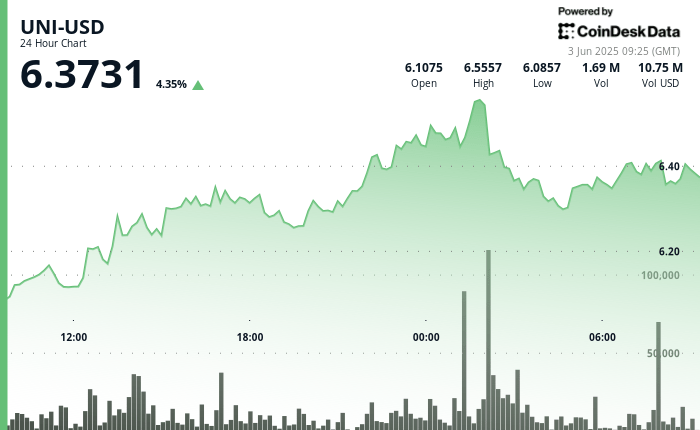

The Uniswap unique token has extended its recent recovery gathering, brushing macroeconomic pressure while investors seemed beyond increased global trade tensions.

The token dropped regularly from $ 6.09 to $ 6.40, establishing a key support higher than $ 6.30.

The market volatility remains high, fueled by geopolitical risk and speculation surrounding the rate reductions in Europe and the United States

However, Uni seems to benefit from risk rotation while traders are looking upwards in Altcoins, with a price retention company despite the jerky conditions.

A sharp increase in volume during the first hours of the session, especially at $ 6.5557, marked a potential short -term summit.

However, subsequent withdrawals have encountered aggressive purchases, strengthening a bias bruise and keeping the university on the right track for new gains – provided that it can maintain prices higher than zone from $ 6.30 to $ 6.33.

Prix Technical Potters

- Uni showed a strong bullish dynamic over 24 hours, from 6.09 to 6.40, representing a gain of 5.09% despite significant price oscillations.

- The token has established a clear rise in higher trend with higher stockings until the resistance at 6.57, followed by net rejection with an abnormally high volume (3.89 m) at 02:00, creating a high volume resistance zone.

- The support formed around the fork of 6.30-6.33 where buyers constantly intervened, while the overall beach of 0.49 (8.07% of the starting price) demonstrates substantial volatility.

- During the last hour, Uni experienced significant volatility with a notable recovery scheme, falling at 6.36 before establishing higher stockings and tops.

- The volume increased spectacular to 56,320 to 07:59, confirming the buyer’s conviction at these levels.

- The price action has formed a clear support area around 6.38-6.39, while the resistance nearly 6.41 was tested several times.

- The consolidation greater than 6.40 suggests a potential continuation of the wider bullish momentum.