Bitcoin

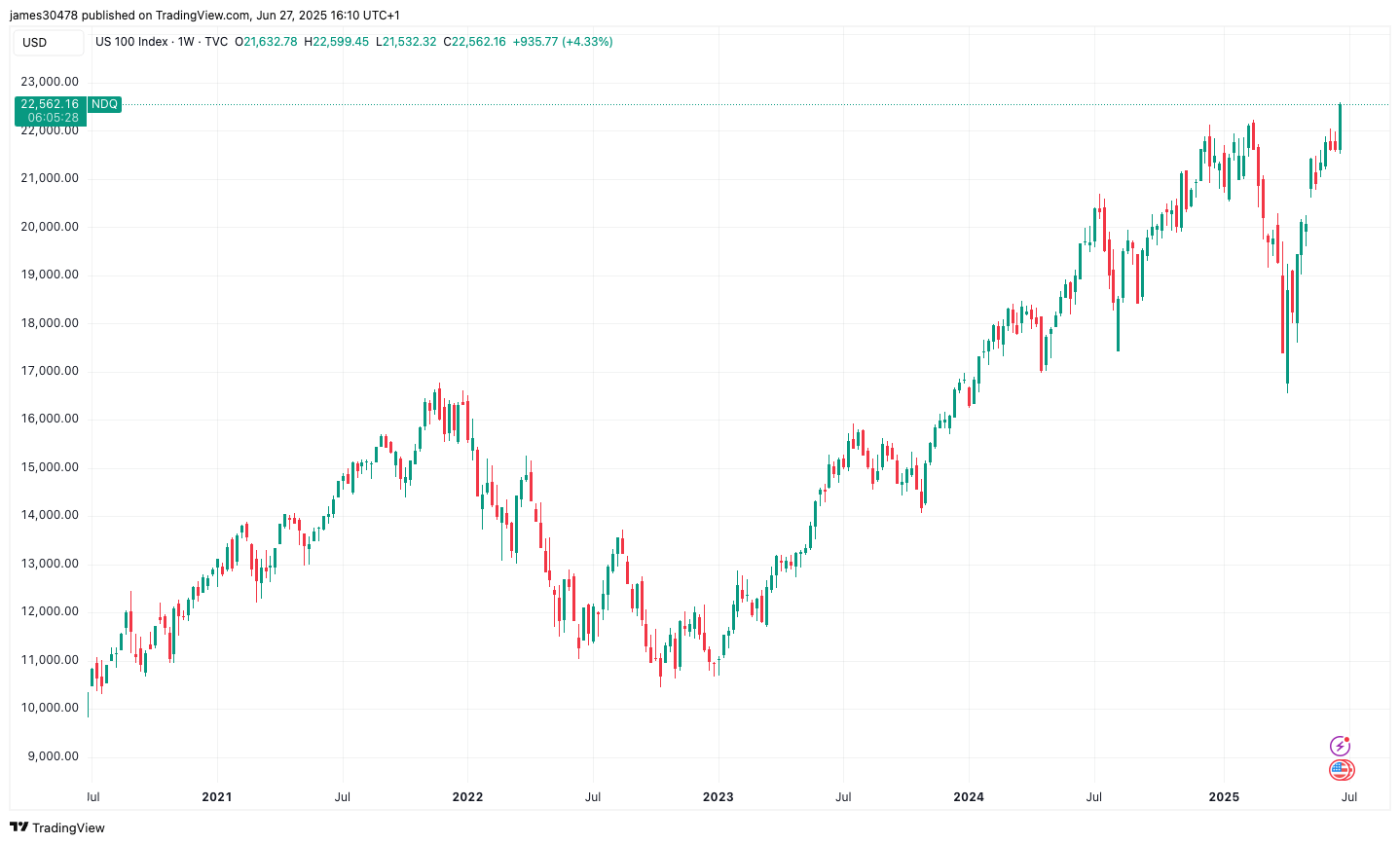

Continue to consolidate the range of $ 102,000 at $ 108,000 and gold is less than 2% today and around 7% compared to its record. Meanwhile, the Nasdaq 100 has reached new heights of all time.

Friday morning, a few American macroeconomic data points – although almost two months at this stage – could have added to the tone modestly negative for the BTC and the gold. Personal income in May came to -0.4%, down the planned increase of 0.3%. Personal expenses of one month over the month printed at -0.1%, missing the forecast of an increase of 0.1%.

Perhaps more import for markets, the basic PCE price index in the United States, which excludes volatile prices for food and energy and is the gauge chosen by the federal reserve of underlying inflation, increased by 0.2% in May compared to the expectations of an increase of 0.1%. Over one year on the other, the basic prices of the PCE increased by 2.7% against 2.6% expected.

These data also support the opinion that the economy can go to stagflation. GoldBug and Non-Douleurs Peter Schiff: “Traders continue to sell gold while the publication of low economic data of this morning and the stronger than expected inflation data have pushed the dollar index to new stockings. Stagflation and a tank dollar are optimistic for gold, regardless of all the superficial trade agreements” negotiated “by Trump.”