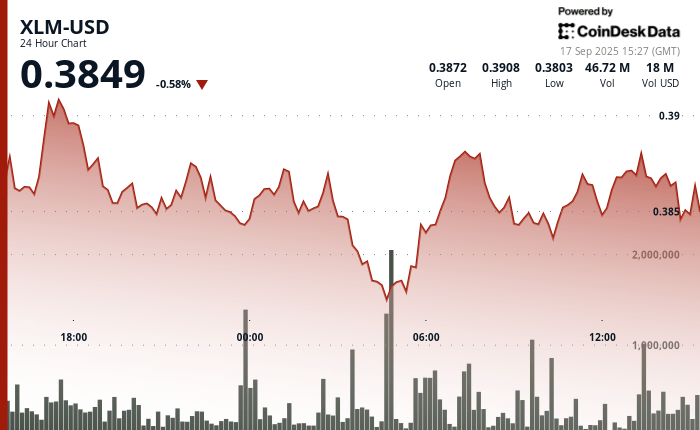

XLM rebounded greatly after faced a night sale pressure, the token dates back above $ 0.39 during European negotiation hours on Tuesday. This decision followed a sharp decline which saw the asset fall from $ 0.39 to 2 h UTC at $ 0.38 to 4 am, marking the steepest drop in the session. A high negotiation activity around the level of $ 0.38 reported a high demand, helping to establish this area as a key support area.

The rebound has grown when the markets in Europe opened, pushing XLM to $ 0.39. Analysts noted that the recovery suggested institutional interests, traders probably accumulating at reduced prices. Action of prices during the 24 -hour window of September 16 at 3:00 p.m. UTC at September 17 at 2:00 p.m. UTC highlighted resilience, the active that oscillates in a narrow strip of $ 0.38 to $ 0.39 – a swing of 2% despite increased volatility on the wider cryptographic markets.

Intrajournal trading in the last hour of the observed period reflected this rope shot between bulls and bear. After briefly tested $ 0.39 at 13:25 UTC, XLM returned to its low 20 -minute session later before resuming the momentum. The recovery of the DIP underlined the purchase of conviction, the closure of the token nearly $ 0.39 and preserving its upward structure before the American session.

Technical indicators signal architecture of constructive momentum

- Negotiation parameters from $ 0.38 to $ 0.39 are a 2% volatility differential during the 24 -hour evaluation period.

- The acute nocturnal drop from $ 0.39 to $ 0.38 marked the most pronounced lowered feeling of the period.

- High participation in volume of approximately $ 0.38 Threshold established the confluence of critical demand.

- The recovery dynamics have accelerated throughout European trade with ascent beyond $ 0.39.

- The institutional accumulation confirmed at reduced levels around psychological support of $ 0.38.

- The succession of ascending hollows by consolidating price behavior suggests an underlying optimistic conviction.

- The volatility of mid-session examined the critical support infrastructure during a one hour negotiation window.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.