The rebound in the cryptographic markets was mainly in a standstill on Tuesday with the American government on the right track to close at midnight at the east.

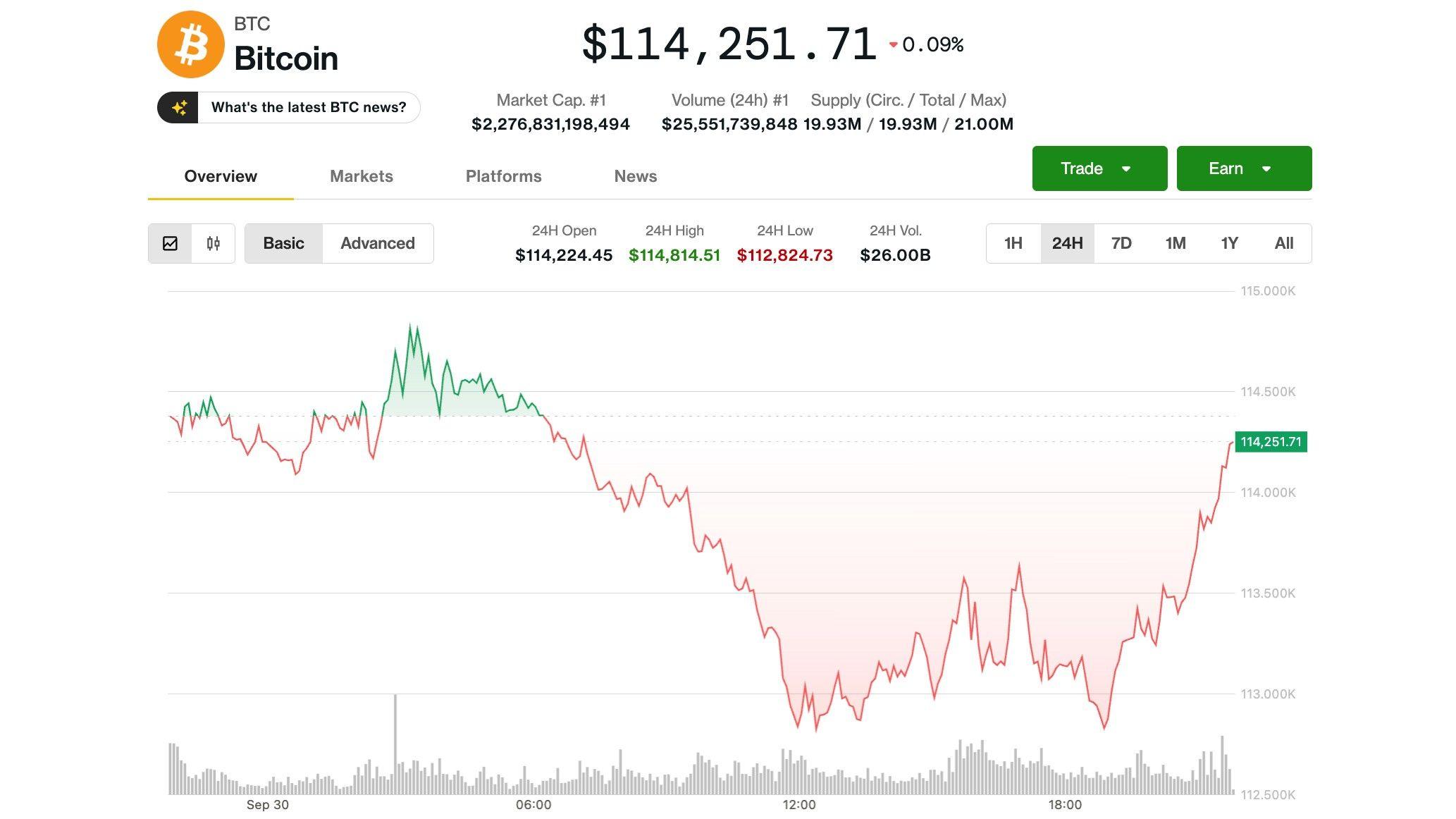

– After having slipped around 2% of the night peaks almost $ 115,000 – managed a rally at the end of the afternoon at $ 114,300, slightly increasing 24 hours ago. Exchanged just above $ 4,100, sliding 1.3% during the same period.

Most tokens in the large commercial reference index 20 index have displayed declins, with UNISWAP (UNI) and Main losses.

A check on the traditional markets has shown that gold rose from 0.5% to $ 3,850, extending its record race, while the NASDAQ and S&P stock indices have also seen late gatherings to move to a positive territory a few minutes before the end.

Most market players are in mode of mode, because the US government seems to go towards a certain closure of an uncertain length.

When the government stops, all non -essential activities within the framework of the executive power will stop, which will probably include one of the titles and the Committee on Exchanges, the Commodity Futures Trading Commission and the continuous efforts of federal banking regulators to create new rules for the cryptographic industry.

Although the closure has no effect on the ability of people to submit comments for open regulation efforts, it is unlikely that anyone in these agencies is responsible for reading the comments. This judgment can also affect the current efforts of companies to list and exchange negotiated funds linked to cryptocurrencies such as And Coindesk reported Tuesday earlier.

The work of the congress on legislation on the structure of the cryptographic market will be delayed. The Senatoric Banking Committee has already postponed a temporarily planned increase – an audience to debate the provisions on the bill – on its market structure project from Tuesday to later in October. The Senate of Agriculture Committee has not published any bill. The Senate Finance Committee, however, is still intended to hold an audience on Wednesday to examine cryptographic tax issues.

The judgment leaves BTC fragile, Bitfinex warns

A closure would also stop the release of key economic indicators such as employment data and IPC inflation reports which could amplify volatility between asset classes, including cryptos, Bitfinex analysts warned in a report.

Data delays could complicate monetary policy decisions of the federal reserve with training effects echo the rate markets, noted the report. Global investors have already reduced exposure to the United States, a trend that prolonged stop could accelerate, depending on the report.

“For markets, the immediate risk is the erosion of confidence and the dead angles of data, rather than systemic financial instability,” said Bitfinex analysts about the potential stop.

In a zoom out, BTC has been correctly in corrective phase since the drop in the Fed interest rate in September, which turned out to be a “rumor, said the information event,” said Bitfinex analysts.

The report noted that, unlike the previous cycles, it took place in three overvoltages of several distinct months, each capped by a generalized profit.

“At each cyclic peak, more than 90% of the displaced parts have been transgeated in profit, a clear signal of generalized distribution,” wrote the analysts.

After taking a step back from the third peak of this type, Bitfinex analysts see probabilities infiltrate a more in -depth consolidation.

“A deep political polarization, an increase in budget deficits and a fragile global economy leave the markets more sensitive to shocks,” they added.