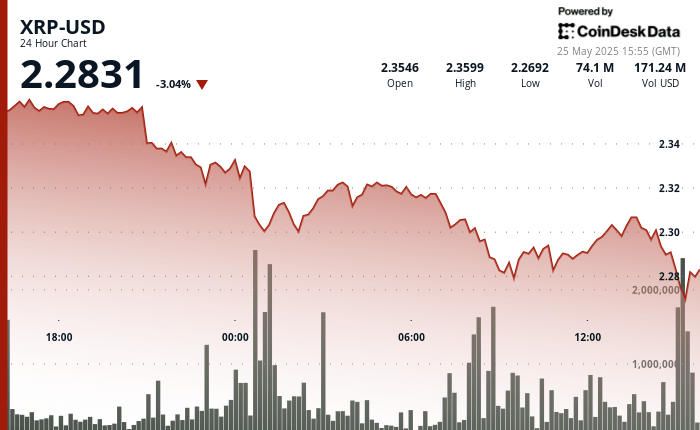

Global economic tensions weigh heavily on the cryptocurrency markets while XRP is a significant correction in the midst of high sales pressure.

The recent announcement of potential 50% prices on European Union imports by the US government has sparked great uncertainty of the market, XRP falling alongside most major cryptocurrencies despite Bitcoin which recently reaches new peaks of all time.

Technical analysts indicate critical support to a range of $ 2.25 to $ 2.26, market observers warning that a break below this level could trigger deeper corrections to zone from $ 1.55 to $ 1.90.

Meanwhile, institutional interests remain strong with the volatility shares that launch an ETF in the long term XRP and the FNB entries in the arrow lever despite the drop in prices, which suggests that Wall Street continues to accumulate positions during market weakness.

Strengths of technical analysis

- XRP underwent a significant correction of 3.46% over the period 24 hours a day, with a downward price of $ 2,361 to $ 2,303, creating an overall range of $ 0.084 (3.57%).

- The largest price action occurred during the midnight hour (00:00), when XRP dropped to an exceptionally high $ 2,297 (37.1 million), establishing a solid volume -based support area.

- A secondary sale at 8:00 am saw the price touch the period of $ 2,280 with the highest volume point (39.9 m), confirming training with two bases.

- During the last hour, XRP experienced significant volatility with a recovery attempt after the previous correction.

- After reaching a hollow of $ 2,297 at 13:11, the price formed a base around $ 2,298 before staging a substantial rally starting at 13:27, culminating at $ 2.307 at 13: 36-13: 39 with an exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $ 2,307, which was tested several times.

- The last 15 minutes have seen a pressure on taking advantage emerging, the price recovering at $ 2,300, establishing a level of short -term support that aligns the psychological threshold of $ 2.30.

External references