This is a daily analysis of Coindesk analyst and the approved market technician Omkar Godbole.

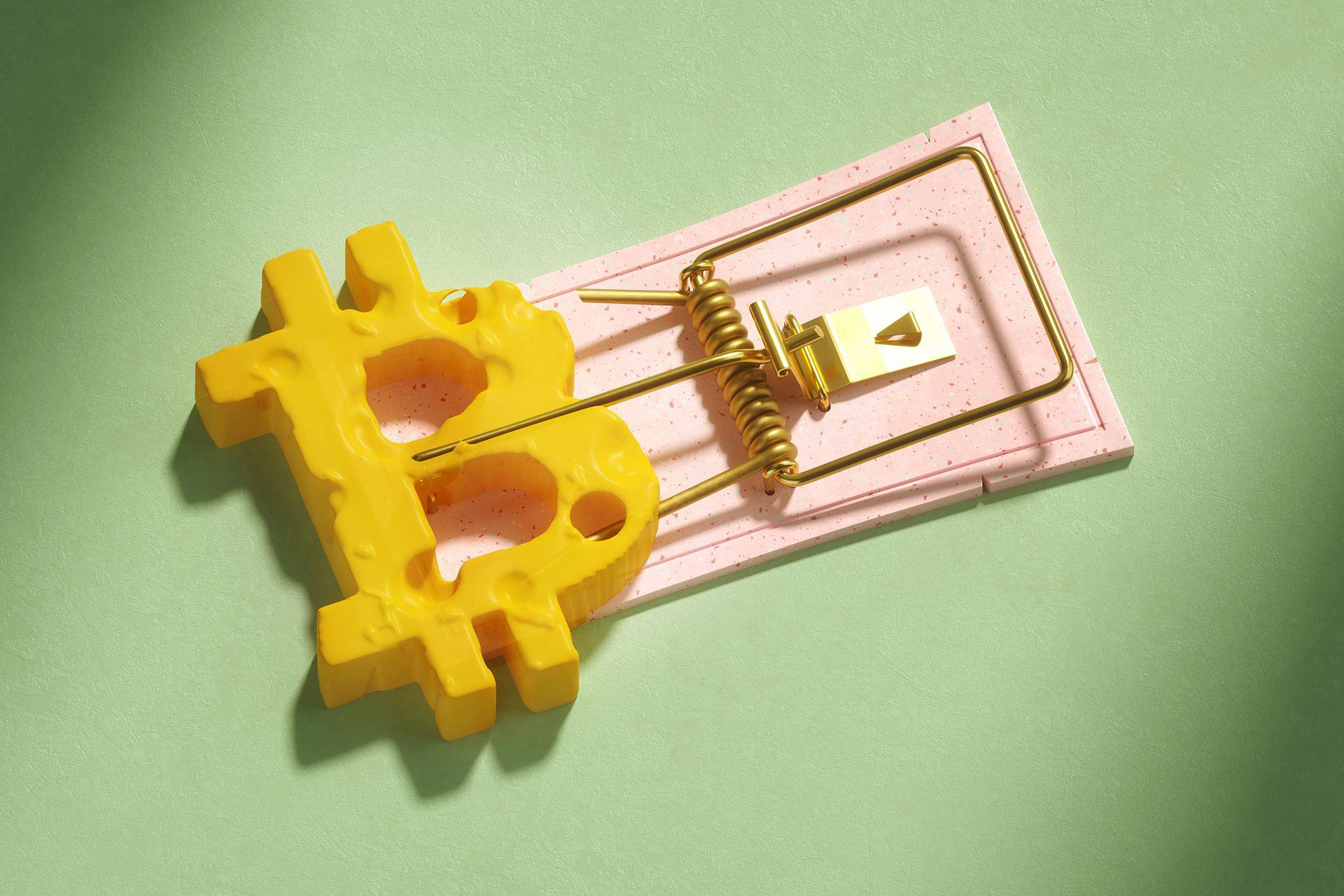

Major cryptocurrencies are optimistic, with the market leader Bitcoin Having a classic reverse head and shoulder break that could propel it around $ 120,000.

But there is a catch. The daily graphic of the S&P 500 E-Futures S&P displays a lower model, indicating a potential sale that could weigh on the cryptocurrency market and trap the bulls on the market side of the market.

S&P 500 Hits Record High With Rising Coin

The term contracts on the E-Mini have increased by almost 5% to a record summit of $ 6,542 since August 1. The slow ascent has taken the form of an upright corner pattern identified by convergent trend lines connecting on July 31 and August 15, the summits and the stockings reached on August 1 and August 22.

The convergent lines of trends indicate that the bullish momentum is declining, increasing the probability of sale.

When asked to identify and analyze the model on the term contracts on S&P 500, Google Gemini replied: “When a rising corner, which is a downward reversal model, appears after a prolonged gathering to record Pollback summits.”

Cryptocurrencies are known to closely follow the feeling of Wall Street, which means that a potential drop in S&P 500 could weigh on bitcoin and other cryptocurrencies.

Eye inflation

The chances of ventilation in the S&P 500 could increase sharply if the American consumer price index on Thursday (ICC) Print hotter than expected. Such a result, combined with the recent weakness of the labor market, can rekindle fears of stagflation – the worst case for risk assets – express additional pressure on actions and cryptocurrencies.

Median forecasts for the American consumer price index (ICC) In August 2025 was a 2.9% increase from one year to the next (not seasonally adjusted)According to Factst. If this estimate is true, it will be the highest annual increase since January 2025, when the IPC reached 3.0% and well above the target target of the Fed. In addition, this 2.9% figure would exceed the average inflation rate of twelve months of 2.6%.

More importantly, the median estimate (from one year to the next, not adjusted seasonally) For the basic IPC, which excludes food and energy, is 3.1%.

BTC, ETH options are already biased

The 25-delta risk inversions linked to the bitcoin and ether deribates options were negative at the expiration of December, according to the source of Amberdata data. In other words, BTC and ETH short and close and ETH were exchanged at a call for calls, reflecting a downward protective bias.

A sale option protects the buyer from a drop in the value of the underlying assets. A call provides asymmetrical upward exhibition. The reversal of risks at 25 Delta implies the simultaneous purchase of a sale option and a sale of a call, or vice versa.

According to the founder of insights options, Imran Lakha, the BTC put in Put in BTC is probably due to the institutions placing long -term hedges. The flows continued to go lower on the paradigm of the over-the-counter technological platform.

“The flows have again presented the [ETH] Sept. 26 4K Put, lifted up to 73 V, “noted the paradigm.

XRP is undecided, Doge looks north

While the opposite break in the head and shoulders of BTC suggests a strong optimistic direction, the action of XRP prices seems undecided.

The cryptocurrency focused on payments remains locked in a descending triangle and continues to be negotiated in the cloud of Ichimoku. Together, these indicators suggest a period of consolidation and uncertainty.

An escape from the triangle could invite a stronger purchase pressure, potentially leading to a re-test of $ 3.38, the high swing of August 8. That said, the descending triangle, in itself, is generally considered a lower motif. Indeed, the downward trend line linked to the lower connection indicates that sellers gradually become stronger and could soon penetrate the level of horizontal support.

Speaking of Doge, he resumed the upward trend line of the bottom of June, trapping the sellers on the bad side of the market. In addition, prices have gone through a bullish territory above the cloud of Ichimoku, which suggests a range for a test of the July summit of 28.76 cents.

However, merchants must still pay attention to a potential break up by the term of term contracts on S&P 500, because a reversal could cap the gains in Doge and weigh on its price moment.