XRP passes key levels in a high volume sale before stabilizing major support, with regulatory clarity now in place after the Ripple-Sec.

Preview of technical analysis

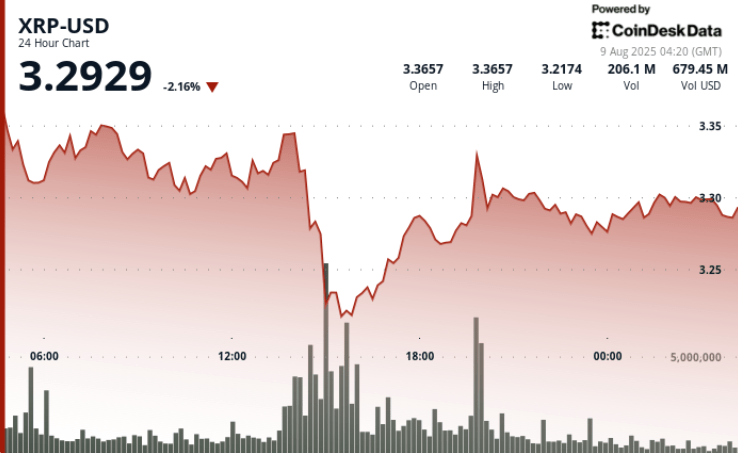

XRP falls by 5% during the 24 -hour period ending on August 9, going from $ 3.34 to $ 3.20 before going back to $ 3.30. This decision extends to a range of $ 0.17, marking volatility of 5.24%.

The sales pressure culminates between 14: 00 and 15: 00, when the price collapses from $ 3.36 to $ 3.20 out of 209.67 million volumes – the largest print at one hour from the session.

Buyers defend the area of $ 3.20, triggering a rebound at $ 3.33 at 7:00 p.m. Resistance forms at $ 3.31 at $ 3.33, with a locked support at $ 3.20.

New context

The Securities and Exchange Commission and Ripple Labs officially ended their five -year legal battle, jointly rejecting their calls in the XRP case. The court of appeal of the second circuit recognized the deposit, the two parties having their own costs.

“Following the vote of the Commission today, the SEC and the undulation officially filed directly with the second circuit to reject their calls,” said Ripple’s legal director Stuart Alderoty, on X.

Summary of price action

• XRP goes from $ 3.34 to $ 3.20 between August 8, 14: 00 to 15: 00 in a high volume sale, printing 209.67 million chips exchanged

• Buyers defend support of $ 3.20, reducing recovery to $ 3.33 to 7:00 p.m.

• Resistance accumulates $ 3.31 to $ 3.33 as a Uppside Momentum lucrative ceilings

Technical indicators analysis

• $ 3.20 confirmed as key support with volume validation at 209.67 million

• Resistance established at $ 3.31 at $ 3.33 during the recovery phase

• Structure of the Taurus flag forming above $ 3.28, suggesting potential upward continuation if $ 3.33 breaks

• an increase in volume to 1.86 million to 01:52 indicates targeted accumulation attempts

• 5.24% intraday volatility Pooling defined exchanges between $ 3.20 and $ 3.33

What traders look at

• If $ 3.20 lies on the next retest in the middle of continuous institutional positioning

• Escape confirmation greater than $ 3.33 to report the end of the profit phase

• Purchase of follow-up linked to post-establishment regulatory clarity

• Spides linked to ETF of the SBI Deposit in Japan and the potential fallout on the US markets