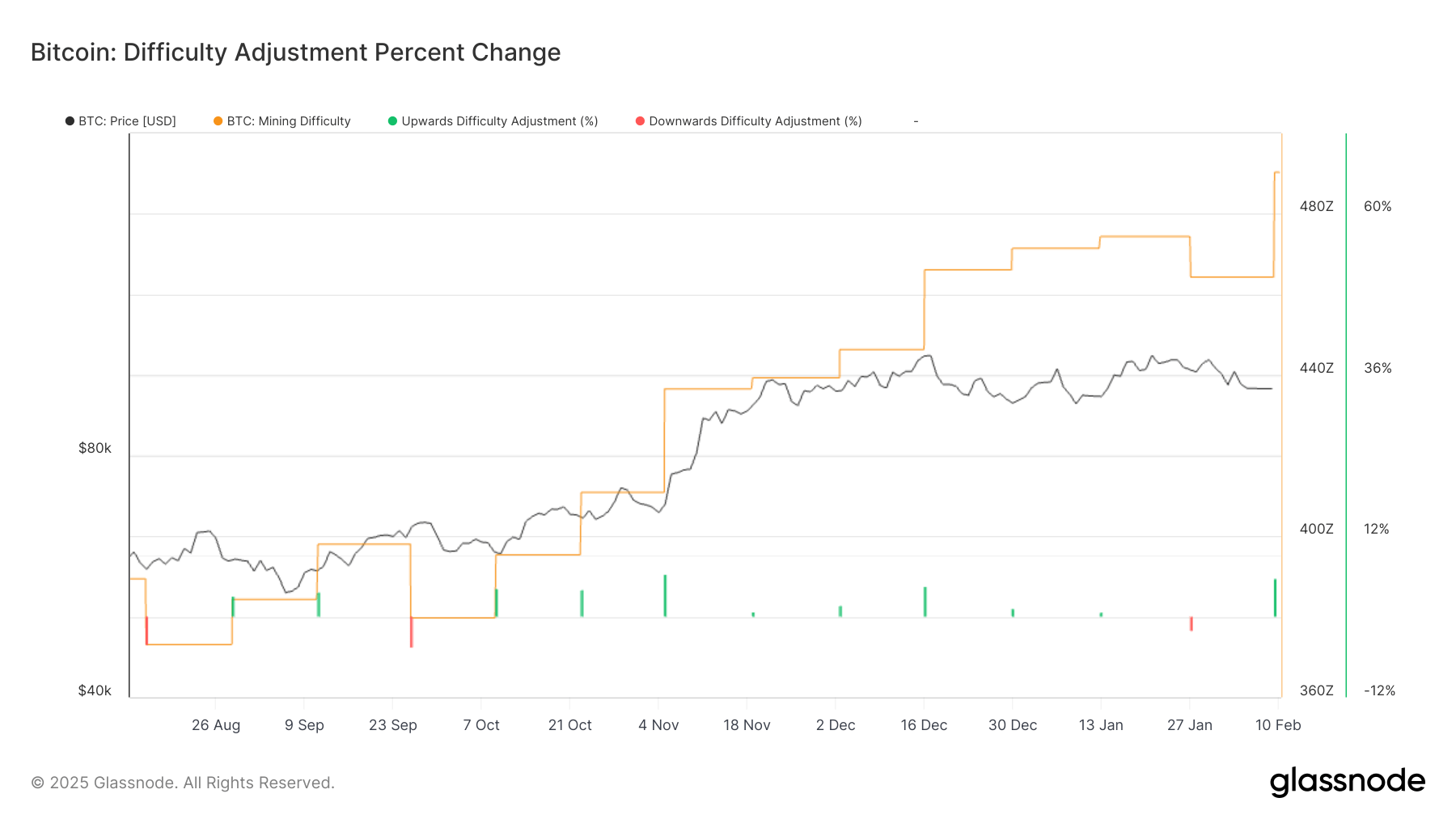

The difficulty of Bitcoin (BTC) reached a summit of 114.7 Billions (T) after an upward adjustment of 5.6% over the weekend, according to Coinwarz.

This coincides with the metric of the hash ribbon signaling a capitulation of minors. Ribbon Hash, is a market indicator, which alludes to a local background for Bitcoin (BTC) and often forms when minors capitulate – when extraction costs exceed profitability.

According to Glassnode data, the capitulation of minors began in early February. Bitcoin is down more than 4% by one month on the date of the start. Historically, when this metric signals the capitulation, it marked the local price.

If this reason is valid, the Bitcoin bottom could be around $ 91,000. The last capitulation signal occurred in October 2024, just before BTC was jumped by 50%.

This increase in difficulty is due to the increase in the bitcoin hash rate, which reached a record level on February 4. The mining difficulty adjusts every 2,016 blocks, targeting an average block time of 10 minutes.

As the difficulty increases, the mining becomes more competitive, exerting additional pressure on minors. The production data in January reflect this, the Riot platforms (Riot) being the only major public minor to report an increase in production from one month to a month.