By Omkar Godbole (all the time and unless otherwise indicated)

The cryptography market is walking on water and the largest cryptocurrency, Bitcoin, takes a Bull Large. His upward momentum is suffocated by the renewed pricing threats of Trump, which also send prices from golden soil to record the heights and support demand for the US dollar.

But there is an action in certain corners of the market. The virtual token broke out after its recent list on Upbit, and the hyperliquid media threshing token experienced a gain of 3%. Litecoin also makes waves, with its perpetual future open interest in centralized exchanges climbing 5.19 million LTS, the most since December 9, according to Coinglass. The overvoltage alludes to a new capital flowing on the market, probably fueled by the hopes of an enumeration of the ETF at the United States

Speaking of Stablecoins, the USDC steals the spotlight as a star interpreter this month, with remarkable growth in market capitalization of 21% to 53.12 billion dollars. It’s his best month since May 2021, according to TradingView Data. On the other hand, the USDT, the heavy goods vehicle champion in dollars stable stables, only increased by 1%. The USDC even surpassed Bitcoin, which increased by 10% respectable.

According to Intotheblock, the outperformance of the USDC is probably due to its compliance with European mica regulations, while rivals like the USDT are faced with opposite winds. But do not yet count usdt; Its market is starting to bounce back and the simultaneous growth of the USDC offers an upward impulse for the cryptography market.

While we keep an eye on the macro landscape, the pivotal core pce – the essential measure of the inflation of the Fed – should be released. Expectations are intended for a hot figure, with basic reading, which excludes food and energy, showing positive improvements that could help BTC get out of its dull price action nearly $ 104,000.

However, ING warns that the dollar could remain strong in the weekend.

“If we do not receive any news in Canada and Mexico by the end of today, there is a risk that the dollar is further strengthening while the market starts at prices in a higher chance of announcements of prices Tomorrow, “he wrote. So stay vigilant!

What to look at

- Crypto:

- January 31: Crypto.com suspends the purchases of Crypto-Monnaies USDT, WBTC, DAI, PAX, PAXG, Pyusd, CDCETH, CDCSOL, LCRO and XSGD in the EU to comply with Mica regulations. Withdrawals will be supported via the first quarter.

- February 2, 8:00 p.m.: Core Blockchain Athena Hard Fork Network Mosed (V1.0.14)

- February 4: Pepecoin (Pepe) half reduced. In block 400,000, the award will drop to 31,250 pepe.

- February 5, 3:00 p.m.: Upgrade of the Holocene Hard Fork network of Boba Network for its Mainnet Layer-2 based on Ethereum.

- February 5 (after closing the market): Microstrategy (MSTR) Q4 FY 2024 generations.

- February 6, 8:00 a.m.: upgrade of the Shenti chain network (V2.14.0).

- February 11 (after closing the market): Exodus movement (Exodus) T4 2024 generations.

- February 12 (before the open market): Hut 8 (Hut) T4 2024 managed.

- February 13: Cleanspark (CLSK) Q1 FY 2025 managed.

- February 13 (after closing the market): Coinbase Global (Coin) T4 2024 generations.

- February 15: upgrade of the QTUM hard fork network (QTUM) in block 4,590,000.

- February 18 (after closing the market): Semler Scientific (SMLR) T4 2024 generations.

- February 20 (after closing the market): Block (xyz) T4 2024 managed.

- February 26: Mara Holdings (Mara) T4 2024 generations.

- February 27: Riot Platforms (Riot) T4 2024 generations.

- March 4: Cipher Mining (CIFR) releases the results of the fourth quarter 2024.

- Macro

- January 31, 8:30 am: The American Economic Analysis Bureau (BEA) publishes the report on income and expenses in December.

- Basic PCE price index Mom is. 0.2% against prev. 0.1%.

- Core pce price index yoy is. 2.8% against Plan. 2.8%.

- PCE Price Index Mom is. 0.3% against prev. 0.1%.

- Index pce price yoy is. 2.6% against Plan. 2.4%.

- February 2, 8:45 p.m.: Caixin Chinese publishes the PMI Manufacturer report in January.

- PMI manufacturing is. 50.5 against prev. 50.5.

- January 31, 8:30 am: The American Economic Analysis Bureau (BEA) publishes the report on income and expenses in December.

Token events

- Governance votes and calls

- Compound DAO votes on upgrading its governance contracts from Governorbravo to the implementation of the modern governor of Openzelin.

- The DAO balancer votes if you have to launch an exchange of tokens between the DAO balancer and the DAO cow involving 200,000 ball tokens and around 631,000 cow’s tokens.

- Unlocking

- January 31: Optimism (OP) to unlock 2.32% of the supply in circulation worth $ 46.39 million.

- February 1: SUI (SUI) to unlock approximately 2.13% of its supply in circulation worth 261.91 million dollars.

- February 2: Ethena (ENA) to unlock approximately 1.34% of its supply in circulation worth 29.53 million dollars.

- Token lists

- January 31: movement (movement), virtual (virtual) and Sundog (Sundog) protocol to list on Indodax.

Conferences:

Positioning of derivatives

- TRX, Trump and OM recorded the highest increase in open -end -term interest. Merchants, however, seem to be short-circuiting Trump, as the Delta cumulative volume show.

- BTC, ETH Open Interest and CVD are little modified. The BTC CME base oscillates around 10%.

- The flows on the deribit options market have been silent, but BTC and ETH calls continue to negotiate more than the points.

Market movements:

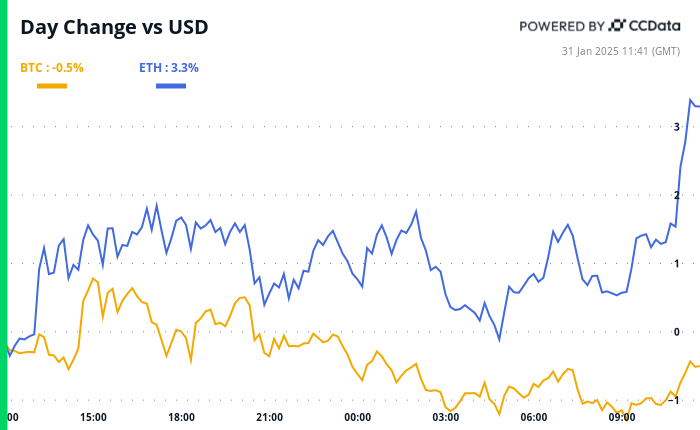

- BTC is down 0.29% compared to 4 p.m. HE Thursday at $ 104,810.50 (24 hours: -0.47%)

- ETH is up 2.39% to $ 3,324 (24 hours: + 3.32%)

- Coindesk 20 is down 0.3% to 3,838.81 (24 hours: + 0.28%)

- The CESR composite strings rate increased from 4 BPS to 3.07%

- The BTC financing rate is 0.0012% (1.2961% annualized) on OKX

- Dxy increased by 0.47% to 108.30

- Gold is unchanged at $ 2,794.77 / Oz

- The money increased from 0.19% to $ 31.60 / Oz

- Nikkei 225 closed + 0.15% to 39,572.49

- Hang Seng closed + 0.14% to 20,225.11

- FTSE is up 0.3% to 8,673.13

- Euro Stoxx 50 increased by 0.39% to 5,302.75

- Djia closed Thursday + 0.38% to 44,882.13

- S&P 500 closed + 0.53% to 6,071.17

- Nasdaq closed + 0.25% to 19,681.75

- The S&P / TSX composite index closed + 1.31% at 25,808.25

- S&P 40 Latin America closed + 2.21% to 2,388.03

- The 10 -year -old American treasure increased from 2 BPS to 4.536%

- E-Mini S&P 500 Futures increased by 0.43% to 6,125.75

- The term contracts on the NASDAQ-100 E-Mini increased by 0.79% to 21,795.50

- E-min dow jones industry index index future increased by 0.32% to 45,200.00

Bitcoin statistics:

- BTC dominance: 59.21 (-0.11%)

- Ethereum / Bitcoin ratio: 0.03127 (0.84%)

- Hashrate (Mobile average at seven days): 781 EH / S

- Hashprice (spot): $ 61.7

- Total costs: 4.97 BTC / $ 522,698

- CME Futures open interest: 176,270 BTC

- BTC at the price of gold: 37.3 oz

- BTC VS Gold Bourse Capt: 10.60%

Technical analysis

- The graph shows that $ 60 has become strong resistance for the IBIT exchange fund of BlackRock since December, the bulls not being established above this level.

- Such models represent bullish exhaustion and often pave the way for minor prices withdrawn that shakes low hands, preparing the ground for the next leg.

Cryptographic actions

- Microstrategy (MSTR): closed Thursday at $ 340.09 (-0.34%), up 0.2% to $ 340.77 in pre-commercialization.

- Coinbase Global (room): closed at $ 301.30 (+ 3.54%), down 0.17% to $ 300.80 in pre-commercialization.

- Galaxy Digital Holdings (GLXY): closed at $ 29.33 CA (+ 0.83%).

- Mara Holdings (Mara): closed at $ 19.18 (+ 4.13%), up 0.36% to $ 19.25 in pre-market.

- Riot Platforms (Riot): closed $ 11.90 (+ 6.06%), up 0.76% to $ 11.99 in pre-market.

- Core Scientific (CORZ): closed at $ 12.26 (+ 6.98%), up 3.18% to $ 12.65 in pre-market.

- Cleanspark (CLSK): closed at $ 10.97 (+ 6.92%), up 0.55% to $ 11.03 in pre-market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed $ 22.50 (+ 6.33%), up 3.47% to $ 23.28 in pre-market.

- Semler Scientific (SMLR): closed at $ 52.15 (+ 0.13%).

- Exodus movement (Exodus): closed at $ 61.38 (-31.27%), down 2.23 %% to $ 60.01 in pre-commercialization.

ETF Flows

ETF Flows

BTC ETFS spot:

- Daily net flow: $ 588.2 million

- Cumulative net flows: $ 40.18 billion

- Total BTC Holdings ~ 1.18 million.

ETH ETFF SPOT

- Daily net flow: $ 67.77 million

- Cumulative net flows: $ 2.73 billion

- Total of Eth Holdings ~ 3.65 million.

Source: Wacky investors

Nightflow

Graphic of the day

- The MOVE index, which represents a measure based on the options of the way in which the US Treasury market is likely to become likely to become in the next four weeks, has dropped.

- The drop in the volatility of the treasury market is often well bored for risky assets.

While you slept

- Stable bitcoin, gold tokens shine while Xau touches the record; Inflation to Tokyo Rises (Coindesk): President Trump’s pricing threats are a headwind for bitcoin, but derivative data indicate skepticism towards a major slowdown, the remaining optimistic and increasingly interesting traders for the reserves of BTC at the state level.

- Grayscale Files Dry Proposal to convert XRP Trust to ETF (Coindesk): Thursday, NYSE Arca filed a 19B-4 form to the SEC to include the actions of XRP Trust de Graycale as ETF.

- Virtual increases by 28% while the Upbit list exhibits the token in Altcoin Savvy Sud-Corens (Coindesk): Virtual Prix, the native token protocol of the virtual protocol, a decentralized platform on the basic blockchain for the creation of AI agents, jumped after Upbit said that it would list the token.

- Trump obtains the interest rates below that he required everyone except the Fed (Reuters): despite Trump calls for rate reductions, the Fed remains a healicist, while the Bank of Canada, the Bank Bank from England and the European Central Bank soften monetary policy.

- Trump says that 25% of prices on Mexico and Canada may not include oil (CNBC): Trump confirmed Thursday that 25% of Mexican and Canadian import prices will start on February 1, but that oil has left uncertain .

- The Japan economy faces fallout from Trump’s porcelain pricing threats (Bloomberg): Japan chief economist Tomoko Hayashi said that an American-Chinese trade war could harm the economy of his Country, although she thinks that companies are better prepared now than during Trump’s first term.