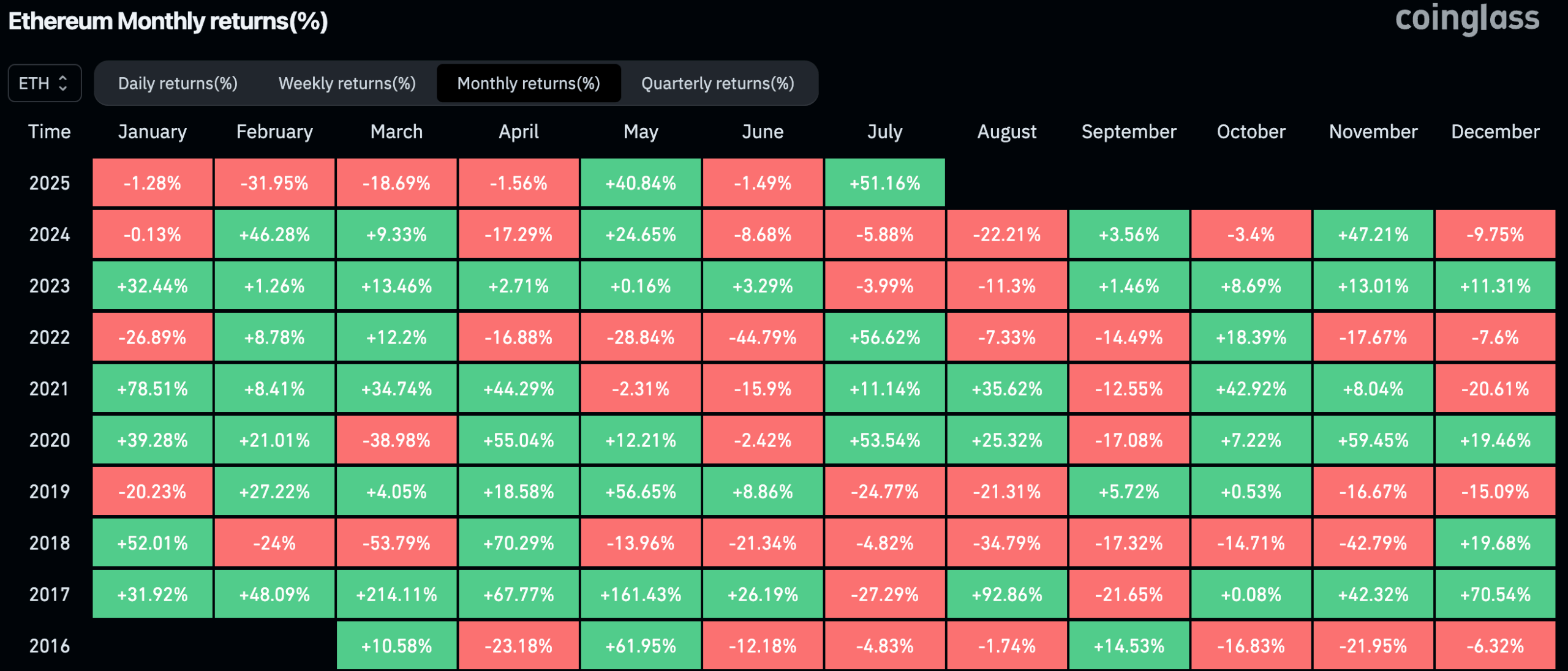

Ether (ETH), the native token of the Ethereum blockchain which was 10 years old, comes from its best performances in July in three years.

The second largest cryptocurrency climbed more than 50% in July, culminating at $ 3,940 before relieving $ 3,800 towards the end of the month.

The last time that ETH increased as much in a single month was in July 2022, bouncing the depths of the crypto accident marked by very publicized implosions of Terra-Luna, Three Arrows Capital and Celsius.

This time, the rally has a different driver with money from the capital markets.

The United States (ETF )’s etch funds absorbed $ 5.4 billion in net entries throughout the month, their strongest sequence since the products made their debut last year, according to Sosovalue data.

Corporate balance sheets also follow suit. As part of the frenzy of the treasury of digital assets, public companies have engulfed an ETH value of $ 6.2 billion, according to data collected by Cex.io. The Bitmin of Tom Lee and Sharplink by Joseph Lubin are the two most notable players, but the last participants, such as Ethzilla and Ether Machine, have already raised large sums of capital of the institutions to deploy for asset purchases.

Price action came from hand with a positive narrative change, positioning ETH as a key proxy for the booming market of stablescoin and tokenization.

With the new American rules for stablescoins by virtue of the law on engineering and Ethereum hosting more than half of the $ 250 billion offer, this clarity could consolidate its role as skeleton of token pointed in dollars.

Regarding the price, ETH is currently faced with resistance at $ 4,000, where several attempts at breakup failed last year. The cryptography market also enters a historically silent phase, which could see the rally refresh in a consolidation phase.

However, ETH could have a “juice in the tank” to push up to $ 4,700 as part of its current Crypto investor, said Bob Loukas in a post X.

Read more: Ethereum could win the war, but lose the price