Bitcoin (BTC) Bull, who once looks with confidence in the future, reconsiders his long -term bullish condemnation.

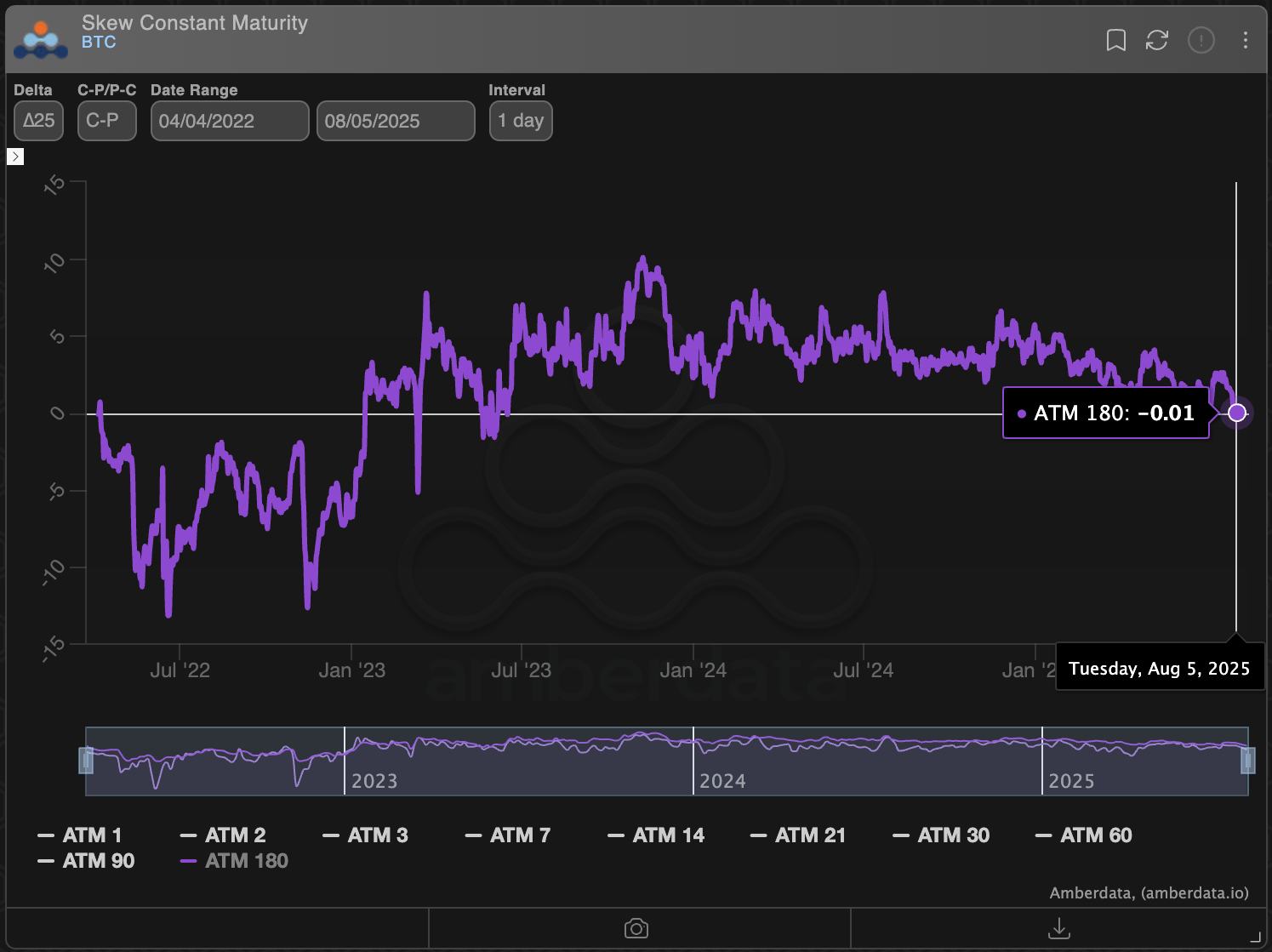

This is obvious from the 180 -day bias, measuring the difference in implicit volatility (pricing) between the appeal and power options on time. The metric recently withdrew from scratch, according to the source of Amberdata data, indicating that the long -term feeling of the market has passed from the bruise to the neutral. The change comes as some analysts warn against a lower market in 2026.

Similar reset occurred at the start of the previous Bitcoins market, according to Griffin Ardern, manager of trading and research operations on the Crypto Blofin financial platform.

“I noticed a fairly disturbing sign with the recent decline in the market. Bitcoin’s bullish feeling for distant options has disappeared, and it is now firmly neutral,” Ardern told Coindesk. “This means that the options market considers that it is difficult for the BTC to establish a long -term trend, and the probability of new summits in the coming months is decreasing.”

“A similar situation occurred for the last time in January and February 2022,” he added.

An option to sell provides insurance against price reductions in the underlying assets, while a call provides an asymmetrical upward exhibition. A positive bias involves a bias towards calls, indicating the increase in the market, while a negative bias suggests the opposite.

Neutral change in the 180 -day bias could be partly motivated by structured products selling higher typing purchase options to generate additional return in addition to cash market participations.

The popularity of the so -called covered appeal strategy could be the reduction in implicit volatility compared to puts.

Macro “

The BTC dropped by more than 4% last week, testing almost its old record of $ 11,965, while the basic PCE, the Fed’s preferred inflation measure, increased in June, while the unclean wage bill disappointed, stirring concerns about the economy.

The drop in prices has pushed short -term biases lower than zero, a sign of traders seeking downward protection thanks to puts.

According to Ardern, the inflationary effects of “pulses of the supply chain” already appear in economic data.

“Although the drop in automotive prices in the latest IPC report compensates for the rise in prices for other goods, one thing is undeniable: the impulse of the west coast of the Pacific has reached the east coast, and retailers are already trying to transmit prices and a multitude of costs associated with consumers. Noted, explaining the renewed neutrality of long -term BTC options.

According to JPMorgan, President Donald Trump’s prices are expected to increase inflation in the second half.

“Global basic inflation should increase to 3.4% (annualized rate) in the second half of 2025, largely due to an American point linked to prices,” said analysts of the investment bank, adding that costs on costs will probably be concentrated in the United States

An increase in inflation could make Fed more difficult for rates. Trump repeatedly criticized the central bank to maintain high rates at 4.25%.

Merchants will receive the Non -Manufacturing ISM PMI later Tuesday, providing information on inflation in the service sector, which represents an important part of the American economy. It will be followed by July CPI and PPI versions later this week.

Read more: Bitcoin still on the right track for $ 140,000 this year, but 2026 will be painful: Elliott Wave Expert