- Google Wallet now has an integrated payment system for children

- Parents can monitor their child’s transactions and apply the limits

- The update takes place in the coming weeks

Allowing your children to access the wallet of your phone can be an infallible way to quickly lose your savings, but there are also times when you may want to let them in, for example when they need to use a digital library card. So what can you do to do things right?

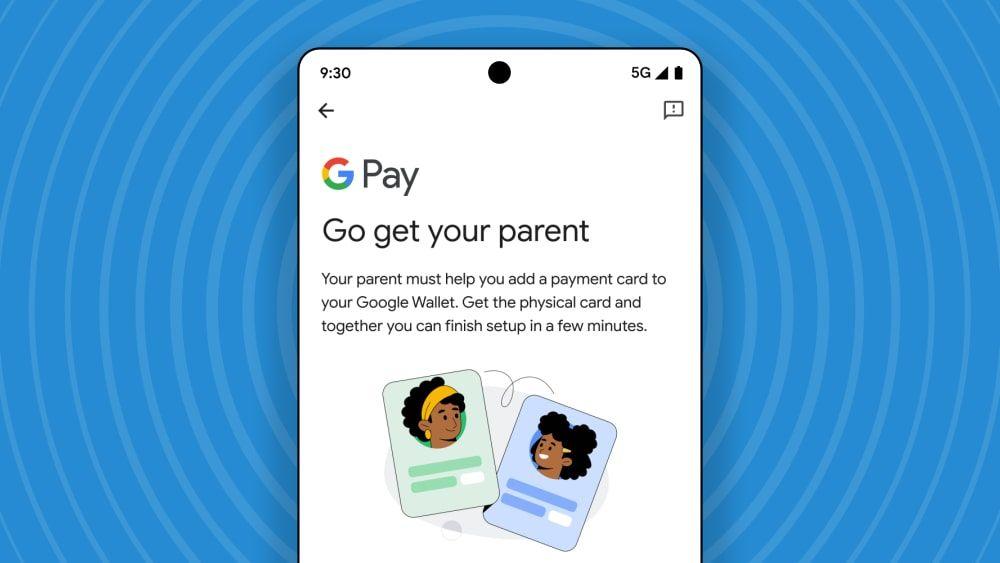

Well, Google thinks it has a kind of solution. He has just announced a new feature for Google Wallet which gives children access to limited funds while ensuring that parents still control. The functionality is deployed to users of the United States, the United Kingdom, Australia, Spain and Poland “in the coming weeks,” Google said.

According to Google’s press release, parents and tutors can “allow their children to access digital payments on their Android device with appropriate supervision”. In practice, this means “children can use Google Wallet to type safely to pay in stores and keep passes supported like event tickets, library cards and gift cards in a practical place.”

The update is delivered with integrated parental commands. “A child’s payment cards can only be added with parents’ consent,” said Google, “and parents will receive an email whenever their child makes a transaction. Parents can also easily follow recent purchases, delete payment cards and deactivate access to pass in the family bond.”

Financial independence

This is not the first time that Google has implemented a payment system adapted to children with included parental checks. In the company Smartwatch Fitbit Ace of the company, for example, children can draw to pay the items, while parents can monitor purchases and reward their young people when the tasks are over.

Apple also has a similar feature integrated into Apple Cash. Parents or tutors can consult the recent card transactions of a child, choose who they can send money, receive notifications when a payment is made, lock the child’s Apple cash account, etc.

Financial literacy is a great skill of life that children can have, it is therefore logical to allow them a certain degree of independence here, as Google and others do. Integrated checks should go in one way to reassure parents, although each family will have to find an arrangement that suits them best.