Bitcoin (BTC) tightened its grip on the cryptography market on Tuesday, dominance reaching a new four -year summit while crypto traders turned into the market anchoring before the main policy meeting of the Federal Reserve of tomorrow.

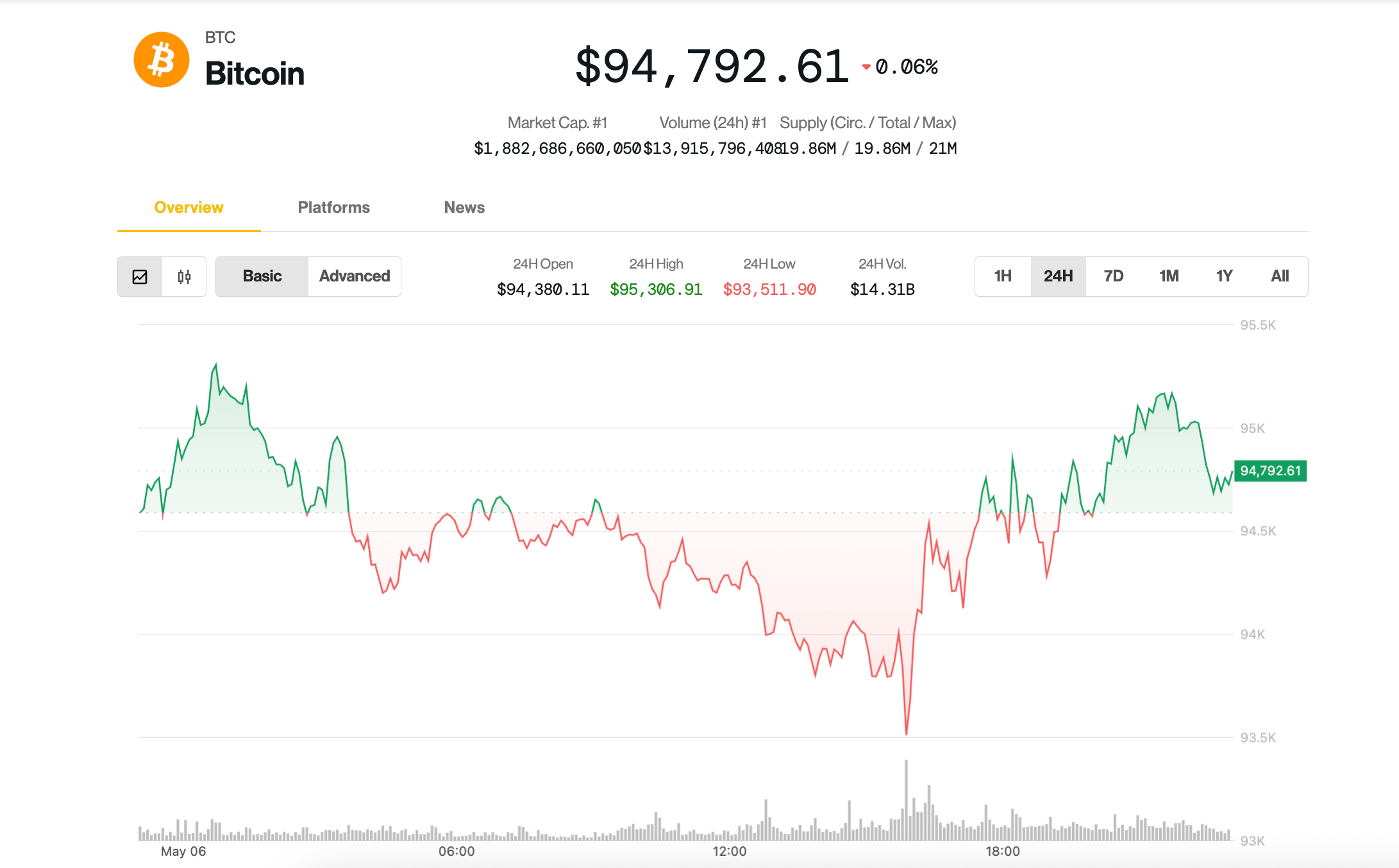

BTC held stable around the $ 94,000 area to $ 95,000, up 0.4% in the last 24 hours and extending a tight-tone trading model that has persisted since weekends.

Meanwhile, the Coindesk 20 large market index slipped 0.7% less, with Ethereum ether (ETH) and native tokens of Su (Su), Aptos (Apt) and Polygon (POL) causing the benchmark lower.

A control over the traditional markets has shown actions reserving consecutive losses, the S&P 500 and the NASDAQ, technological heavy, closing 0.7% to 0.8%, underperforming once again BTC.

Despite the lack of main price action, the development has turned more and more towards the growing share of Bitcoin on the global cryptography market: the so -called Bitcoin dominance metric has exceeded 65%, its highest reading since January 2021, according to tradingView data, signaling capital consolidating in the perceived asset as the most macroeconomic.

Joel Kruger, strategist of the LMAX group market, described the current landscape as a break and an anticipation. “The cryptocurrency market has largely staggered since the weekly opening, prices set up in a model of detention while investors are waiting for a central catalyst,” he noted. “This momentum can result from traditional markets, drawn by updates on the economic impacts linked to the prices or the planned decision of the FOMC of the Federal Reserve on May 7.”

The federal reserve should largely have stable interest rates, according to the CME Fedwatch tool, but traders are at the limit for any change in the tone of the Fed president, Jerome Powell, which could have an impact on risk appetite.

Bitcoin volatility broke out on the horizon

The recent Bitcoin price action being extremely stable, the next FOMC meeting “is rigged to cause significant volatility,” said Vetle Lunde, research manager in K33. He noted in a Tuesday report that the short -term volatility of the BTC is “abnormally compressed”, the average fall of 7 days at the lowest level of last week in 563 days.

“Such low BTC volatility diets tend to be short -lived,” said Lunde. “Violent volatility explosions generally follow this form of stability once prices are starting to move, as leverage transactions are unrolled and traders are reactivated on the market.”

He said that a lower significant cascade is unlikely because the financing rates of perpetual swaps are still negative. Similar periods historically offered good purchasing opportunities for medium and long -term investors, added Lunde, promoting an “aggressive exposure of points” to come.