The Solana floor token is ready for a potential price swing of almost 6% after certain major investors, or whales, spilled their assets before the American non -agricultural pay (NFP) report on Friday later.

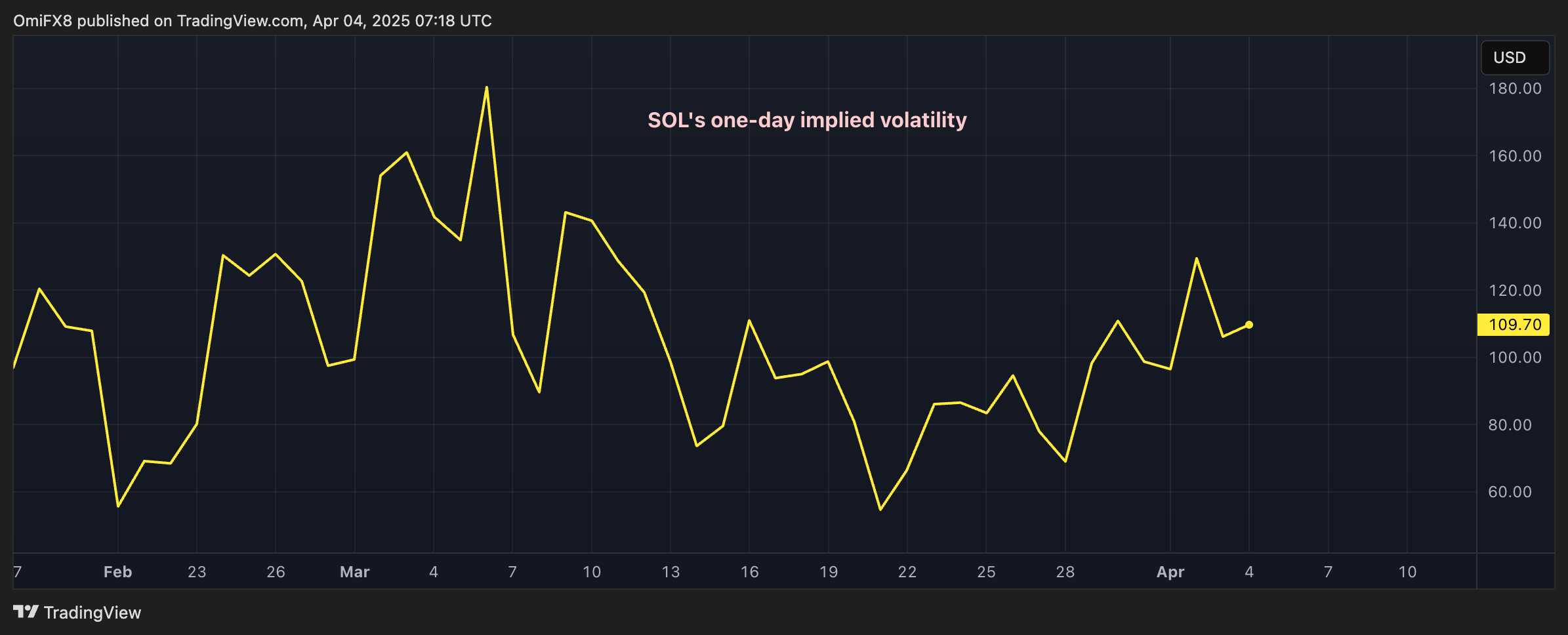

This estimate comes from the implicit volatility index for a day of Volmex (IV) for soil. At the time of the press, the index showed a day reading from 109.70%, indicating a volatility of the expected prices of 4.74%. (The daily figure is derived by dividing the volatility annulized by the square root of 365, the number of days of negotiation in one year.)

A movement of this size represents moderate volatility, especially given that cryptocurrency has experienced several days by 6% or more volatility since early March, according to Coindesk data.

In other words, the market is likely to be volatile, but nothing out of the ordinary.

Sale of whales

The data followed by Blockchain Sleuth Lookonchain show several unpaid and spilled whales worth $ 46.3 million on the market.

A large unloading of parts by whales often leads to a lower price action. However, the amount sold early today is 0.97% of the 24-hour negotiation volume of the cryptocurrency of $ 4.7 billion.

It is therefore not surprising that Sol is little negotiating at around $ 116, having printed a hollow of $ 112 on Thursday. In general, cryptocurrency has been downwards since it reached a summit of $ 295 on January 19.

Concentrate on payroll

US data on jobs, scheduled at 12:30 p.m. GMT, should reveal that the economy added 130,000 jobs in March, slowdown compared to February 151,000 and well below 122,300 of 12 months, according to Factst.

The median estimate of the unemployment rate for March is 4.2%, the highest since November and more than February at 4.1% of reading. Average hourly income should have increased by 0.3% per month, corresponding to the rate of February.

A lower than expected figure will probably validate the prices renewed for four interest rate reductions to 25 points this year, potentially sending risk assets, including higher cryptocurrencies.