The tax proposals intended to reduce the charges among crypto users, one of which would renounce the calculations of capital gains for small -scale transactions, would not go to the bill on the Budget Budget of President Donald Trump but which are now considered as autonomous legislation in the American Senate.

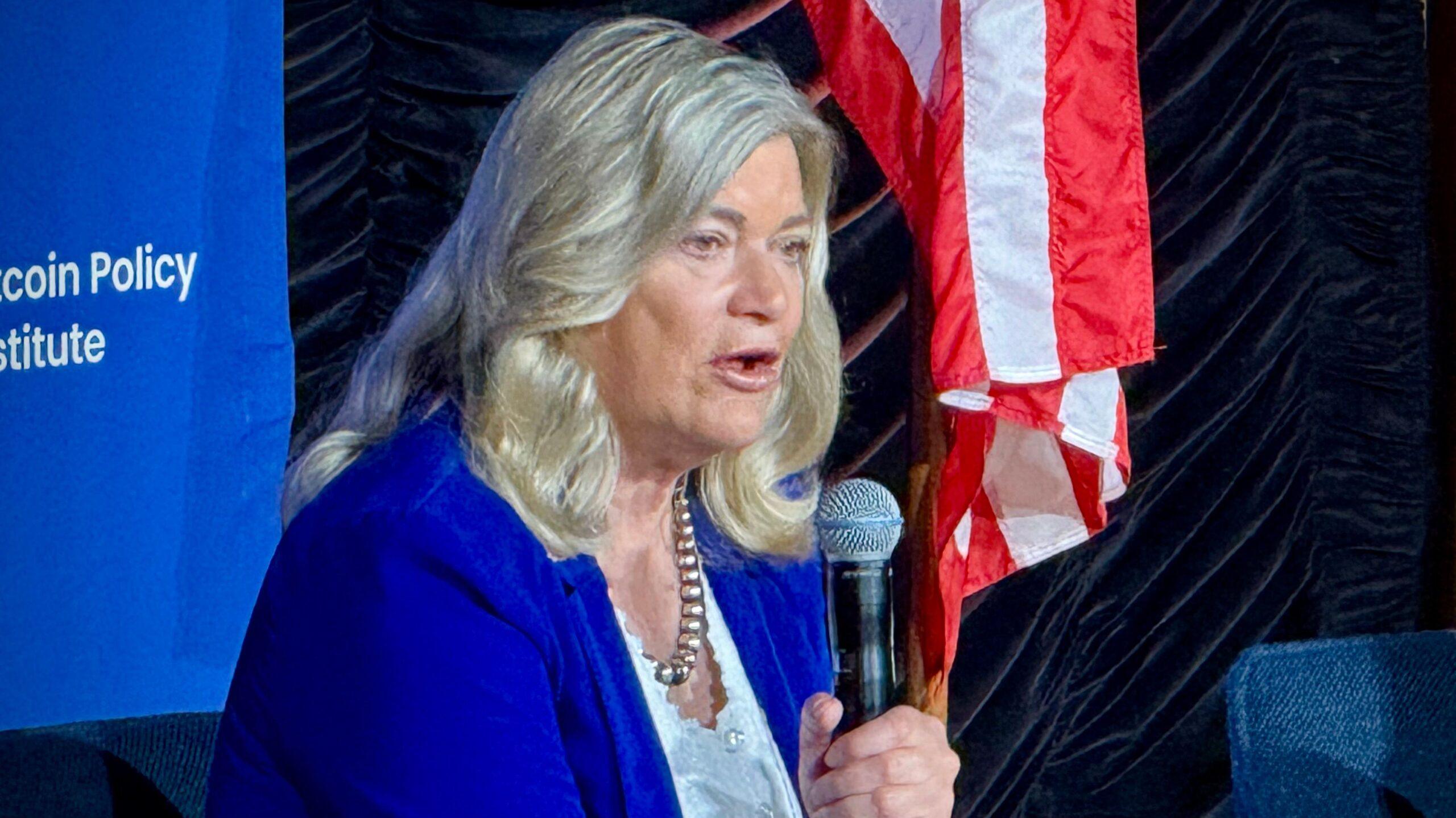

Senator Cynthia Lummis, who directs the subcommittee of cryptography within the Senate Banking Committee, presented the bill on Thursday to combat a certain number of main tax complaints in the digital asset sectors. The legislation would fix a threshold of $ 300 on cryptographic transactions which should take into account user tax calculations, releasing the daily transactions of people from capital headaches – limited to a total of $ 5,000 per year.

The effort would also eliminate the double taxation on the crypto given in the development, the mining, the paratroopers and the forks, throwing the initial tax stroke when the rewards are received and focusing solely on the taxation of the possible sale. He would also address loans, wash sales, charity donations and let concessionaires and traders choose to mark their assets at the current market value in their accounts.

“We cannot allow our archaic tax policies to stifle American innovation, and my legislation guarantees that Americans can participate in the digital economy without inadvertent tax violations,” Lummis said in a statement.

Lummis launched this bill in uncertain waters. Getting the time of the Senate devoted to solitary bills is a challenge in an already busy session, but adding to this complication is the fact that a number of other crypto issues are likely to prioritize – including the two bills that would establish regulations for American cryptographic markets and stable issuers. And another of its legislative campaigns for establish a federal bitcoin

reserve is also in the mixture.

The Wyoming Republican has been at the forefront of cryptographic issues, but the absolute priority for industry on Capitol Hill at the moment is the progress of the bill to establish road rules for the way the government will supervise the digital asset markets. Lummis publicly agreed from Hew to a deadline recently set by Senator Tim Scott, the president of the Senate Banking Committee, to deliver the market on the market structure to the Trump office by the end of September.

Read more: the Budget Budget Bill of the Congress advances the Senate without tax provision of cryptography