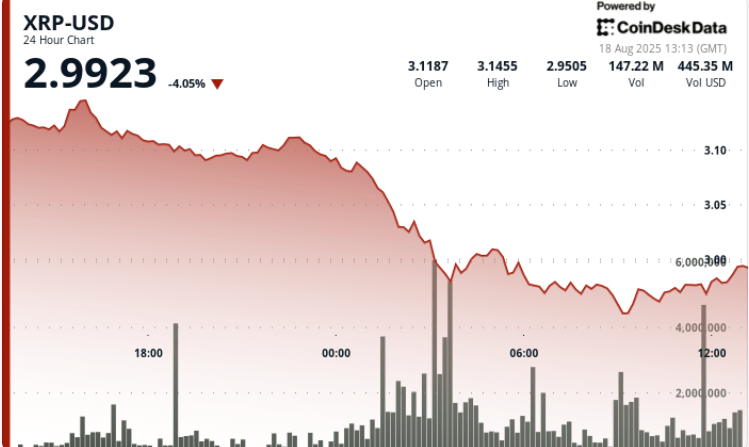

XRP slipped to $ 2.97 in its strongest drop in weeks, losing 5.4% on a 23 -hour section, the retail sale exceeded orders.

This decision occurred on increased volumes which overshadowed the daily averages, but whale wallets have quietly absorbed the body – picking it of 440 million tokens worth $ 3.8 billion. The divergence between retail capitulation and institutional accumulation establishes a central point around the $ 3.00 bar.

New context

• XRP has increased from $ 3.14 to $ 2.97 in less than 24 hours, displaying its steepest decline in July.

• Whale buyers added 440 million XRP even though retail traders have poured assets.

• A symmetrical triangle pattern formed, with a rupture target almost $ 3.90 if the resistance emerges.

• Larger crypto markets have seen weakness correlated in an increasing feeling of risk.

Summary of price action

• XRP lost 5.41% in the 11 -hour window ending on August 18 at 8:00 am.

• The heaviest sale came between 01: 00 and 03: 00, with $ 3.08 to $ 2.97 collapse out of 172 million volumes.

• The last hour saw a gourmet recovery attempt, XRP from $ 2.97 to $ 2.98.

• Trading has stopped in the last four minutes of the session, suggesting a closure or disruption of the data.

Technical analysis

• The resistance is grouped at $ 3.08 to $ 3.14, the area that tries to recovery capped.

• The support increased to $ 2.96 to $ 2.97, where the whales absorbed the offer.

• A symmetrical triangle indicates an upward target of $ 3.90 if $ 3.26 breaks.

• Golden Cross emerged last week, but the signal has not yet triggered the follow -up.

• Volatility remains high, with an intra -day beach of $ 0.18 and an increase of 163% volume compared to the averages.

What traders look at

• The question of whether the whales continue to absorb hollows almost $ 3.00 in support.

• Breakout or rejection at $ 3.08 to the resistance area of $ 3.14.

• Impact of trading interrupted in the last minutes – Glitch on the market or structural weakness.

• Continuation of the sale or stabilization of the larger market.

• Confirmation of the triangle escape to $ 3.90 or a failure of less than $ 2.96.