Michael’s controversial controversial Bitcoin strategy is no longer fringe – it is imitated through American companies. According to a recent Wall Street Journal report, companies have raised more than $ 85 billion in 2025 to buy cryptocurrencies for their corporate treasury bills – more than double the amount collected in the US stock exchange this year.

Unlike 2020, when Saylor de Microstrategy was held alone in the sale of shares to buy Bitcoin, a new wave of companies – from toy manufacturers to semiconductor companies – performs similar strategies with institutional support. Capital Group, Galaxy Digital and D1 Capital are part of companies paying money in companies that collect funds to directly accumulate digital assets. The overvoltage has spread beyond Bitcoin to include less known tokens, often with higher risk reward profiles.

One of the most important examples is Hyperliquid Strategies Inc. (HSI), a public cryptographic treasure company during training to contain large media threshing reserves, the native token of hyperliquid blockchain.

How was HSI was created: Atlas and Sonnet unite their strengths

The HSI initiative was disclosed on July 14, when Sonnet Biotherapeutics (Nasdaq: Sonn) announced an inverted merger with Rorschach I LLC, a newly formed entity supported by Atlas Mercant Capital, ParadigM and other eminent investors. The transaction will transform Sonnet into a vehicle for a cryptographic business strategy of treasury focused on media threshing.

At the end, the combined entity will be renamed Hyperliquid Strategies Inc. (HSI) and will continue to negotiate on the Nasdaq capital market. HSI will initially hold 12.6 million media tokens, worth $ 583 million when signing. It will also allocate at least $ 305 million in additional capital to acquire more media threshing on the free market, creating one of the greatest vouchers focused on Altcoin.

Sonnet will remain a subsidiary in exclusive HSI property, now its biotechnological R&D in parallel. Investors will receive contingent value rights (CVR) linked to the performance of Sonnet’s therapeutic pipeline.

The Board of Directors of HSI will be chaired by Bob Diamond, former CEO of Barclays and co-founder of Atlas Merchant Capital. Eric Rosengren, the former president of the Boston Federal Reserve, should join as director. The agreement is supported by Galaxy Digital, Pantera Capital, D1 Capital, Digital Republic and 683 capital, and should close the second half of 2025.

What is hyperliquid and how does the media threshing token work?

The hyperliquid is the name of a decentralized exchange (DEX) and a high performance layer 1 blockchain launched in 2023. It was designed to offer the speed and commercial experience of centralized exchanges with transparency and access without authorization to decentralized financing (DEFI).

Its infrastructure includes two central layers:

- Hypercore, which feeds the place at high speed and perpetual trading with chain control books – supporting more than 200,000 orders per second.

- Hylerevm, a layer of intelligent contract for general use compatible with Ethereum, allowing developers to create DEFI applications which can interact with hypercore liquidity.

Médiatique is the native token of the hyperliquid ecosystem. It is used for stimulum, governance, commercial incentives and as a basic active in value capture through the network. At the time of the editorial staff, the media threshing is the fifteenth cryptocurrency by market capitalization and the hyperliquid has treated more than 1 dollars billion in volume of cumulative negotiation.

Analysts commentary: solid fundamentals, divergent views

The sharp increase in institutional attention did not pay the debate on the assessment of the media threw – despite its solid rally earlier this quarter, from a hollow of $ 37.41 to almost $ 50 (reached on July 14).

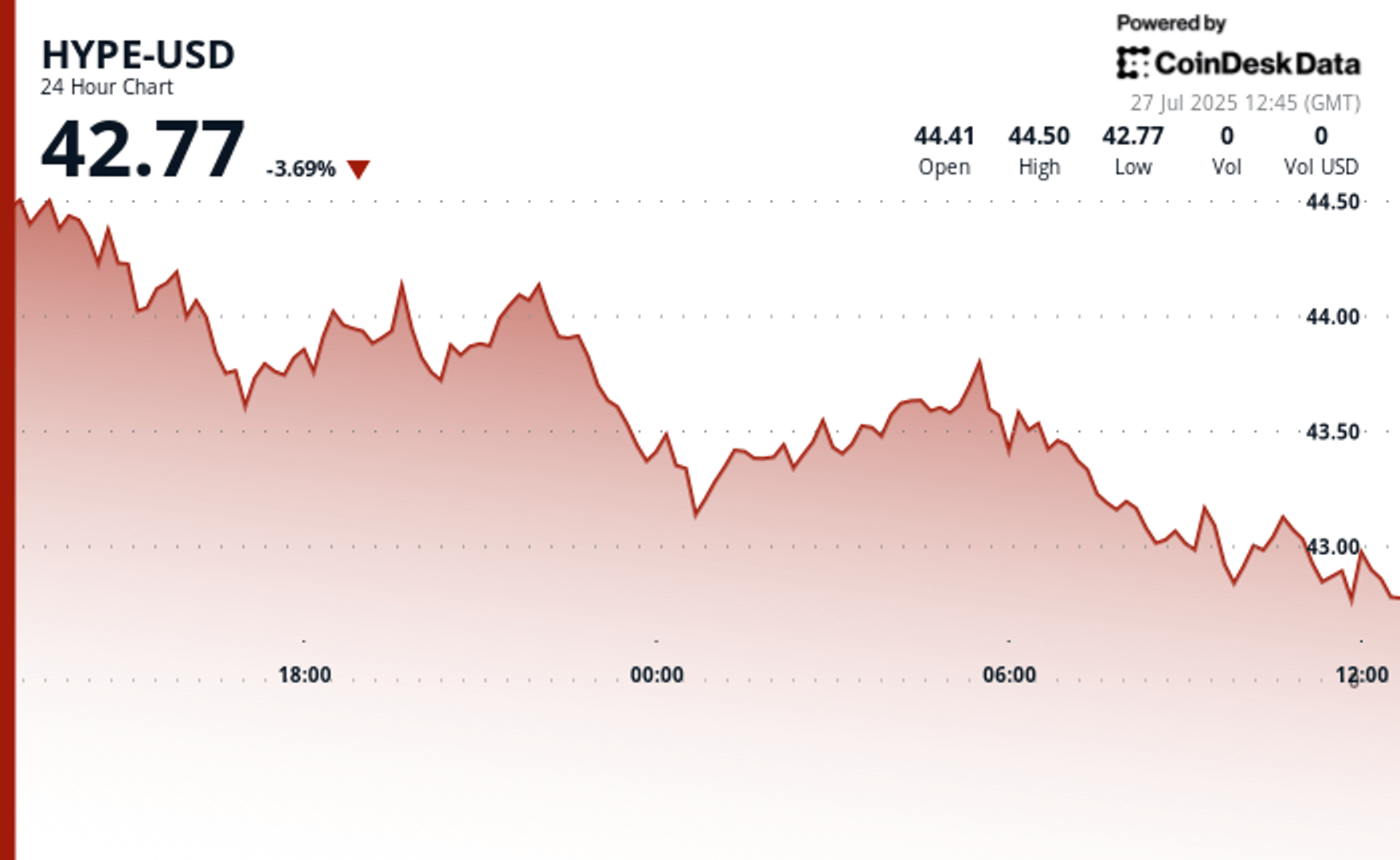

At the time of writing the editorial staff, according to Coindesk data, media threshing is negotiated at $ 42.77, down 3.69% in the last 24 -hour period.

Crypto analyst “McKenna” suggested on Saturday that the beateering could still be undervalued according to income metrics. He estimated that if the token was neglected at the same evaluation multiple (known as SWPE, or prices with weighted profits), it reached during its last peak in the market, its current average turnover of $ 3.2 million would imply a just $ 77 price. Its analysis uses a ratio comparing market capitalization to the income of the train platform – a common method both in the shares and the analysis of the tokens.

On the other hand, “Altcoin Sherpa” reported caution earlier during the day. Although he rents the fundamentals of Hype – including a high user activity, a reliable token and a strong team execution – he declared that the $ 9 to more than $ 40 has exhausted the short -term increase. He said he had a small ignition position for long -term exposure, but did not actively accumulate more at current prices. He suggested that he would expect a more substantial withdrawal before increasing his allowance.

The two points of view illustrate a key tension: even with high income and institutional support, tokens such as the beateering can become too extensive in the short term – in particular when they are motivated by narrative impulse and speculative capital.

Institutional Altcoin bets are just beginning

Whether the media is continuing to climb or cool from here, the creation of Hyperliquid Inc strategies marks a turning point in the way the strategies of the business cryptography treasure are being executed. Unlike previous models focused on bitcoin as a digital reserve ratio, HSI is under construction around a single Altcoin which did not exist a year ago. With more than $ 888 million in combined commitments and cash, the structure resembles a thematic cryptography fund – but with public registration and institutional leadership.

If this approach turns out to be successful, more companies can follow – increase capital not only to hold the crypto, but to take concentrated positions in the tokens, according to them, will define the next phase of digital finance.