ETHER (ETH) fell 39% this year compared to Bitcoin (BTC), the largest cryptocurrency, taking the ratio between the two at the bottom at almost five years as a more risky macroeconomic preventing weighs on the second cryptocurrency.

At the current level, 1 ETH is the equivalent of 0.02191 BTC. It has been the least since May 2020, while Ether exchanged $ 200 and Bitcoin just under $ 10,000. Today, the ETH price is around $ 1,800 and the BTC price around $ 82,000.

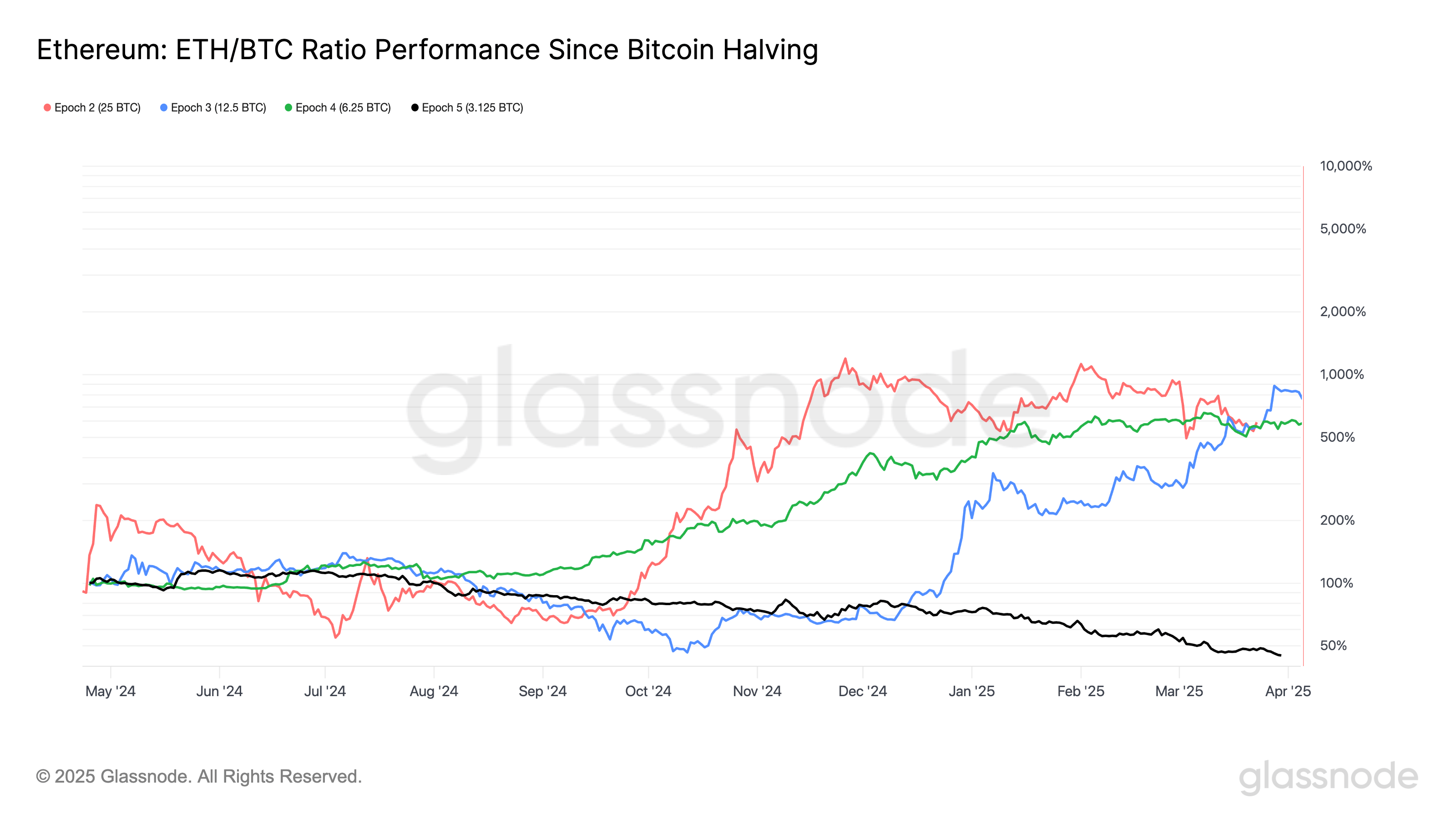

The underperformance is notable because it is the first time that the ether has weakened against Bitcoin during the 12 months after a reward for BTC award. On April 20, 2024, the Bitcoin Payment minors received for confirmation of blockchain blocks were reduced by 50% to 3.125 BTC.

In the previous divan cycles, Ether surpassed Bitcoin during the first year after a reduction in half. This time, the report fell by more than 50%.

This is partly because the threat of a trade war focused on prices, persistent inflation and high obligations give global scale has led to investors to assets considered to be more liquid and less risky. Gold, The Ultimate Haven, climbed to record peaks, and on the cryptocurrency market, Bitcoin is considered to be a safe bet than ether.

This relative performance also marks one of Ether’s worst quarterly performance against Bitcoin in several years, according to Glassnode data. The last time Ether underperformed Bitcoin to a similar degree, it was in the third quarter of 2019, when the ratio fell to 0.0164, a quarterly drop of 46%.

This current collapse reflects the underperformance observed in 2019 and highlights the relative weakness of Ether, in particular compared to the other assets of layer 1. The Soleth – Measuring the value of Solana soil compared to the ether – is up 24% at the beginning of the year at 0.07007. This indicates that Sol considerably surpassed the ether in 2025, although the token itself has been down 35% since the start of the year.

Update (March 31, 9:25 UTC): Add a macroeconomic environment to the fifth paragraph.