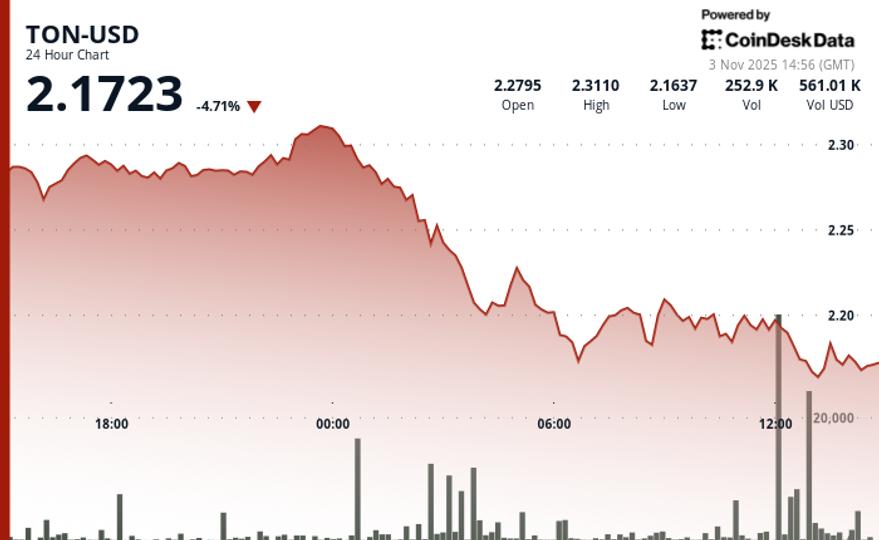

The price of fell 5% in 24 hours to $2.165 as market pressure intensified and Nasdaq chastised TON Strategy for a $272.7 million purchase of the token.

The price has broken through key support zones on the way down, according to CoinDesk Research’s technical analysis data model. Trading volumes jumped to 5.76 million tokens, almost 1.5 times the 24-hour average, confirming strong selling conviction.

A brief rebound late in the session helped TON recover from its low of $2.162, but resistance near $2.19 limited the rebound. The broader crypto market, as measured via the CoinDesk 20 Index (CD20), fell 3.7% over the past 24 hours.

TON’s underperformance also came amid a Nasdaq rebuke of one of the token’s largest holders.

TON Strategy (TONX), the largest publicly traded company building a toncoin treasury, failed to obtain required shareholder approval before issuing shares to finance a large token acquisition, according to an Oct. 28 filing with the SEC.

The deal, structured as a private investment in public equity (PIPE), used nearly half of the proceeds, or approximately $273 million, to purchase toncoin.

Nasdaq reported the rule violation, but did not recommend delisting, citing lack of apparent intent to evade compliance. Nonetheless, the warning adds pressure to TON Strategy’s broader efforts to legitimize a cryptocurrency-focused public treasury. TON Strategy currently holds 217.5 million tokens.

TON’s price action now largely depends on technical levels. Support appears to be forming near $2.162, while resistance at $2.19 may continue to cap any upside attempts.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.