The Upbit of the exchange of South Korean crypto temporarily suspended the Stellar XLM token trade on Tuesday, a precautionary decision while the stellar network is preparing for its upgrading of the protocol 23.

The planned modernization, scheduled for September 3, should improve scalability and accelerate transaction speeds, which has prompted several exchanges to adopt stability measures during the transition.

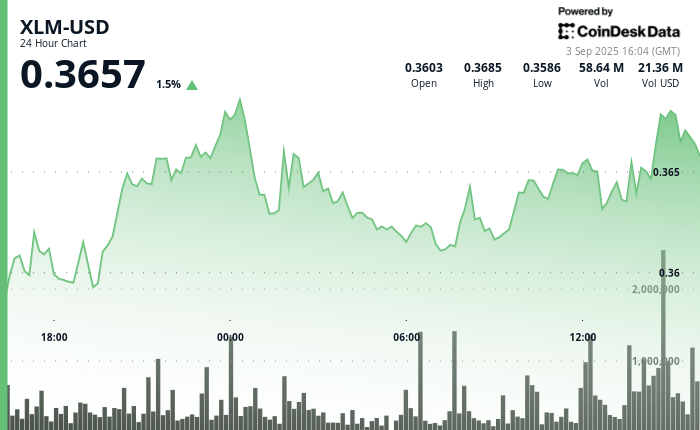

XLM exchanged in a narrow strip between $ 0.36 and $ 0.37 within 24 hours preceding the upgrade, the volume tips coinciding with resistance tests at the upper end of this beach.

Despite several attempts to break through $ 0.37, the sale of pressure kept prices, while solid support was formed at $ 0.36. Analysts suggest that this consolidation reflects institutional accumulation, market participants carefully ensuring a decisive break.

The last hour of negotiation before the suspension saw increased volatility, XLM briefly affecting $ 0.37 before returning to $ 0.36. Price action highlights the importance of the network in cross -border payments and the growing institutional emphasis on the infrastructure of digital assets.

A wider momentum is also powered by an increase in interest in the digital currencies of the central bank (Cbdcs) And the adoption of corporate blockchain, including partnerships involving Hedera.

With the upgrading of the Stellar 23 protocol in progress, the traders are considering two critical levels: the resistance of $ 0.45, which XLM has failed to erase four times since June, and the support area from $ 0.30 to $ 0.32, considered as a potential accumulation area. Market observers claim that the outcome of the upgrade could dictate if Stellar will finally lose its ceiling or withdraw to rebuild support for lower levels.

Main technical indicators

- Price parameters: XLM exchanged in a corridor of $ 0.36 to $ 0.37 during the 24 -hour period with overall volatility of 3%.

- Volume assessment: cutting -edge negotiation activity of 28.91 million during the threshold resistance examination of $ 0.37.

- Support / resistance dynamics: Robust resistance established at $ 0.37, the support now integrity around $ 0.36.

- Configurations in small groups: several unsuccessful attempts to maintain the evaluations above the resistance threshold of $ 0.37.

- Institutional participation: volume overvoltages coinciding with the main technical levels suggest models of accumulation among sophisticated market players.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.