Many have been made of the Bitcoin à l’Or sub -performance – which struck another discs on Tuesday, crossing more than $ 3,800 per ounce for the first time. But gold is not the only asset to party while Bitcoin stagnates less than $ 115,000.

American actions also made record heights on what seems to be daily, including the Bellwether S&P 500 index, which is perched just below the level of 6,700.

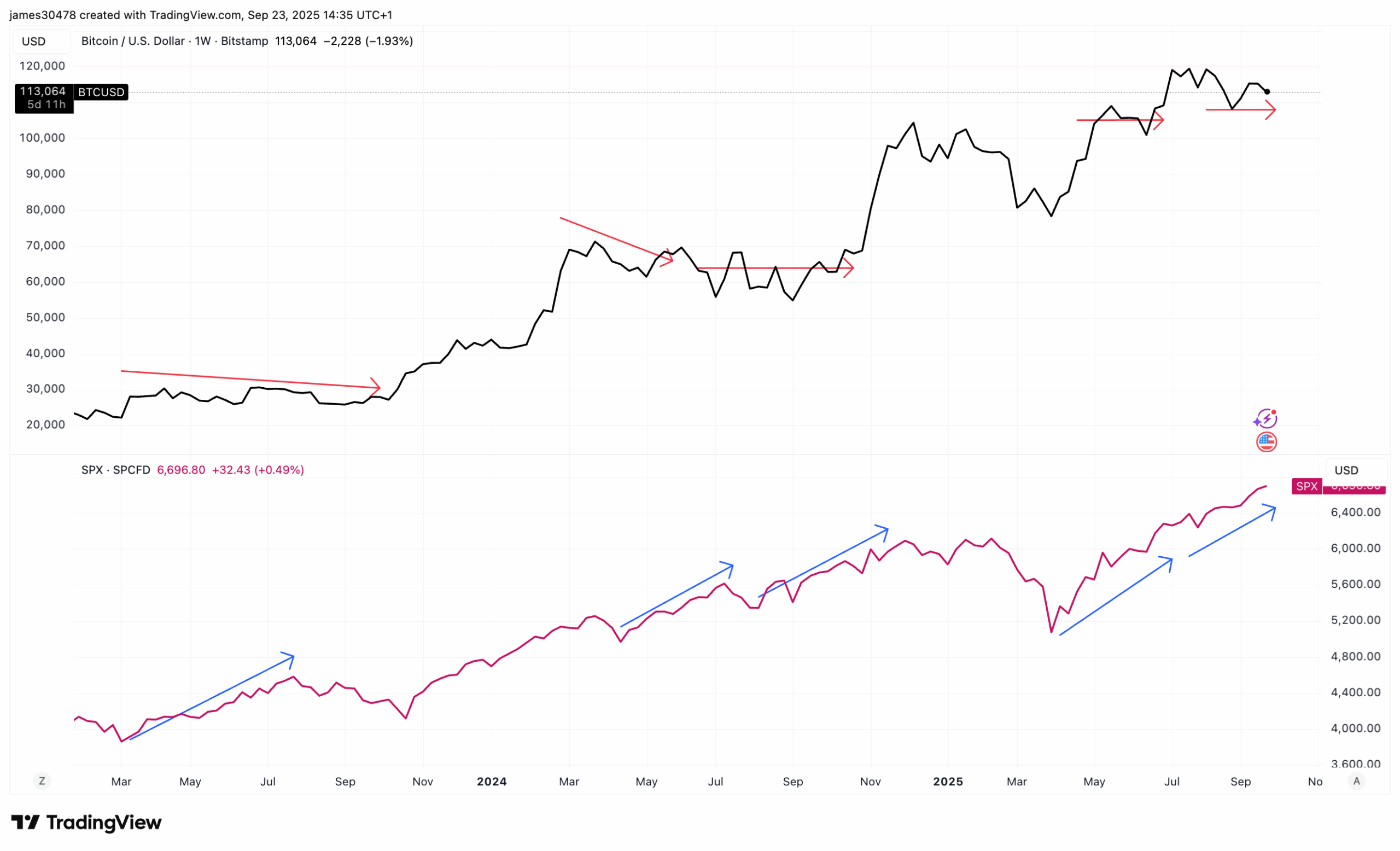

Even with the BTC in difficulty recently, the largest crypto in the world remains on a bull market and this is not the first time that this cycle, its performances diverge from that of the S&P 500.

The first divergence occurred between March and July 2024. During this period, the S&P 500 increased from around 4,000 to 4,600, while Bitcoin rose from just under $ 30,000 to $ 25,000.

The second divergence took place later that year when the S&P 500 gathered from 5,200 to 6,000 from April to October. With only a brief summer break. Bitcoin, however, did not follow, his rally not starting until November (alongside the results of the presidential elections).

As for this most recent divergence, the S&P 500 since May has progressed regularly, while Bitcoin consolidated in the range from $ 110,000 to $ 120,000. Bitcoin collapsed for new heights of all time in August, but these gains were quickly reversed, BTC returning to the bottom of its previous range.

History suggests that if Bitcoin and S&P 500 often move in the same general management, they diverge periodically for long periods. Data of at least this current cycle suggest that Bitcoin is likely to catch up with gold.