The financial markets are in a merger and each lower step strengthens expectations on the credit market that the Fed will soon offer support.

Bitcoin (BTC), the main cryptocurrency by market value, was negotiated at 8% at $ 75,800 and American shares were on the right track for their worst three-day performance, with S&P 500 term contracts dropped by only about 5% on Monday and losses approaching 15% overall.

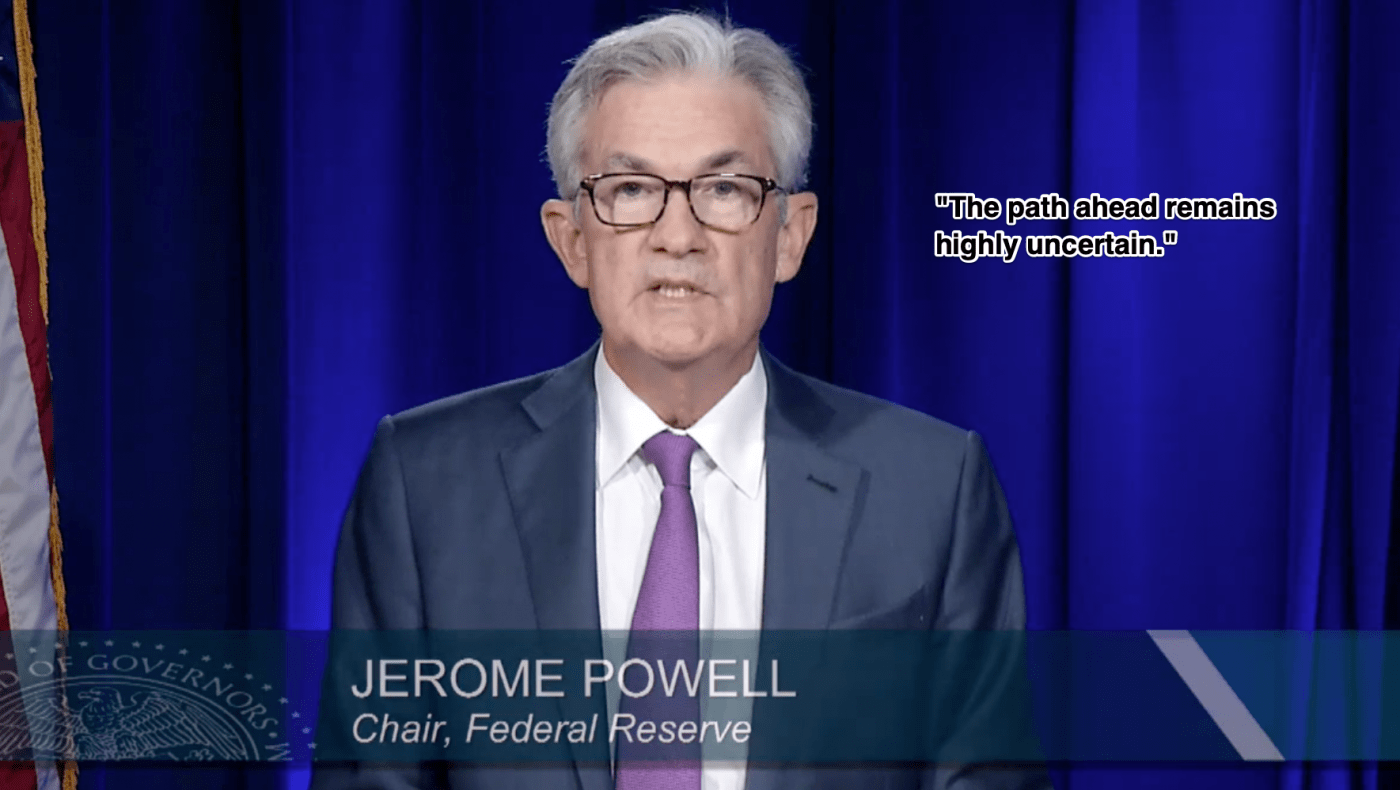

The Fed has history of intervention during financial collapses with rate reductions and other stimulation measures. Thus, traders, have gotten used to liquidity support, bet that the Fed will act in the same way this time.

According to the CME Fedwatch tool, the Federal Funs Futures market is now prices up to five rate drops in 2025. For the next May 7 meeting, there is a probability of 61% of a drop of 25 base points, which would reduce the target beach to 4.25 to 4.50%. At the end of the year, the market saw the rate of federal funds drop as low as 3.00 to 3.25%.

The risk, associated with growth in growth and bets to lower the rates of the Fed, gives the Trump administration what it wants – plunge the yields of the Treasury. The very important yield at 10 years – the reference for the American economy – fell to 3.923%.

The popular account is that lower yields would facilitate the treasure to refinance billions of dollars in debt in the next 12 months, which is why Trump administration can be more tolerant to the fainting of the asset market.

This refinancing emergency arises from a change of policy under the former secretary of the Treasury, Janet Yellen, who went from a longer coupons to the bills of the short -term treasure law. Since 2023, around two -thirds of the deficit had been funded by the issue of law – short -term debt with rates that oscillate approximately 5%. Although this may have temporarily supported liquidity, he created a delay bomb of an expensive short-term debt which must now be returned.