Shiba Inu posted contradictory market indicators during the last negotiation sessions. The token initially demonstrated bullish momentum with significant volume support, but this quickly gave way to intense sales pressure.

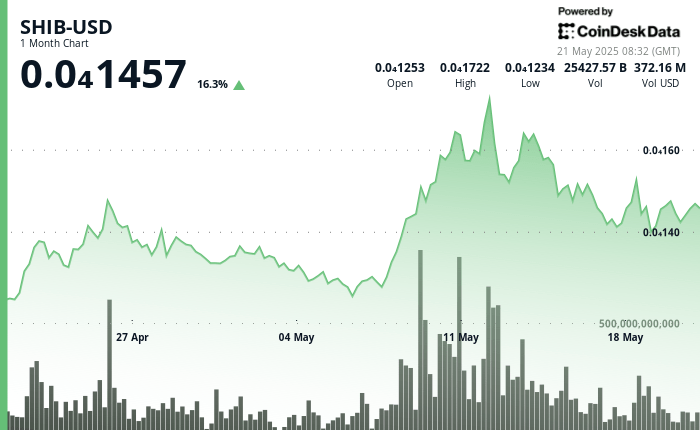

Technical analysis reveals that SHIB consolidates the key resistance levels below, traders closely monitoring the area from 0.00001450 to $ 0.00001600 for potential rupture signals. Chain metrics paint a worrying image, with a drop in whale stupids (-311%) and a substantial decrease of 68% of active addresses since December.

The current market structure suggests that continuous variation behavior can precede a decisive directional movement, with confirmation requiring a rupture above the resistance to the descending line at around $ 0.00002044.

With only 17% of holders currently in profit, while more than 80% remain underwater, any significant increase in prices could face substantial sales pressure while investors seek to break.

Analysts remain divided on the short -term SHIB perspectives, some identifying potential optimistic patterns while others indicate that the weakening of fundamentals as a cause of prudence.

Strengths of technical analysis

- SHIB has established significant support at high volume at $ 0.00001417 during 7:00 p.m., followed by a constant purchase pressure.

- Notable volume tips occurred during the period of 04: 00-06: 00, exceeding USD 700 million, confirming the initial bullish momentum.

- The time of final negotiation has experienced a clear decline by 1.77% compared to the summit, suggesting profits after the rally.

- An Ema Bearish battery has formed, prices find it difficult to recover the 50 -day mobile average.

- A descending channel motif emerged in the time graph, with lower ups and lower stockings indicating a short -term lower feeling.

- A peak in volume of more than 110 billion commerce coincided with a clear rupture below key support levels.

External references