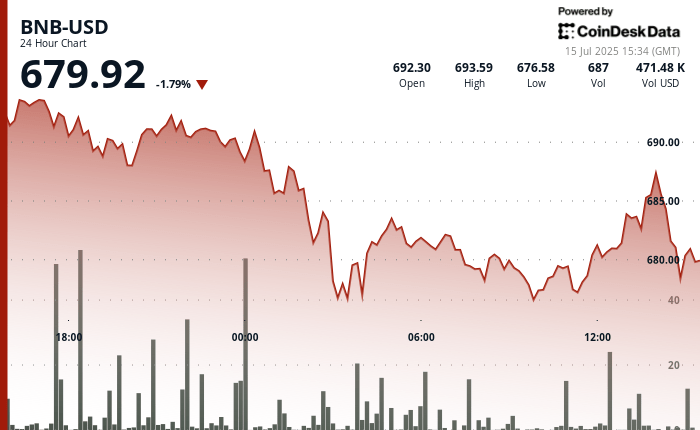

The BNB has dropped by almost 2% in the last 24 hours while crypto traders rushed to lock the profits, the falling token to negotiate now around the $ 680 mark after briefly touched $ 700.

The slide reflects broader market tremors after Bitcoin

Increased to a record greater than $ 120,000, which sparked a wave of profits that brought the cryptocurrency to $ 116,000 when writing the editorial’s moment.

The trend for profit also occurs at a time when inflation increased to 2.7% in June, measured by the consumer price index. This is an annual increase of 2.4% in May, according to the Bureau of Labor Statistics

For hours, BNB has oscillated in a narrow corridor of $ 23, bouncing between $ 698.72 and $ 675.47, according to the Technical Analysis model of Coindesk Research. Buyers arose nearly $ 675, helping to stem the slide with a burst of volume greater than 134,000 negotiated tokens while prices have reached lower session. BNB has since fallen from the field.

The technical signals remain mixed. A downstream trend persists, crowned with resistance from $ 690 to $ 695, an area where previous support overturned in sales pressure.

However, the increases in commercial activity indicate a possible accumulation, as seen in a brief increase of more than 1,600 tokens exchanged by a four -minute window. Various companies have indeed moved to adopt a BNB cash reserve.

Volatility comes as the BNB celebrates its eighth anniversary, a milestone that underlines its trip. He also recently suffered a $ 1 billion token burn.

BNB also benefits from the BNB channel joining the Ondo Global Markets Alliance to provide token titles, which include American actions, ETFs and funds, to its network.

That the BNB can break the resistance over the resistance or pour lower if taking profits continues could shape the broader market of cryptography in the coming days.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.