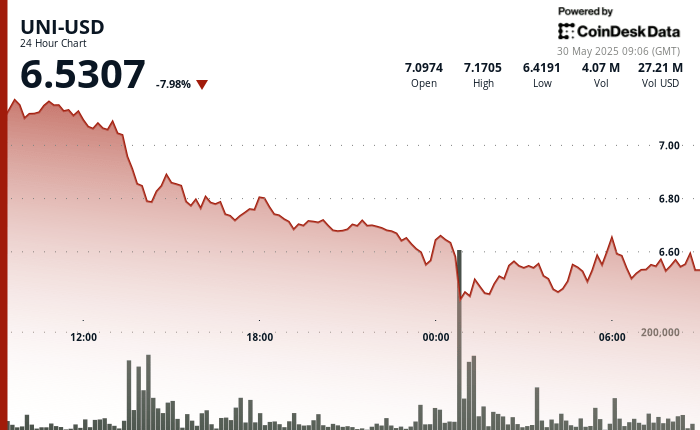

In the past 24 hours, UNISTWAP Native Token Uni has been a marked decline due to volatile market conditions. The price movement of $ 7.119 to $ 6.532 indicates a substantial drop pressure, amplified by macroeconomic factors such as the lower markets of the global market and the feeling of investors.

At the same time, microeconomic elements, including the latest advances in the Uniswap protocol and the strategic interests of cryptocurrencies, provide counterweight support points, potentially extinguishing other price reductions. Despite the decline, long -term confidence could rely as Uniswap is gaining ground with its latest innovations, suggesting a strategic consideration of investors.

Strengths of technical analysis

- The UNI price increased from $ 7.119 to $ 6.532 in 24 hours.

- The intermediate support was found at $ 6.40, supported by significant trading volumes, according to the Technical Analysis Data model of Coindesk Research.

- The price attempted a recovery reaching a summit of $ 6.595 but stabilized at $ 6.522 at 8:00 am.

- Constant lower tops noted throughout the session, suggesting a continuous bearish feeling.

External references

- “Uni Eyes $ 10 as the UNISWAPX launch triggers a breakdown from the reverse”, Crypto.News, published on May 29, 2025.

- “Prediction of the uniswap price: is it ready for a bullish break?”, Coinpedia, published on May 29, 2025.

- “Price prediction united for May 30: Momentum slows down nearly $ 7.25 after a major break”, Coin Edition, published on May 29, 2025.

- “What is the next step for this Popular Defi token? Uniswap (Uni) will he walk above $ 10 in the coming month?”, Coinpedia, published on May 29, 2025.