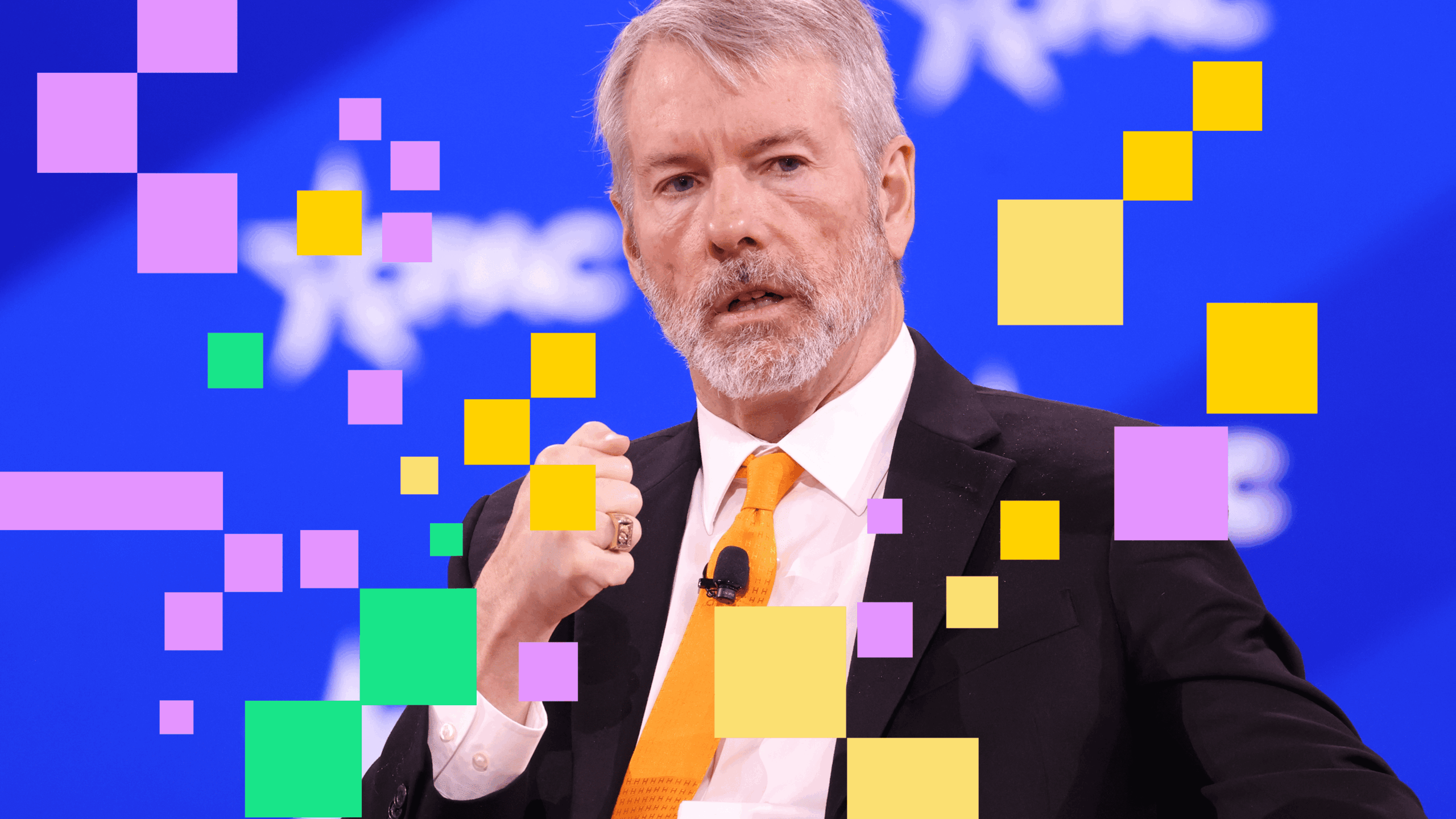

Strategy (MSTR) The attempt to join the S&P 500 index was rejected, despite the satisfaction of the technical eligibility criteria, in what JPMorgan (JPM) calls for a sign of increasing prudence towards companies that work as de facto bitcoin funds.

The discretionary decision of the index committee is a setback not only for the strategy, but for the growing number of business treasury bills that moved its strategy to use balance sheets to accumulate bitcoin, analysts led by Nikolaos Panigirtzoglou wrote.

The inclusion of the strategy in other major references, indices of the Nasdaq 100 in MSCI, quietly gave Bitcoin a rear door in retail and institutional selling wallets, analysts wrote in the Wednesday report.

Wall Street Bank warned that the decision of the S&P 500 could mark the limit of this trend and could encourage other index suppliers to rethink the existing inclusions of Bitcoin companies.

Adding to the pressure, the Nasdaq would have started to demand the approval of shareholders before companies could issue new actions to buy a crypto, according to the report.

The strategy itself recently abandoned its commitment without dilution, signaling a desire to issue actions to lower multiple to continue to finance Bitcoin purchases.

The news comes as the treasury of corporate cryptography treasures face a weakening of stock prices and a slowdown in the program. JPMorgan notes that volumes of funds and debt funds have decreased in the last quarter, which suggests that the appetite for investors is decreasing.

This fatigue raises questions about the sustainability of the Bitcoin-Treasury corporate model. While some companies have turned to more complex funding. Bitcoin -supported loans to the convertibles linked to tokens, rising risks could push investors and index suppliers to promote cryptography companies with operating companies, such as exchanges and minors, on Pure Bitcoin Bitcoin restraint vehicles, added the report.

Find out more: Michael Saylor’s strategy snobbed by S&P 500 in the middle of Robinhood’s surprise inclusion