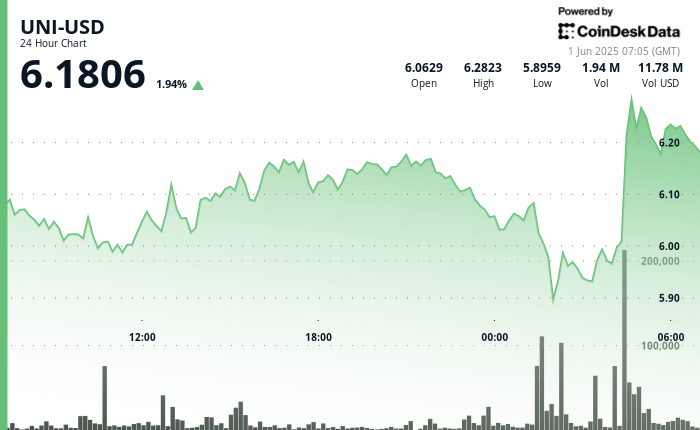

The native token of Uniswap is initially broken below its upward trend line after failing to maintain the momentum over the support level of $ 6.00.

The decline followed the formation of an ascending channel earlier in the day, but this structure collapsed under a high volume sale, including an increase of more than 1.4 million units, prices briefly affected $ 6.00.

However, ventilation has proven to be temporary. Uni quickly reversed the course and returned to $ 6.18, indicating a strong interest in diving purchasing and suggesting that the upward trend can always be intact if support almost $ 6.05 continues to hold.

Strengths of technical analysis

- Uni formed a clear ascending channel for most of the day, with a notable support at the level of $ 6.00 supported by a volume greater than the average.

- A net reversal occurred while UNI has briefly broken below its bullish trend line, triggering a high volume sale.

- Two large volume peaks occurred: more than 455,000 units at 01:38 and exceeding 1.4 million units at 01:42.

- The token quickly rebounded after the breakdown, regaining ground and pushing back to the $ 6.18 area.

- The initial resistance was encountered at $ 6.19, which now appears at hand while the Haussier dynamics return.

- Price action has shown an substantial intra -day range of 0.226 (3.78%), highlighting persistent volatility

External references