Hello, Asia. Here is what is news on the markets:

Welcome to the morning briefing in Asia, a daily summary of the best stories during the hours and an overview of market movements and analyzes. For a detailed overview of the American markets, see the Americas of the Coindesk Crypto Daybook.

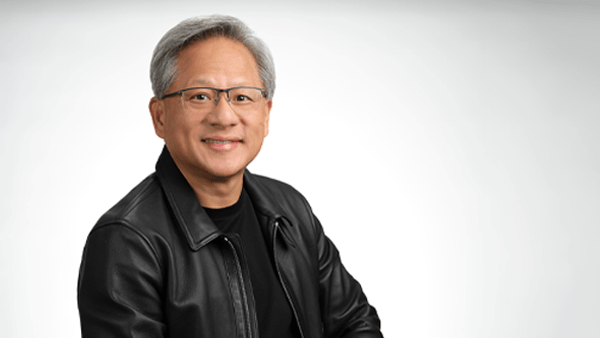

NVIDIA’s ascent to a historic market capitalization of $ 4 billions, the very first company to reach this stage, could be exactly the Bitcoin catalyst

Necessary to get out of its closely wound commercial range and increase to new heights of all time, responding to the concerns of analysts that the crypto market did not have a clear driver.

BTC is currently negotiating at $ 110,900, according to Coindesk market data, after joining the American negotiation hours at more than $ 111,000 and touched briefly from all time.

Glassnode analysts had previously described the recent Bitcoin market activity as silent, characterized by a drop in chain transactions, minimum revenues of minors and deleted costs.

Rather than interpreting these factors as lowered indicators, Glassnode highlighted a mature market increasingly dominated by high -value institutional transactions and long -term cautious holders.

All that said, the correlation between Nvidia and BTC could be short -lived because the data suggests its weakening.

While the correlation between the GPU giant and the BTC culminated above 0.80 during the Euphoria led by the AI of the beginning of 2024, and the average of three months remains relatively high at 0.69, the last data show a drop to approximately 0.36, indicating a possible decoupling as the development of investors changes.

However, the milestone of Nvidia seemed to serve as a potential trigger for BTC’s rupture compared to the weeks of price inertia.

However, it is possible that the course of NVIDIA shares be corrected at a given time, taking into account its volatile nature. But this weakened correlation means that the price of the BTC can remain resilient – at the end of that day.

Australia begins CBDC tests in the real world

Digital currency of the Central Bank of Australia (CBDC) The initiative, Project Acacia, has entered its next phase while the reserve Bank of Australia names 24 industry participants selected to test the real digital money applications on the tokenized asset markets.

Mergé by the Reserve Bank of Australia and the Digital Finance Cooperative Research Center, the project brings together major banks, fintechs and infrastructure companies for the programmable digital money in financial workflows in the real world.

The pilots will explore the settlement between asset classes such as obligations, carbon credits, private markets and commercial claims.

Nineteen projects will involve live transactions, while five will remain at the stage of proof of concept. ASIC has given targeted regulatory relief to allow tests with real assets, continuing its approach to allow responsible innovation in digital finance.

While Australia goes ahead with additional CBDC development, the Canada Bank has moved its objective to develop a retail CBDC, in the midst of growing criticisms that such a system could allow government surveillance by allowing authorities to monitor each transaction, unlike the anonymity offered by Cash.

Market movements

BTC: Bitcoin has hovered nearly $ 109,000 while institutions defended key support levels in the middle of light resistance at $ 110,000, showing resilience despite sleeping wallet activity and regulatory uncertainty, while macro-waves such as a weakened dollar and regular cutting ratings have strengthened the company’s appetite for risk assets, Coindesk Market Insights.

ETH: ETH closed a 23 -hour volatile session up 2.8%, with a high institutional volume and resilience greater than $ 2,650 signaling continuous bull positioning in the middle of the uncertainty of the market.

Gold: Gold prices have extended losses for a second day, oscillating nearly $ 3,285, because reduced rates reduction bets in July, a strong US dollar, and the firm treasure yields have pressure on metal, although the concerns of the commercial price and the next minutes of the FOMC have helped to limit the drop downwards further down..

Nikkei 225: The Asia-Pacific markets opened Thursday, while investors weighed the rate gain of the Korean bank and the decision of the US President Trump to impose a 50% rate on Brazilian imports, citing unjust trade and reprisals on the prosecution of Bolsonaro, with Nikkei 225 of Japan.

S&P 500: The term contracts on stock were mainly flat Wednesday evening after the S&P 500 recovered some losses compared to the drop in this week’s price, with term contracts on Dow only sliding 37 points.

Elsewhere in crypto

- Digital asset tax policy in the United States (Coindesk)

- Pump.fun provides for a share of 25% income with tokens holders: Sources (Blockworks)

- The judge recommends abandoning the former assistant of Logan Paul of the “Cryptozo” pursuit (Decrypt)