The big question for bitcoin is whether the basic trade, an attempt to take advantage of the difference between the cash price and the long -term market, will return if the federal reserve reduces interest rates on September 17.

There is a 90% chance that the Federal Open Markets Committee will reduce the target rate of federal funds of 25 basic points compared to its current range of 4.25% to 4.50%, according to the Fedwatch CME tool. A policy towards an easier policy could arouse a renewed demand for leverage, pushing higher term premiums and breathing life in a business that has remained moderate throughout 2025.

Basic trade implies the purchase of bitcoin on the cash market or through a negotiated stock market fund (ETF) While selling future (or vice versa) To take advantage of the price difference. The objective is to capture propagation by shrinking towards expiration, while limiting exposure to the volatility of bitcoin prices.

With federal funds still just greater than 4%, an 8% base – the return on the basis of the trade – may not seem attractive until the rate reductions are starting to speed up. Investors are likely to want lower rates to encourage them to enter the basic trade rather than simply hold money.

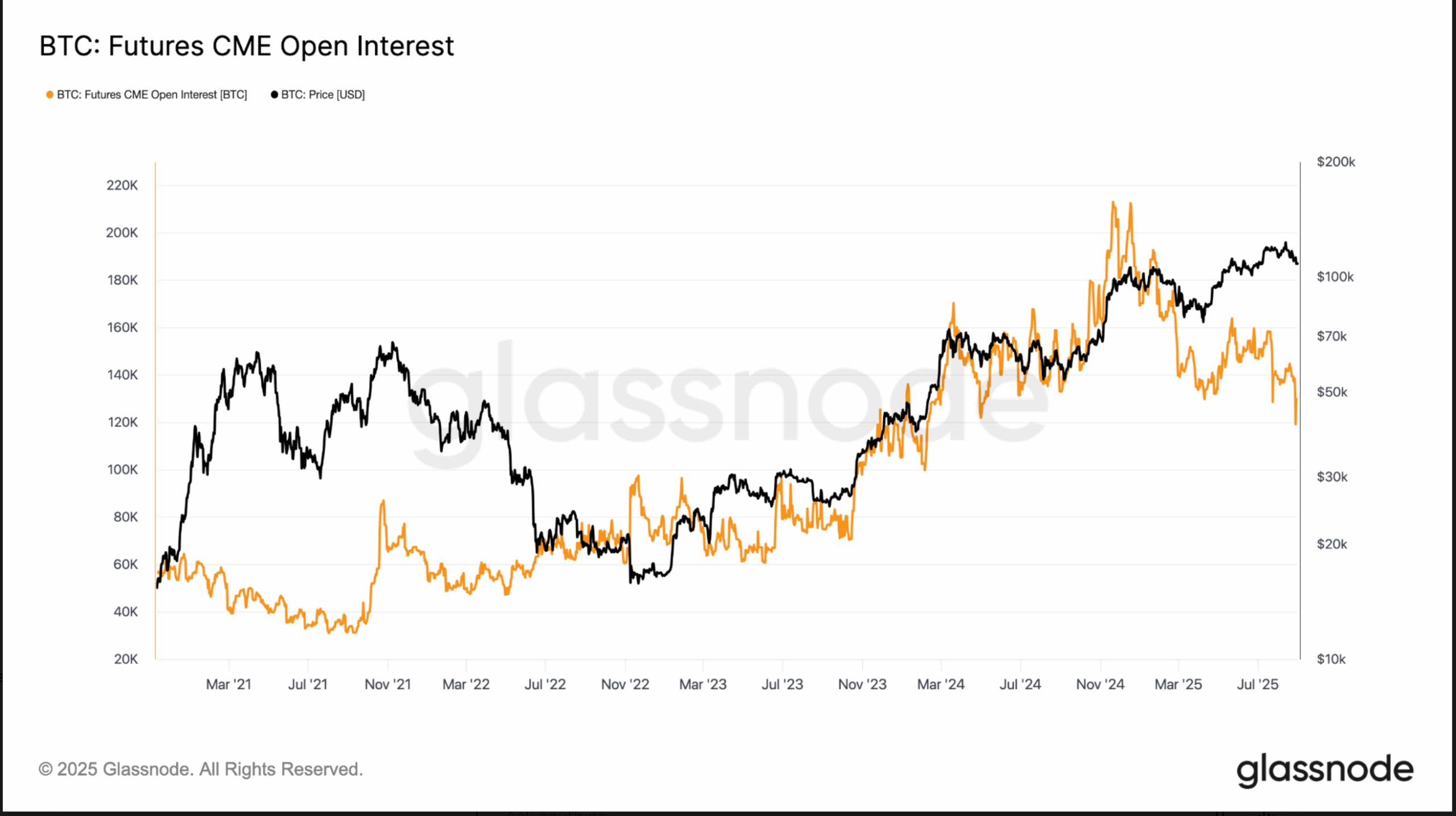

On CME, Bitcoin Futures Open Interest fell by more than 212,000 BTC at the start of the year to around 130,000 BTC, according to Glassnode data. This is roughly the level observed when the Bitcoin ETFs were launched in January 2024.

The annualized base remained below 10% all year round, according to Velo Data, a striking contrast with the 20% seen towards the end of last year. The weakness reflects both the market and the macro-functions: stricter financing conditions, FNB entries slow down after the boom of 2024 and a rotation of the appetite of risks outside the bitcoin.

Bitcoin’s compressed trading fork has reinforced the trend. Implicit volatility, a gauge of expected price swings, is only 40 years old after reaching a lower record of 35 last week, according to Glassnod data. With the suppressed volatility and the institutional light with leverage, the term premiums have remained capped.

If the Fed reduces rates, liquidity conditions could facilitate demand, increasing the demand for risk assets. This can in turn raise the open interest of CME in the long term and relaunch the base trade after a year of stagnation.