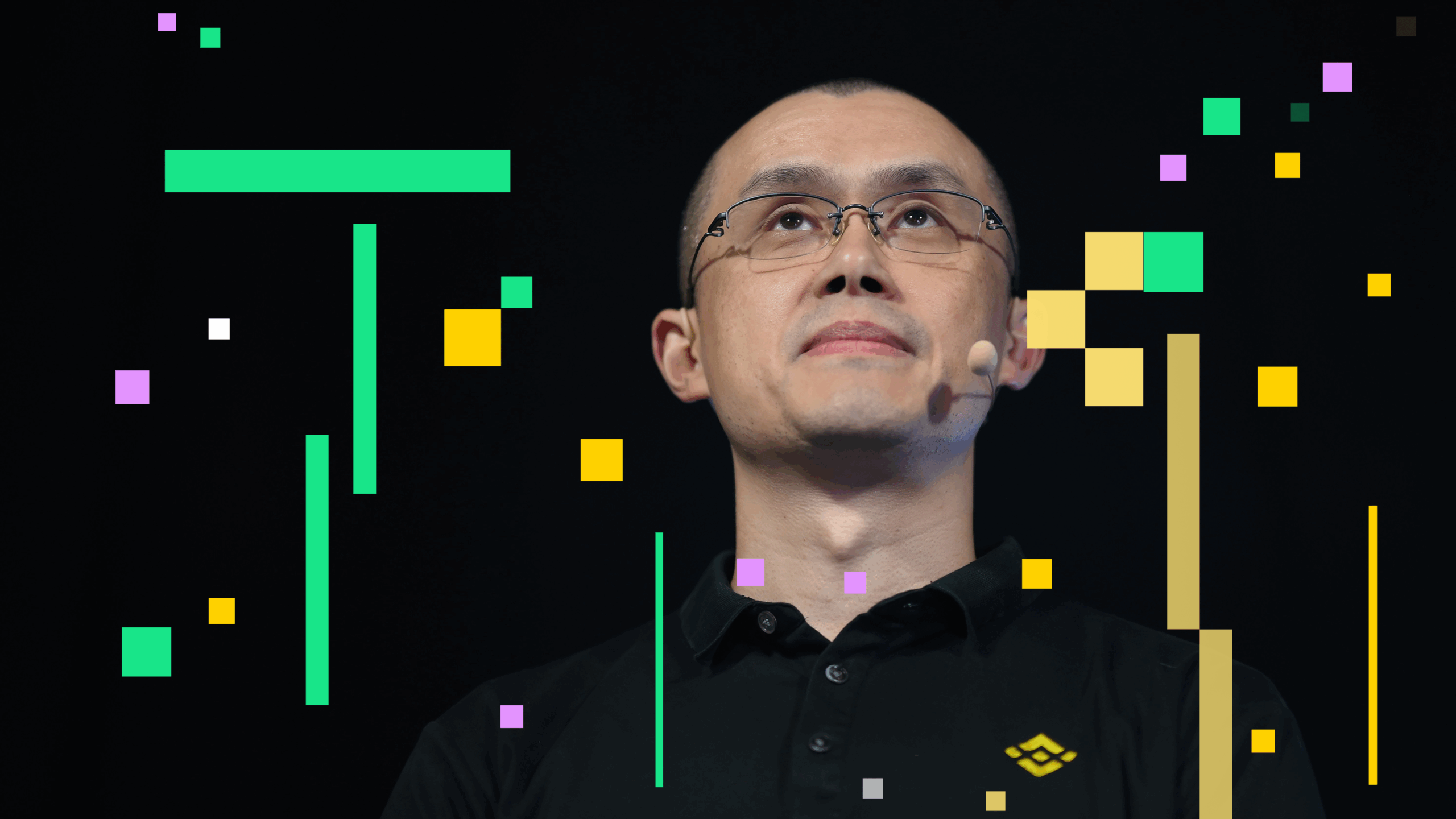

Yzi Labs, the family office founded by the co-founder of Binance, Changpeng “CZ” Zhao and Yi He, which was renamed from Binance Labs, has widened its position in Ethena Labs, the protocol behind the USDE, which has become the third largest traffic in the knockout stages in American dollars with more than $ 13 billion.

The investment comes when Ethena is entering a new growth stage, which includes the extension of its imprint on the BNB channel. This includes the deployment of products designed to fill the crypto and traditional finances, such as USDTB, a developing stable of Fiat in development, and converges, a layer of institutional settlement during security and partners connected to BlackRock.

The USDE, marketed as a “synthetic dollar”, uses Bitcoin BTC, Ether (Eth) And Solana soil (GROUND)As an active, by associating them with an equal value of short perpetual positions on exchanges to maintain an ankle of $ 1.

Launched less than two years ago, the synthetic dollar has crossed the milestone of the $ 10 billion supply faster than any other cryptographic active active in dollars.

“Since our investment team met Guy for the first time [Young] At the end of 2023, Ethena became the final category of synthetic dollars provided for yield, “said Dana Hou, investment partner at Yzi Labs.

For users, developments mean more options to hold and use digital dollars through centralized exchanges and decentralized funding protocols. For institutions, products like Converge aim to create a familiar layer of regulation for tokenized assets, potentially expanding the adoption of chain financial infrastructure.

Read more: Ethena’s USDE exceeds Bitcoin by Blackrock, ETHER with an entrance overvoltage of 3.1 billion dollars