Christmas

News context

The move comes as crypto markets remain volatile through the end of the year, when liquidity often declines and positioning tends to dominate price action. Traders have turned to short-term risk control rather than directional conviction, especially after recent sharp moves among the majors.

XRP also traded amid mixed signals from the analyst community. Some chart watchers have reported an ascending wedge structure that could push prices lower if support continues to erode, while others point to RSI divergence patterns that often appear near local exhaustion points. This split kept conviction low and reinforced the market’s tendency to blunt rallies near obvious resistance.

Technical analysis

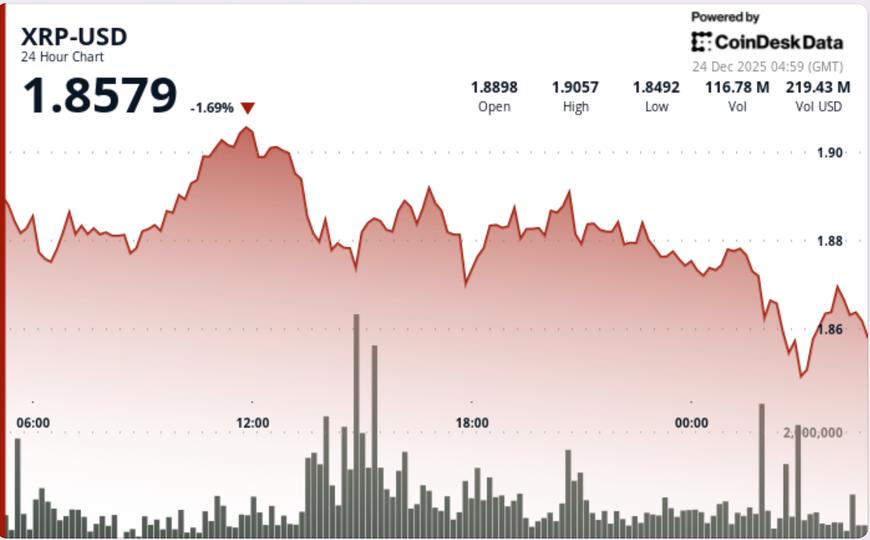

XRP spent most of the session using the $1.8615 to $1.8700 band as a working support zone, but late session selling pushed the price below that bottom and into a lower distribution range.

The key indicator was volume concentration at resistance. Trading peaked at around 75.3 million tokens during the rejection near $1.9061, nearly double the 24-hour average, suggesting that large players were active on the sell side to strengthen rather than stepping in to accumulate.

From an intraday perspective, the breakout from around $1.878 to the mid-$1.86 occurred with repeated volume spikes, including a 2.7 million burst during the decline from $1.867 to $1.865, reinforcing that the breakout was due to flow and not just drift.

Price Action Summary

- XRP rose from $1.8942 to $1.8635 over 24 hours

- Resistance held near $1.9061 on the highest volume of the session

- The support band at $1.8615 to $1.8700 broke late, moving the price towards a lower range.

- Trading remained mostly contained, with a range of $0.0395 (around 2.1%).

What Traders Need to Know

$1.87 moved from support to a near-term decision level. If XRP can reclaim this area and hold it, the move is more consistent with a range reset and a potential move back towards $1.90 – $1.91. Otherwise, the next area traders will focus on is $1.860 to $1.855, where buyers are expected to defend to avoid a deeper decline.

For now, the trend remains “sell bounces to $1.90, buy dips near $1.86”, and the next directional move will likely depend on whether volume increases on a breakout – not another probe of low liquidity inside the range.