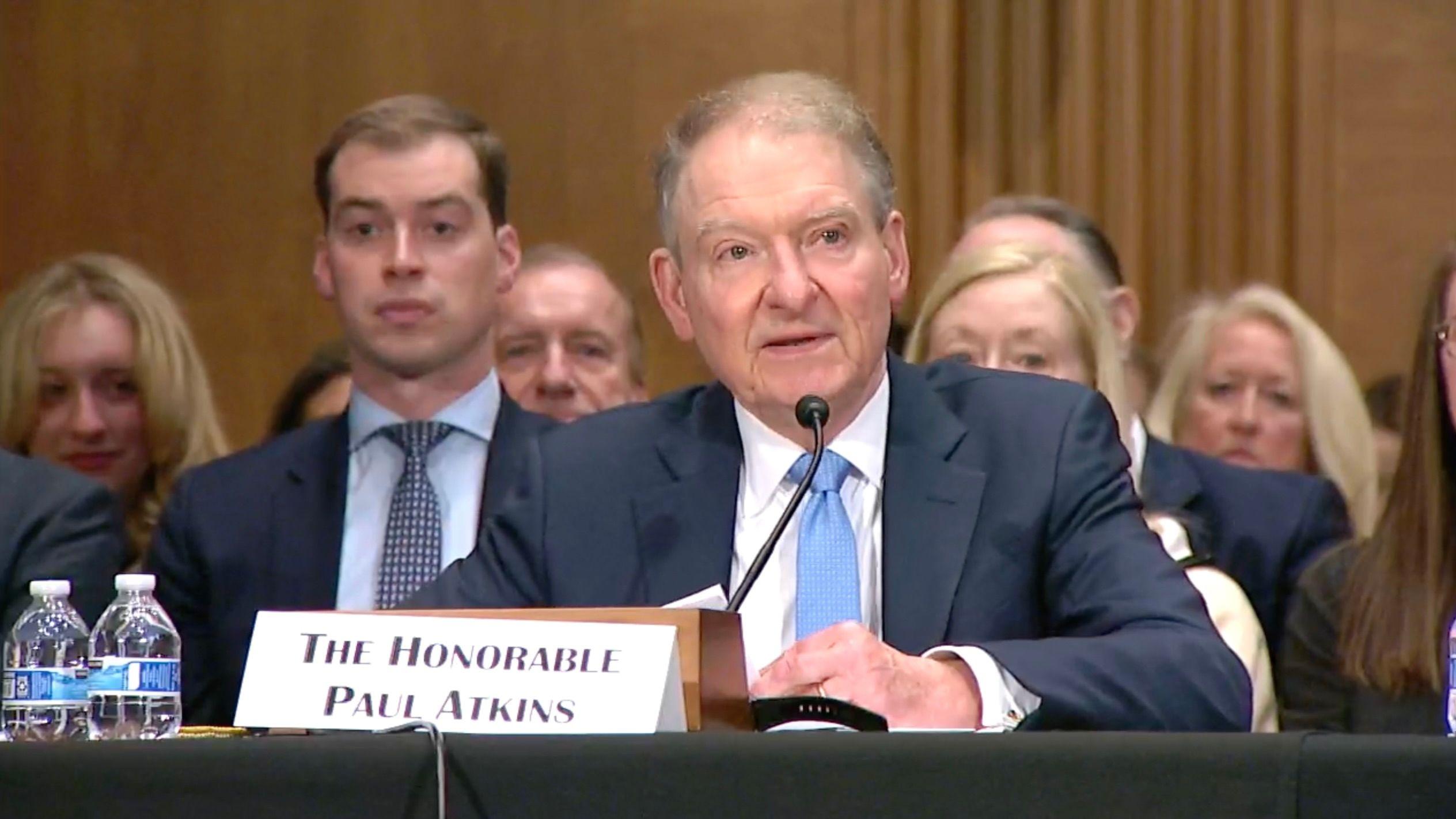

Paul Atkins, the former member of the American Securities and Exchange committee that President Donald Trump tapped to manage the agency, provided a different management for the agency on the crypto of the last four years, although there has not been a question of large -scale digital assets at a confirmation hearing on Thursday.

Now that Trump has obtained the level at the level of his government’s office, the White House is working on shepherds’ agencies through the Senate confirmation process. While many of the titles of cryptography come from administration and congress these days, those who direct regulatory organizations will ultimately be those which will write the regulations with which the industry will have to comply.

Atkins seeks to be the successor of former president Gary Gensler, whose years at the agency established it as the most important Nemesis in the digital asset sector. But Trump’s candidate is already positioning himself in a contrast that striking with peopleler, who criticized the history of industry with crooks and argued that the current securities law was sufficient to treat a large part of the space as if it were in active violation of the registration requirements.

“An absolute priority of my presidency will be to work with my colleagues commissioners and the congress to provide a firm regulatory basis for digital assets thanks to a rational approach, coherent and based on principles,” said Atkins in his testimony prepared for Thursday.

Senator Tim Scott, the Southern Carolina Republican who chairs the Committee, said that ATKINS “will provide long -awaited clarity to digital assets”.

But even before the start of the hearing, Atkins was criticized by Senator Elizabether Warren, the Massachusetts legislator who is the committee classification democrat, who recorded a doubt about his ability to be impartial in the digital asset sector that he served as an advisor.

At the audience table next to Atkins, Gould made his arguments to take over the office of the Currency Controller, the regulator of national banks. The occurrence was an important player in the campaign in the digital asset sector against American banking surveillance which puts pressure on the banks to maintain the industry at the length of the arm. Crypto companies and initiates had trouble maintaining banking relations and argued that regulators have written this “Debanking” tension.

The first question to Gould was on this situation, Scott asking if he undertakes to reverse this previous position, to which Gould answered, “absolutely”.

For the cryptography industry, Atkins’ answers on cryptographic issues are potentially more urgent. But he was not questioned about his opinions on the next stages for the surveillance of cryptocurrencies, nor on the legislative efforts ready to redo us to redo us the crypto policy.

Sbf

At one point, the Republican senator John Kennedy of Louisiana raised the subject of the former CEO of the FTX, Sam Bankman Fried, who, according to him, resembles a “fourth finalist in a double contest by John Belushi”, and asked Atkins if the Sec has appropriately examined the parents of SBF for their participation in his fraudulent activities.

“I can’t wait to get to the dry to discover what happened,” said Atkins. “Like you, I am concerned about these reports.”

But Kennedy has taken further, suggesting a lack of responsibility which signals “two standards of law and punishment” in the United States

“I don’t think the dry has done nothing,” said Kennedy. “These are crooks!” he cried. “And I expect the dry to do something.”

Few of other senators have immersed themselves in broader cryptographic questions, and those who could, like senator Cynthia Lummis, were not present. The hearing only lasted two hours and included four candidates for various offices, which had certain Democrats deplore that it was not enough to speak with each person.

Atkins’ most difficult moments have revolved around his mandate as the SEC commissioner, approaching the 2008 collapse and the agency’s failures in the Mortgage Titles Police that contributed to this crisis. Atkins has diverted the main responsibility of the crisis as belonging to the mortgage giants Fannie Mae and Freddie Mac.

The next step in the confirmation process is to vote on candidates and transmit them for potential approval by the entire Senate.