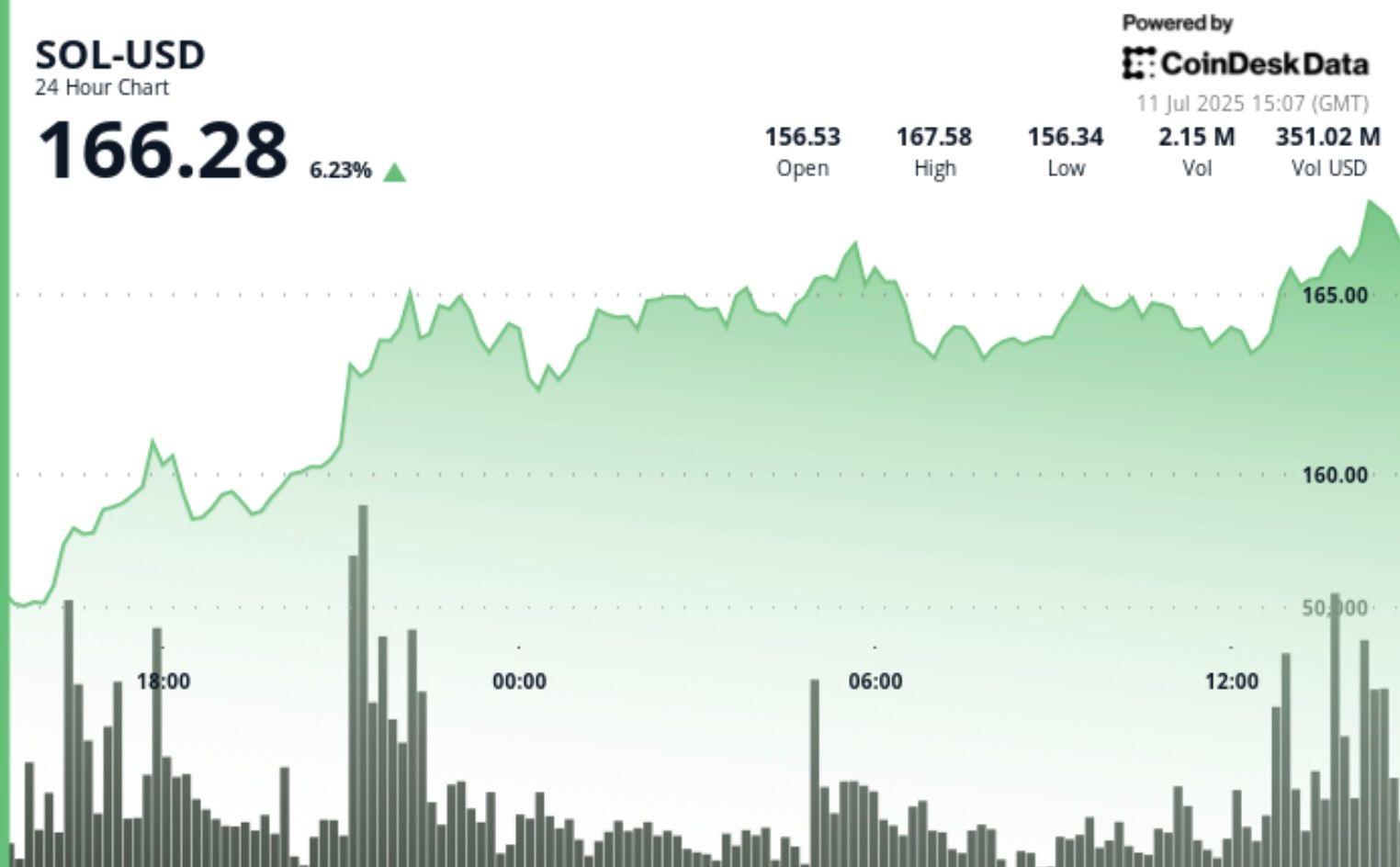

At the time of writing, Solana

Negotiate around $ 166.28, up 6.23% during the last 24 -hour period, according to the Technical Analysis model of Coindesk Research.

Upexi (Upxi)A consumer brands company based in Tampa listed on the NASDAQ, announced on Friday that it had obtained around $ 200 million in new funding thanks to a combination of rating and convertible rating offers. Part of the profits will support existing Upexi operations, while the rest will be used to develop its cryptocurrency treasure, with a specific accent on Solana

.

As part of the actions component, Upexi has lifted $ 50 million from accredited and institutional investors, including its CEO Allan Marshall. The shares were sold at $ 4.00 each, with management purchases at a bonus of $ 4.94. The company said that the equity agreement should be concluded around July 14.

In addition, Upexi has concluded agreements to issue $ 150 million in convertible tickets to institutional investors. Tickets are supported by ground as a warranty and have an annual interest rate of 2%. They are convertible into UPEXI shares at a fixed price of $ 4.25 per share and ripen in 24 months. The notes should close around July 16, the date on which the associated soil will be added to the company’s assets.

In a press release of June 26, Upexi revealed that it held 735,692 soil on June 24, an increase of 8% compared to the 679,677 soil reported on May 28. After the end of the new funding, Upexi plans to double its current soil position.

The offers were made in private and are not registered with the SEC.

Technical analysis

- Sol has demonstrated exceptional resilience throughout the previous period from 24 hours from July 10 to July 11 to 11:00 a.m., from $ 156.45 to $ 166.65, which was a substantial assessment of 6.52% with an overall negotiation range of $ 10.99 extending from $ 155.78 to $ 166.76.

- The price dynamics have unveiled separate accumulation sequences with considerable support supported by the volume materializing at $ 160.31 during the increase of 9:00 p.m., where an extraordinary volume of 3.23 million has substantially exceeded the average of 24 hours of 1.34 million, corroborating the deployment of institutional capital.

- The pivot resistance emerged at $ 165.30, subject to multiple exams between 10 p.m. and 3:00 a.m., while the conclusive breakthrough greater than $ 166.00 occurred with an amplified volume of 2.26 million, indicating an persistent optimistic conviction.

- Technical architecture suggests that Sol has consolidated a superior trading corridor with a robust volume validation, establishing foundations for potential advancement towards the psychological threshold of $ 170.00.

- Throughout the final interval of 60 minutes from July 11, 13:05 at 2:04 p.m., Sol has met considerable volatility while preserving its primordial upward arrangement, oscillating in a bandwidth of $ 2.90 from $ 164.24 to $ 166.76 and set up at $ 165.87, representing a marginal contraction of 0.44% 165.92.

- The period expressed consolidation attributes par excellence encompassing two discreet phases: an initial retirement at $ 164.28 around 13:33 accompanied by intensified distribution pressure of 45,017 volume, succeeded by a vigorous recovery at 13:48 when the volume increased to $ 81.740.

- A fundamental support crystallized almost $ 164.30 with multiple successful exams, while the resistance materialized around $ 166.50 to $ 166.75, establishing a very delined negotiation corridor which suggests a discovery of constructive price after the previous realization of this consolidation phase.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.