Ether (ETH), the second largest cryptocurrency by market value, experienced a significant increase in volatility on Monday while the renewed trade war between the United States and its commercial partners triggered a large risk aversion on the markets financiers.

The price of the ether hunted up to 24%, with considerable dislocations through centralized exchanges. In drunkenness, the price reached a hollow of $ 2,065, compared to $ 2,127 on Kraken and $ 2,150 on Coinbase (corner), the lowest on August 5 crash, according to tradingView and Coindesk data.

According to cryptocurrency, the slide was the largest since May 19, 2021. The Ethereum blockchain token fell for a third consecutive day, losing 23% during the period, the most since November 2022. , dropped just over 5% from 5% to $ 91,200.

Volatility at the time of Ether day increased from 34% to 184% annualized as the price dropped, according to the deribit options followed by Presto Research.

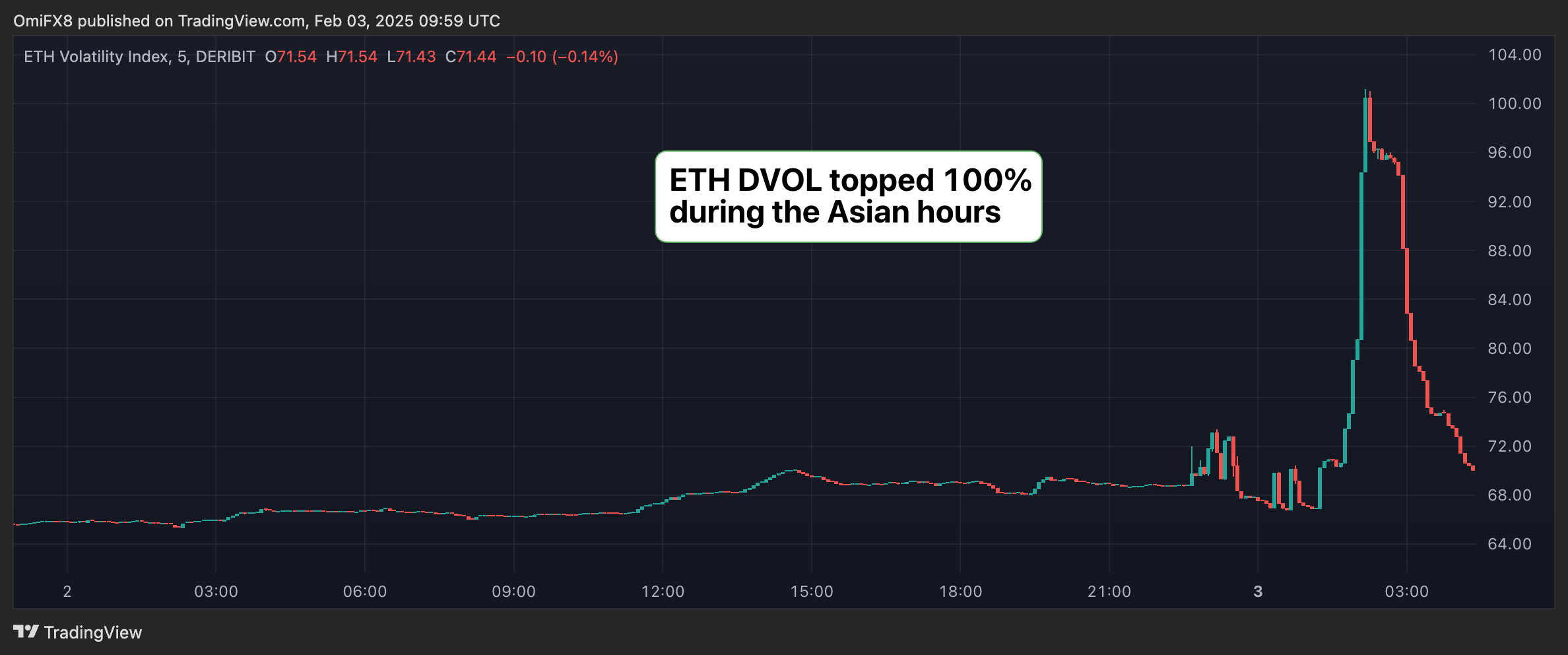

The Ether Dol de Deribit index, which measures the turbulence of the prices expected over the next four weeks, has also increased, climbing to around 67%, according to tradingView data.

The jump came while merchants rushed to buy ETH put options, which offer protection against the drawbacks, according to Presto Research.

“The move, which saw the prices of the ETH Perp on the derments plunge from $ 3,285 to $ 2,065, triggered a significant change in the positioning of the market, as evidenced Relatively calm from last week to 2.5 today – indicating a precipitation for downward protection among market players, “said Rick Maeda, analyst at Presto Research in Coindesk.

At a given time, the risk inversions, which measure the implicit volatility bonus (request) for calls compared to puts, have flashed negative values greater than 10%, an unusually strong bias for puts.

Market manufacturers added to volatility

According to Griffin Ardern, responsible for trading and research on volatile trading conditions, which come in part from market manufacturers, a common characteristic in the conditions of volatile trading, the manager of trading and research operations on the platform Crypto-platform financial form.

“Some market manufacturers have chosen to withdraw liquidity under high volatility, and their risk behavior affects options,” Ardern told Coindesk.

According to Markus Thielen, 10x research manager, Delta coverage by market manufacturers added to the volatility of the drawbacks of the ETH.

“While market manufacturers and exchanges rushed to unload the contracts in the long term, they sold in any available offer, accelerating the sale,” Thielen told customers on Monday.

Market manufacturers are responsible for creating liquidity of orders and earning money from bizarre spread. They are agnostics and strive to maintain neutral exposure on the net market (Delta) by buying / selling constantly in the long term. They generally sell in weakness or buy in force, adding to the momentum, when they hold a short exposure to the gamma.

The fears of the trade war weigh

The pace of the sale of ether prices has led to speculations according to which a large fund / merchant is positioned in derivatives or Defid has been liquidated, leading to an exaggerated price blade.

In general, however, the broader ETH and market slide seems to have been stimulated by the renewed trade war between the United States and Canada, Mexico and China. The concern is that it would inject inflation into the global economy, which makes it more difficult for central banks, including the Fed, to continue to reduce interest rates to support economic growth.

Traditional markets have also suffered from these concerns. Dow Futures fell by more than 650 points earlier today, with European stocks on European actions alongside an increase in the dollar.

12:08 UTC: Corrects the name of Presto analyst at Rick Maeda. The previous version wrongly mentioned Presto’s Min Jung