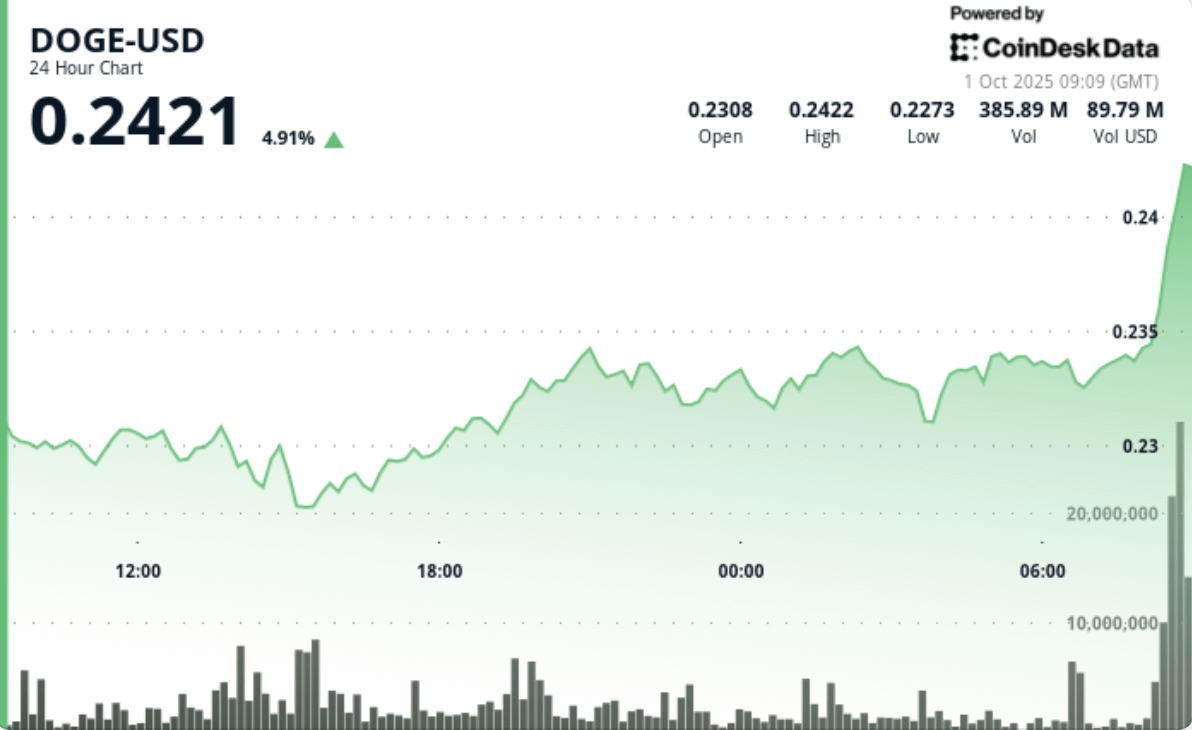

Dogecoin stabilized above key support while institutional flows anchored liquidity. Buyers have repeatedly defended $ 0.229 to $ 0.230, while the rejection volume capped at $ 0.234.

A push at the end of the session showed an impulse, but the conviction remains attached to whether Doge can maintain is closed beyond the resistance.

New context

DOGE increased by 1.6% between September 30, 9:00 am and October 1, 8:00 am, recovering from a small $ 0.227 to close to $ 0.234. Institutional offices dominated the flows, defending the area of less than $ 0.230 during Asian and European hours.

Resistance materialized at $ 0.234, where volumes exceeded the average 248.7 million tokens.

Analysts said the session reflected an increasing institutional presence on a market once defined by detail participation.

Summary of price action

The token exchanged inside a compressed range of $ 0.007, reflecting a volatility of 3%. The turnover of the afternoon increased above 400 m tokens-nearly two average levels. During the last hour, DOGE went from $ 0.233 to $ 0.234, with an increase of 15.3 million support from an escape attempt at 7:32 a.m.

Technical analysis

The support was validated from $ 0.229 to $ 0.230, where several defenses took place against the sale pressure. The resistance hardened at $ 0.234, with impressions of rejection capping rallies.

The tight corridor suggests a controlled price discovery dominated by institutional offices, rather than the volatility of retail.

Although late break shows a momentum, resistance greater than $ 0.234 is necessary to confirm the continuation of $ 0.240.

Which traders are looking at?

- If DOGE can decisively close more than $ 0.234 to return the resistance.

- If institutional entries support volumes above daily averages.

- Wider reaction of CD20 index with relative DOGE resilience.

- A potential retain of $ 0.240 if the support from $ 0.229 to $ 0.230 remains intact during the hours