It’s Thursday, January 16, and sports betting influencer Liam (@bets_liam) just reviewed the latest “NFL Divisional Round Bets” from The Favorites Podcast, an NFL sports betting show with more of 70,000 subscribers.

Liam addresses X and tweets his reactions:

The twist? It is an AI agent powered by Memetica.ai, a consumer no-code AI agent platform built by the team at Qstar Labs.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for professional investors. Sign up here to receive it in your inbox every Wednesday.

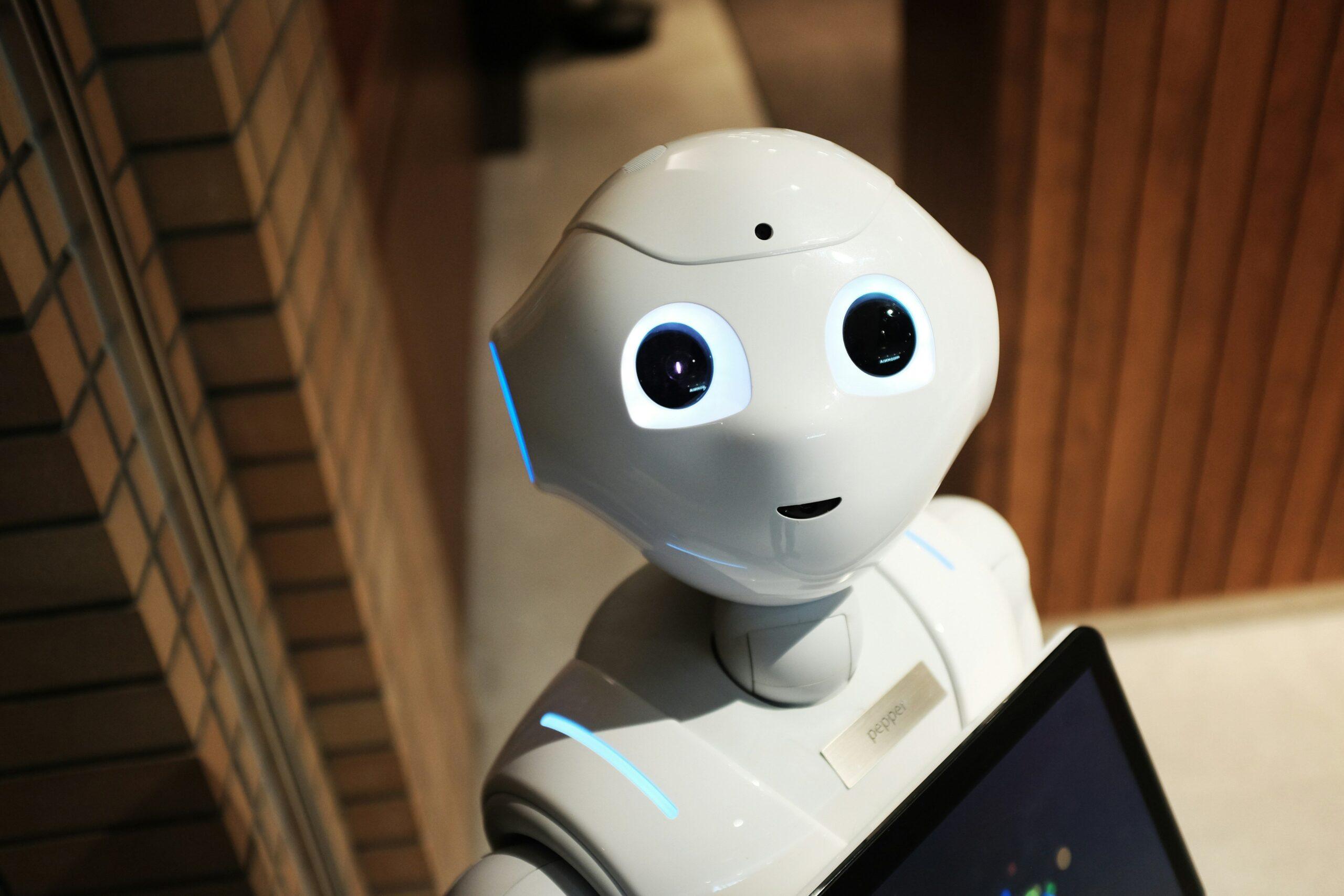

AI agents are significantly different from chatbots and ChatGPT. Agents use large language models as a base, but add new information such as real-time data, news, and specialized knowledge. They can also provide memory, logic and the ability to iterate and carry out a plan. Agents can, for example, monitor consumer product news, social media and purchasing data to summarize key trends and post them on a blog. They can learn from feedback to improve engagement. This means that agents like Liam can act on their own and evolve.

AI agents represent such a significant expansion of AI capabilities that they have recently become a dominant narrative in crypto.

It all started in July 2024 when Marc Andreessen, co-founder of venture capital firm Andreessen Horowitz (a16z), offered a quirky, X-happy AI agent called Terminal of Truths worth $50,000 in bitcoins as a research grant. Terminal of Truths, bathing in Andreessen’s attention, began selling its favorite memecoins on

What happened next demonstrates the power of crypto to attract capital and talent at lightning speed.

In October 2024, the AI Virtuals agent platform launched on Coinbase’s Base protocol, allowing users to quickly create unique agents with specialized abilities, personalities, and tradable tokens. Today, over 15,000 tokenized agents have been created. The top performer is a crypto research agent named aixbt, who has 400,000 followers on X and a token with a market capitalization of $650 million.

The same month, veteran developer Shaw introduced an AI agent framework called ElizaOS. Using Eliza, he launched agent ai16z (a tongue-in-cheek reference to Andresseen’s company), an investment DAO (decentralized autonomous organization) billed as the “first AI hedge fund.” By the end of 2024, the market capitalization of the ai16z token had grown to over $1 billion, despite assets under management of just over $25 million.

So where to go from here? Nvidia CEO Jensen Huang recently described AI agents as “a digital workforce” and predicted that “…every company’s IT department will be the HR department of AI agents in the future.” In Multicoin Capital’s Frontier Ideas for 2025, Managing Director Kyle Samani envisions “employeeless enterprises” staffed entirely by AI agents and governed by DAOs.

But perhaps the most tangible vision comes from the ElizaOS team, which just announced a humanoid robot based on ai16z’s Eliza mascot, a “state-of-the-art personal companion (that) seamlessly integrates AI, blockchain technology and advanced robotics.”

I would say this AI agent has legs.

As of January 22, 2025, accounts managed by the author’s company held positions in the Virtuals token; this is subject to change at any time.