Many investors are currently consulting Bitcoin via an end -of -cycle lens, suggesting that the Q4 could mark the closure of the current market cycle. However, two key measures indicate the possibility that the Haussier market is in reality in its infancy.

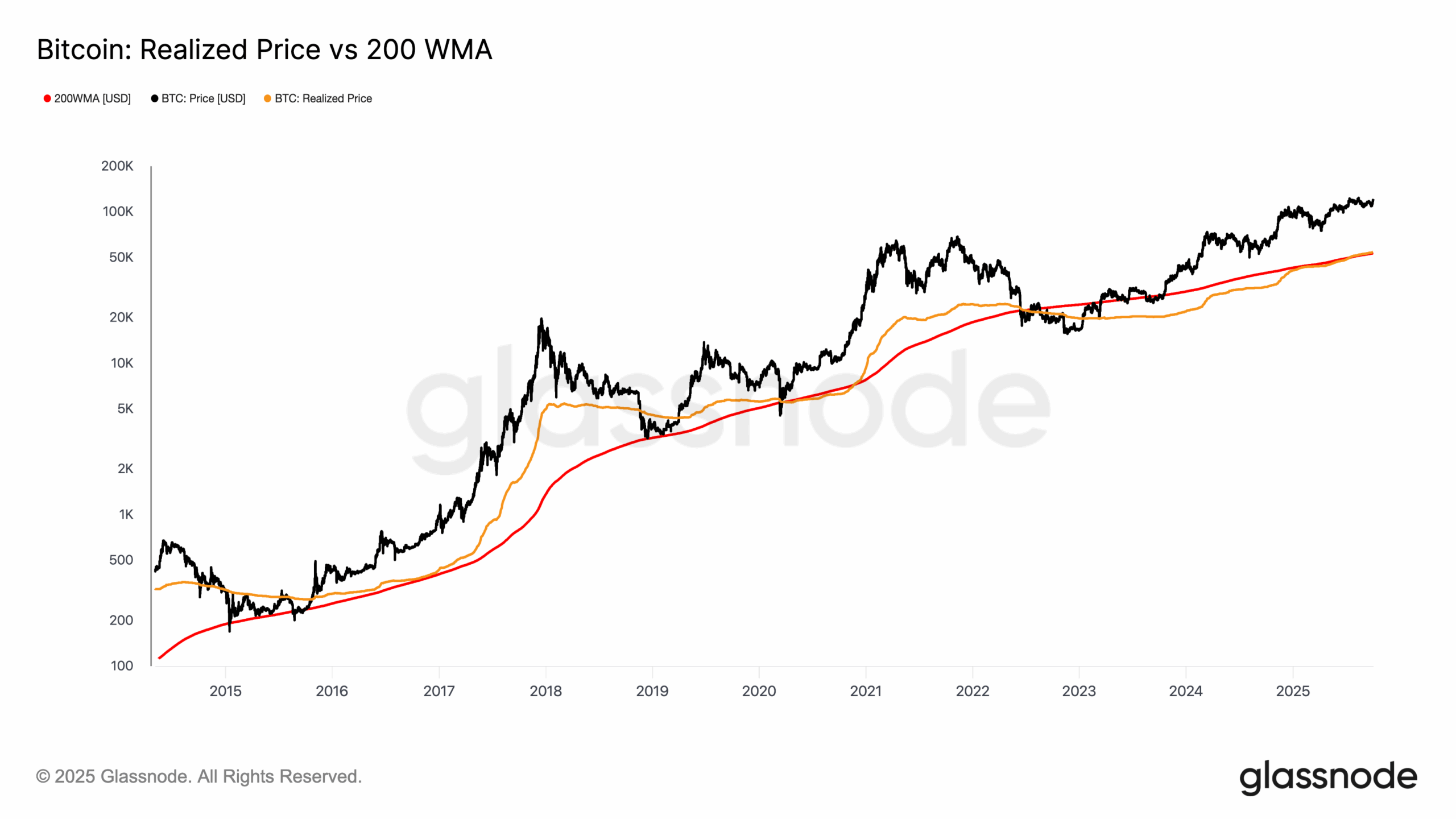

Glassnode data shows that the 200 -week mobile average (200WMA), which smooths the price of bitcoin on a long -term horizon and has historically only increasing up, has just raped $ 53,000.

Meanwhile, the price achieved, the average price to which all the Bitcoin of traffic has moved on the last time onchain, has just exceeded 200 WMA at $ 54,000.

Looking back on the previous cycles, we see a coherent diagram. On the bull markets, the price made tends to stay above 200-WMA, while on the bear markets, the reverse occurs.

For example, in the 2017 and 2021 bull markets, the price made has gradually increased and widened its gap above 200-WMA, before finally collapsing below and reporting the start of the bear markets.

While, during the slowdown of 2022, the price made fell below 200-WMA, it was only recently exceeded. Historically, once the price is made above this long-term mobile average, Bitcoin has tended to push higher as the Haussier market is progressing.