The Bitcoin (ETF) FNB (ETF) listed by the United States (ETF) experienced the second trips of the year on Monday, lowering $ 516.4 million, show the Farside data.

Withdrawals, the ninth net outing in 10 days, reflect an increasing discomfort with the largest cryptocurrency, which exchanged a narrow range between $ 94,000 and $ 100,000 for most of this month.

Tuesday, Bitcoin came out of his three -month channel, falling below $ 90,000 and sliding up to $ 88,250.

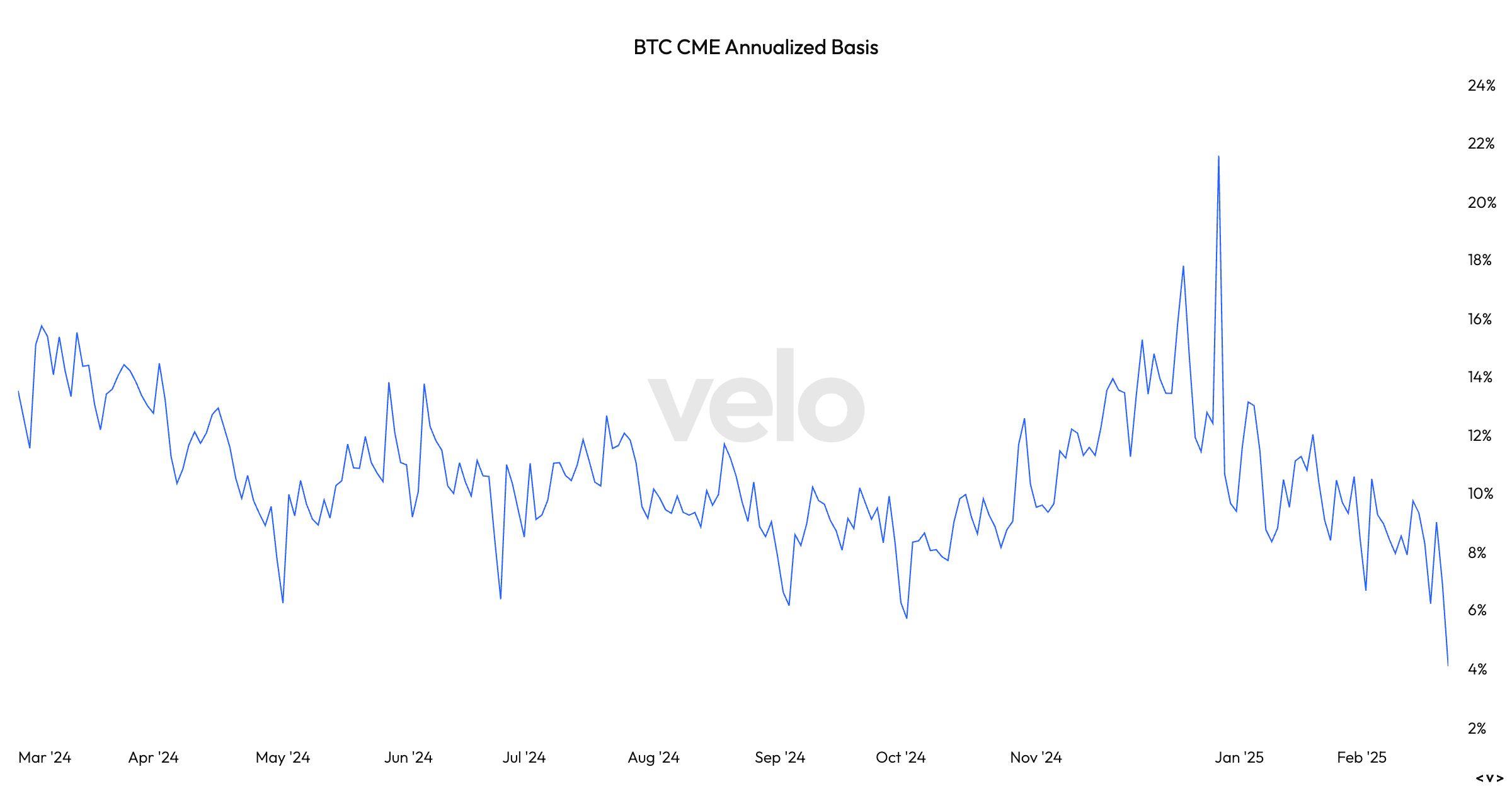

According to Velo Data, the cancelled base of Bitcoin CME – the difference between cash prices and term contracts – fell to 4%. It is the lowest since the ETF began to negotiate in January 2024. This is also known as liquidity and Carry, which is a neutral strategy of the market that seeks to take advantage of bad pricing between the two markets.

The strategy is to take a long position in the cash market and a short position in the long -term market. VELO data shows a contract eventually one month. Investors perceive a premium between the propagation of the point of the place and the prices in the long term until the closure of the expiration date of the term contract.

At the current level, the base trade is lower than the so-called risk-free rate, the yield on the Treasury at 10 years 5%. The difference can persuade investors to close their positions in favor of higher yield. This could see other ETF outputs. Because it is a neutral strategy, investors will also have to close their short position in the long -term market.

Arthur Hayes, the co-founder of Bitmex, alludes to the trade base which is unleashed in a post on X.

“Many Ibit holders are designer funds that have made a long, short-sized future to obtain a higher return to what they finance, in the short term American treasury bills,” he wrote. “If this base falls as Bitcoin falls, then these funds will sell Ibit and buy the contracts in the long term on CME. MOFO!”