- RAM’s prices increase should affect almost all market segments

- The food limits linked to dram node changes lead to product shortages

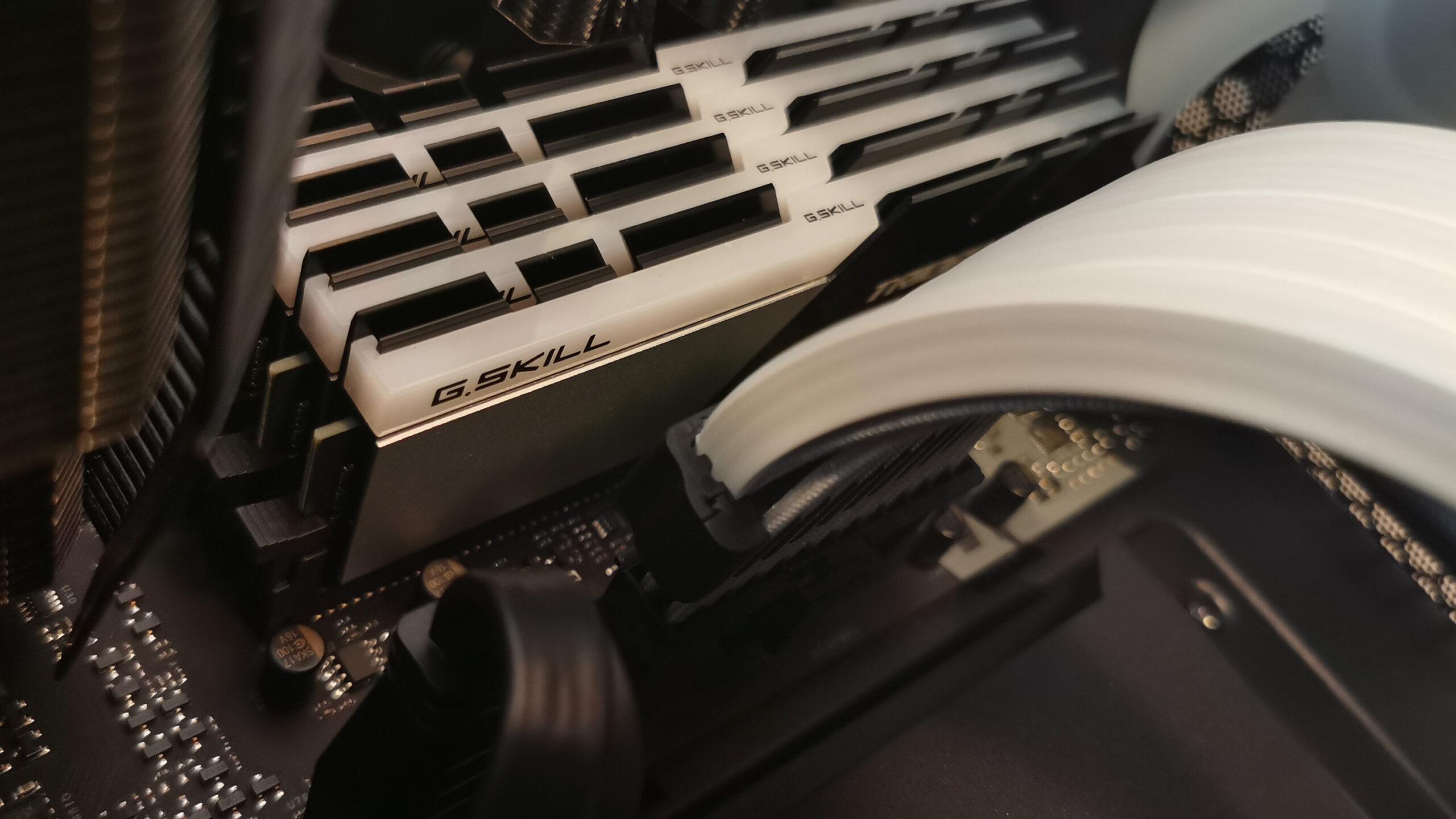

- GDDR6 and DDR4 direct the current increases in memory prices

RAM prices are increasing once again, but this time, the finger of the blame cannot be pointed only on the AI, said new research.

The current financial quarter would provide high increases in all areas, affecting everything, from the server memory to DRAM Mobile and to graphics cards.

New data from TrendForce, supported by the search for Computerbase, indicates that the DDR4 saw the largest leap, with prices up to 45% higher than in the previous quarter.

Training

The trend started earlier this year when manufacturers, including Micron, began to remove DDR4 and LPDDR4. These were produced using older dram nodes which are now retired.

Micron has issued end -of -life notifications for these products, which had a major impact on large volume customers in consumer, customers, mobile and data centers.

The DDR4 and LPDDR4X shortages followed, creating a training effect on the memory market.

In some regions, DDR4 has become temporarily more expensive than DDR5. DDR4 prices in the PC segment should now increase by 38 to 43% in the third quarter, compared to 13 to 18% in the second quarter. The DDR4 server follows closely with an increase of 28 to 33%.

Graphic memory is also affected. GDDR6 is expected to increase by 28 to 33%, which makes mid -range and entry -level GPU options more expensive.

GDDR7, still at the start of adoption, could see prices increase from 5 to 10%.

Mobile devices are not safe from price increases. LPDDR4X is expected to jum from 23 to 28% and LPDDR5X can increase from 5 to 10%.

For consumers and OEMs that rely on these chips, timing adds pressure before seasonal product launches.

HBM, mainly used in high performance IT and AI, is expected to reach 20%. Although this segment is smaller, its prices are always important for data centers and corporate buyers.

Micron said he would support customers needing a long-term supply of DRAM 1-Alpha, but only for sectors specific to a volume volume such as the automobile and industry.