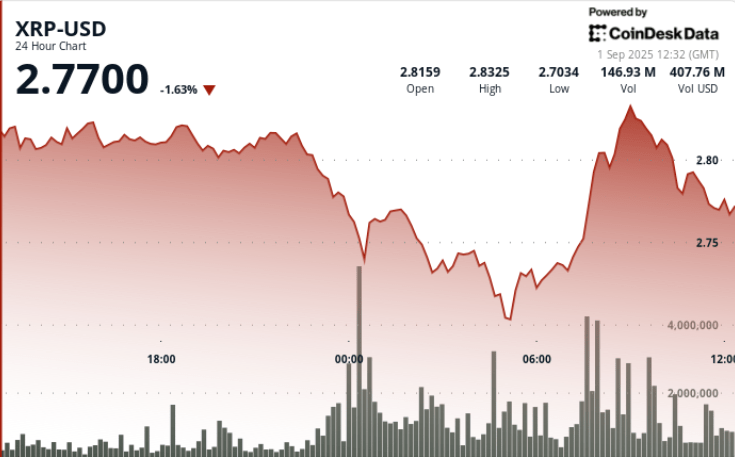

The token is negotiated between $ 2.70 and $ 2.84 at August 31 at Sept. 1 window, with an accumulation of whale against heavy resistance at $ 2.82 to $ 2.84.

New context

- XRP increased from $ 2.80 to $ 2.70 at the end of August 31 – September 1 before bolishing $ 2.82 over heavy volumes.

- Whales have accumulated 340m XRP over two weeksA signal of institutional conviction despite the short -term lower pressure.

- Chain activity enriched with 164m tokens exchanged during the morning rebound of September 1More than the double session averages.

- September remains a historically low month for the crypto, but the accumulation of whales is considered to be a counterweight to the liquidation flows of retail.

Summary of price action

- The negotiation range is $ 0.14 (≈4.9%) Between $ 2.70 low and $ 2.84 high.

- The most steep drop occurred at 11:00 p.m. GMT on August 31, while the price went from $ 2.80 to $ 2.77 Volume of 76.87 mnearly 3x daily average.

- At 07:00 GMT on September 1, Haussiers flows made a rebound of $ 2.73 to $ 2.82 Volume 164mCement $ 2.70 at $ 2.73 as short -term support.

- Last Hours Consolidation (10: 20-11: 19 GMT) The price saw 0.71% from $ 2.81 to $ 2.79, with a large sale between 10: 31 and 10: 39 on Volume of 3.3 m per minuteConfirming the resistance from $ 2.80 to $ 2.81.

Technical analysis

- Support: $ 2.70 – $ 2.73 Floor defended several times, reinforced by the purchase of whales.

- Resistance: $ 2.80 – $ 2.84 remains the rejection area, with $ 2.87 at $ 3.02 as the next upward threshold.

- Momentum: RSI near the mid -40 year old after a rebound, showing a neutral bias in Port.

- MacD: The compression phase continues; potential crossing if the accumulation persists.

- Patterns: Symmetrical triangle forming with compression of volatility; The rupture path remains open to $ 3.30 if the resistance clears.

What traders look at

- If $ 2.70 at $ 2.73 holds, short -term traders will treat it as a springboard for $ 2.84 in repetitions.

- A fence greater than $ 2.84 would give $ 3.00 to $ 3.30 at stake.

- Decreasing scenario: a violation of $ 2.70 exhibits $ 2.50 as the next structural medium.

- Accumulation of whales in relation to institutional sale – the Push -Pull dynamic which could dictate the management of September.