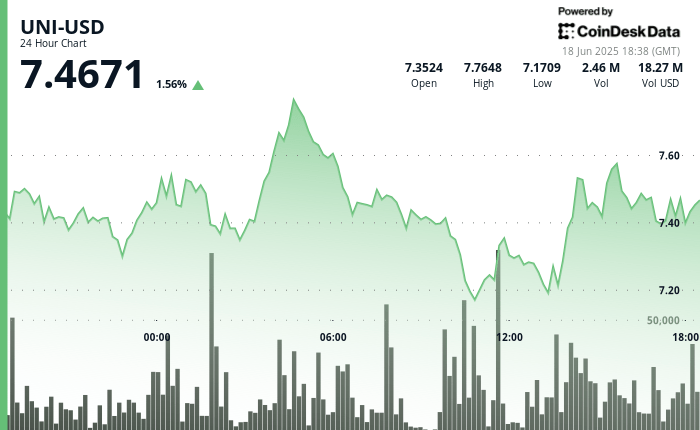

The UNISWAP governance token continues its impressive return, running over $ 7.46 Tuesday after rallied 70% compared to its annual hollow of $ 4.551 on April 7. The token recorded seven weekly gains in the past eight weeks, which has made the longest positive stretch since the beginning of 2023 – and is now to negotiate firmly above the eight weeks of key resistance which went around the attempts at previous recovery.

The wider structure now reflects a conventional bullish reversal, with a prolonged downward trend giving way to rebounded tips, a strong support formation and the improvement of feeling around governance and the role of the market on the chain of United. Buyers absorbed a lively withdrawal earlier in the session and quickly intervened, establishing a new base of about $ 7.14 to $ 7.17.

This support zone now defines the lower limit of the recent trading range of the token. The last rally saw the token push through previous local peaks despite intraday profit taking near the $ 7.52 mark. The higher low and volume coherent scheme very close to the keys inflection points indicates a potentially durable bullish trend, although a net break greater than $ 7.60 would probably be necessary to confirm a complete change of momentum.

Strengths of technical analysis

- Uni exchanged in a 24 -hour range of $ 0,650, from $ 7.142 to $ 7.792, reflecting 8.7% of intraday volatility.

- An acute sale was in the lead at $ 7.142 in 10:00 am, with a volume at 3.96 million, 78% above the daily average.

- The following time increased the volume to 4.69 million as buyers intervene, triggering a recovery in V.

- The price reached $ 7.578 to 3:00 p.m. before facing resistance and temporary consolidation.

- At 5:33 pm, Uni dropped to $ 7.37, followed by a wave between 5:37 p.m. and 5:39 pm, the volume increasing the hourly average to almost 3 times.

- The price culminated at $ 7.53 at the candle 6:00 p.m. with a volume of 162K, which represents a gain of 5.8% compared to the lowest.

- Despite a certain profits almost $ 7.52, the price action took place above the mid-range, extending the recovery in a more defined rise.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.