XRP a augmenté à 3,05 $ sur un chiffre d’affaires doublé avant de se débarrasser de la consolidation, les baleines déchargeant plus de 300 millions de dollars en tant que bureaux institutionnels repositionnés avant une décision pivot de la Fed.

The $2.99 floor held on repeated defenses, leaving the price boxed between $2.99 and $3.05 while ETF timeframes and rate-rate speculation continued.

News background

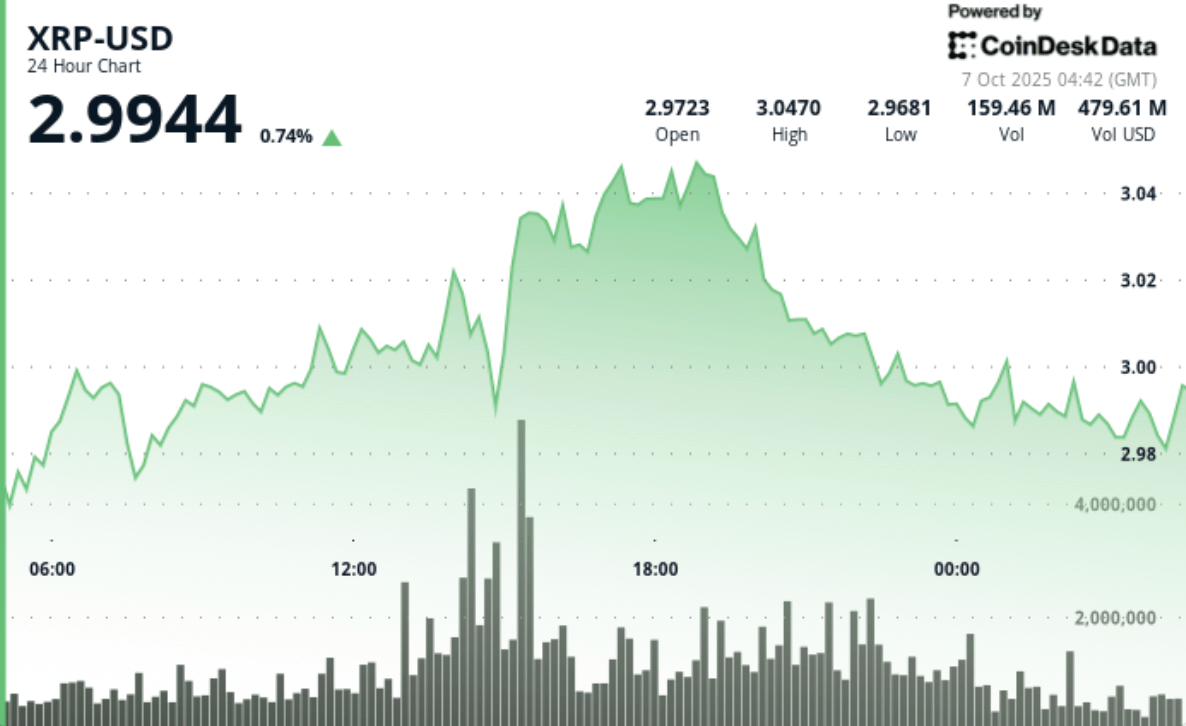

XRP gained 3% in the 24 hours to October 7, trading between $2.97 and $3.05 before closing near $2.99. The move was driven by an increase in institutional flows – more than 1.5 billion tokens were processed – and whale dispositions exceeding $300 million.

Macro catalysts dominated sentiment. Markets are now pricing in a 96% chance of a Fed rate cut on October 29, while more than 70 ETF applications, including seven for XRP, face SEC deadlines starting October 19.

Price Action Summary

- XRP’s session range ran $0.08 (3%), from $2.97 low to $3.05.

- The afternoon rally lifted the price from $3.00 to $3.04 on turnover of 137 million, almost 2x the daily average.

- Repeated rejection at $3.04 to $3.05.

- The price consolidated around $2.99, where buyers stepped in several times.

- A late flush to $2.981 was absorbed quickly, with volume spikes of 2.2 million, creating a short-term bottom.

Technical analysis

Resistance remains rooted at $3.04 to $3.05, where a big sell-off has capped the advance. Support is validated at $2.99, reinforced by several retests and the absorption of intraday liquidation flows. The price structure suggests accumulation to the base of $2.99, with potential bullish continuation if momentum can resume $3.03 and challenge $3.05. Breaking through this resistance could set up targets towards $3.10, although macro catalysts remain the dominant driver.

Which traders are watching?

- If $2.99 holds a firm base of support amid continued whale distribution.

- If institutional positioning supports momentum in the ETF deadlines of October 19.

- Market reaction to Fed policy signals – A cut could increase flows through risk assets.

- Confirmation of breakout above $3.05 to unlock next leg towards $3.10 to $3.12.