Notice of non-responsibility: The analyst who wrote this report has actions of Strategy (MSTR).

The STRK, STRK, produced the most important product of its weekly program on the STRK market (ATM) since the program started in February.

According to a dry Monday dry file.

This amount corresponds to the issue of approximately 621,555 Strk shares. The strategy has around $ 20.79 billion still available in the Strk ATM installation.

The company led by the executive president, Michael Saylor, is at the top of his Bitcoin purchasing strategy, even if the price of the largest cryptocurrency has more than $ 100,000, with an eye on its January 109,000 record. Monday of the BTC BTC strategy brought its total assets to 576 230 BTC.

This represents a BTC yield of 16.3%, a key performance indicator (KPI) which reflects the increase in the percentage of the year up to date with the MSTR Bitcoin operations to its supposed diluted actions, effectively measuring the growth of exposure to the BTC on a paraterre basis.

The recent Strk emission represents just under 9% of the total product generated by the ATM program for ordinary shares, which has raised $ 705.7 million to date. This highlights the growing role that Strk plays in the Bitcoin of Strategy acquisition model.

Strk has a fixed annual dividend of 8%, which is based on the liquidation preference of $ 100 per share, which led to an annual payment of $ 8.00 per share.

This gives it an effective yield, an annual dividend divided by the course of the Strk action, of 8.1%. Above all, this yield is inversely linked during action. As Strk is negotiated, the yield decreases and vice versa.

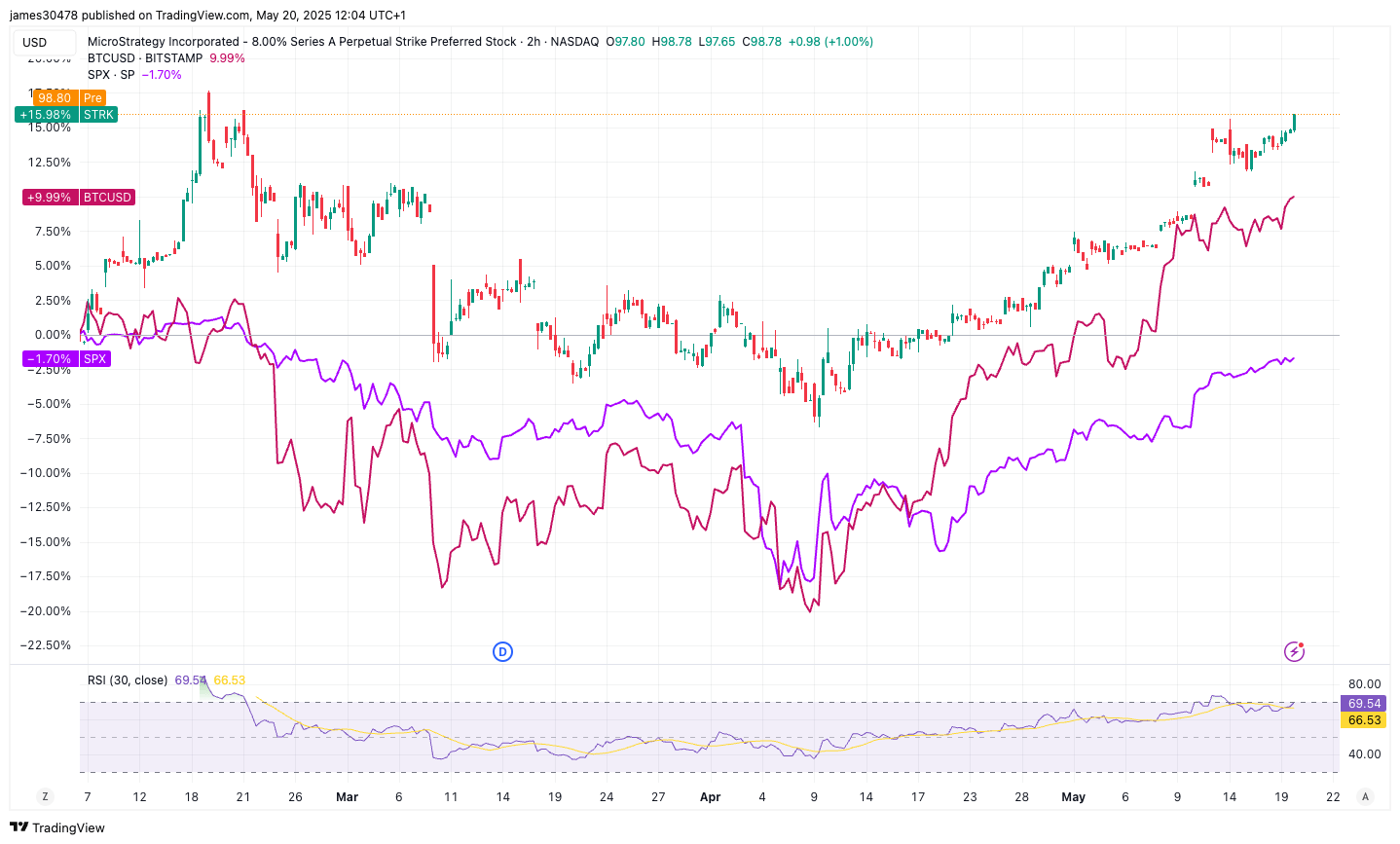

Since its launch on February 10, Strk has increased by 16%, surpassing both Bitcoin, which added 10%, and the S&P 500, which decreased by 2%over the same period.

According to data from the strategy dashboard, Strk presents the lowest correlation with the ordinary MSTR actions, seated at only 44%. On the other hand, Strk maintains relatively higher correlations with wider market references: 71% with Bitcoin and 72% with the fund negotiated in exchange for spy.

This suggests that Strk is negotiated with a unique profile, potentially attractive for investors looking for differentiated exposure because of its hybrid nature as a preferred equity instrument with deployment of capital linked to Bitcoin.