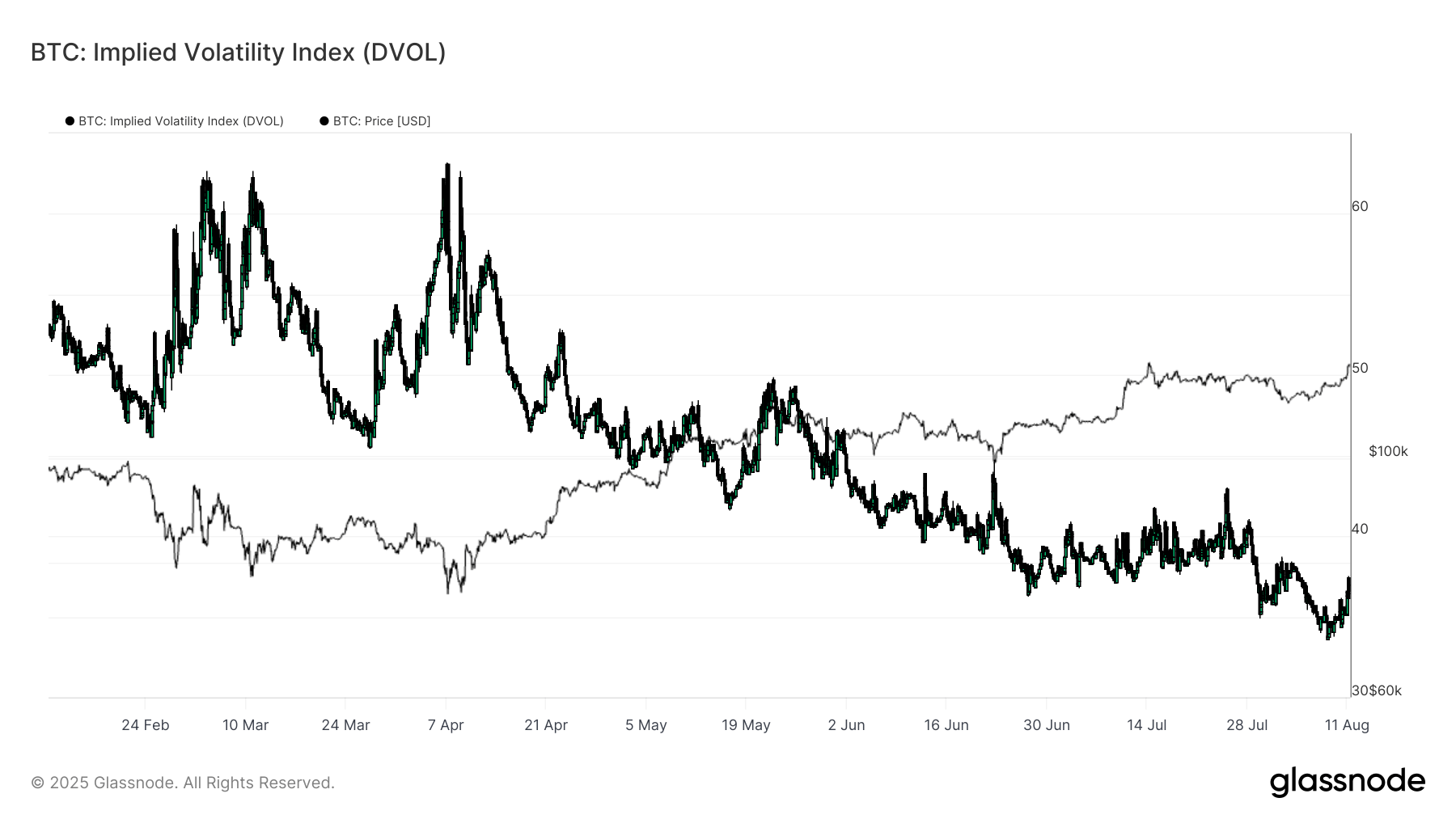

Bitcoin (BTC) implicit volatility (IV) It went from 33 to 37 on Monday, a significant increase in multi -year stockings and a possible signal according to which the long expanse of calm on the market is getting closer.

The VOLTITY OF DIFIBUT (Dvol)Modeled after the VIX on the traditional markets, follows the implicit volatility of 30 days of Bitcoin options and is now at its highest level in weeks.

Implicit volatility represents market forecasts for price oscillations, calculated from the prices of options. In formal terms, IV measures the avowing range to a standard of the movement expected of an asset over one year. Money monitoring (ATM) IV offers a normalized vision of feeling, often amounting and falling along the volatility achieved.

Last week, the short -term BTC IV fell at around 26%, one of the lowest readings since the options of options began to be recorded, before rebounding strongly. The last time the volatility was seated in August 2023, when Bitcoin oscillated almost $ 30,000 shortly before a sharp movement higher.

During the weekend, Bitcoin went from $ 116,000 to $ 122,000, referring to what can happen when volatility begins to develop. August is traditionally a period of low volumes and activity on the mute market, but the increase in IV suggests that traders can position for greater movements.

Checkonchain’s data show that the latter rally was a decision -based decision, which is a healthier market structure than a purely worn overvoltage. The open interest has decreased until August, which means that a sudden influx of leverage could amplify price fluctuations if the feeling changes.

Read more: Bitcoin bulls take another hit on the Golden Fibonacci report above $ 122,000 while inflation data are looming