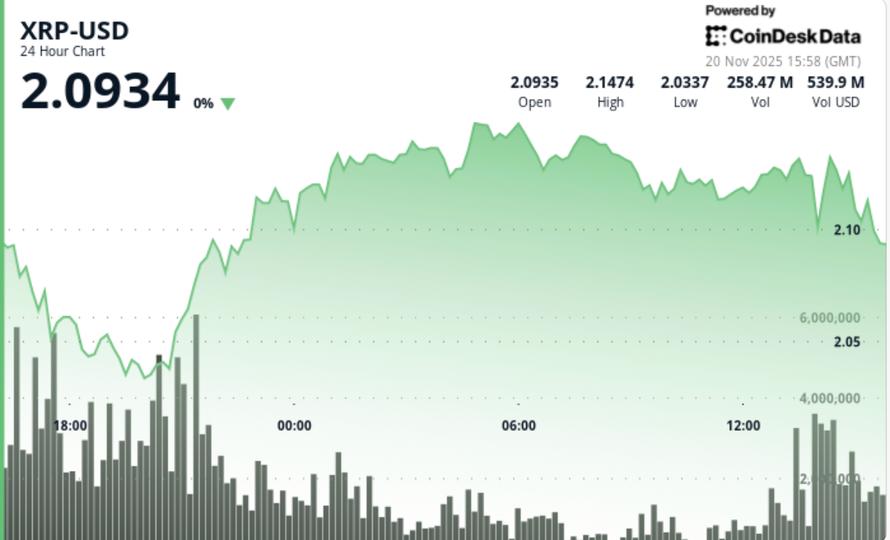

The token broke the critical $2.10 low during late-session selling as traders exited positions ahead of a potential deeper correction.

News context

• XRP traded in a volatile range of $2.03 to $2.15 as broader crypto markets weakened under macro pressure.

• The token’s strong rebound from $2.03 occurred amid a 28% volume increase, signaling active buying on the dip before the momentum faded.

• Multiple failed attempts to reclaim the $2.14-$2.15 area capped on the upside throughout the session.

• Market sentiment remains fragile as Bitcoin death and strong ETF outflows weigh on altcoins.

• Institutional activity slowed sharply over the last hour of trading as XRP broke above the widely watched $2.10 support level.

Price Action Summary

The The token initially showed resilience in the face of broader market weakness, but the bullish momentum steadily deteriorated.

The largest movement occurred at 9:00 p.m. UTC when a volume spike of 177.9 million…28% above the 24-hour average– helped XRP rebound strongly from $2.03. However, the recovery stalled several times at the $2.14 to $2.15 resistance band. A pattern of lower highs developed as sellers absorbed each breakout attempt.

The session ended with a decisive breakout: XRP plunged from $2.124 to $2.103 as heavy selling volumes hit the band. The drop hit cleanly across the critical support at $2.10a level that had lasted for several sessions.

End-of-session liquidity collapsed, signaling that institutional traders were moving to the sidelines ahead of possible continued selling.

Technical analysis

XRP’s chart structure turned firmly bearish as breakdown signals piled up on intraday time frames.

Support and resistance dynamics

The loss of $2.10 turned previous support into immediate resistance. Meanwhile, the market is now oriented around the cycle low at $2.03which formed when rejecting large volume earlier in the session. Failure to recover $2.14 to $2.15 keeps the near-term cap well defined and risk tilted to the downside.

Volume behavior

The rise of 177.9 million during the rebound from $2.03 confirmed strong participation, but the lack of follow-up volume during recovery attempts signaled exhaustion. The last-hour outage occurred on 4.4 million units in a single interval, enough to trigger an algorithmic dynamic sell-off.

Trend structure

XRP now prints a clear sequence of higher highs and lower lowsconsistent with early-stage continuation structures that often precede retests of major swing supports. The broader trend remains under pressure from an unresolved medium-term decline that began after repeated failures above $2.48.

Dynamic conditions

Short-term oscillators are approaching oversold values, suggesting potential stabilization if $2.03 holds. But without reclaiming $2.15, any rebound risks becoming reactive rather than structural.

What traders should watch out for

XRP stands at an unstable inflection point:

• $2.03 must be withheld to avoid a deeper break towards higher level support at $1.91-$1.73

• A recovery of $2.15 is necessary to neutralize the bearish continuation structure

• Liquidity conditions suggest that institutions suspended activities after the fall from $2.10; volume renewal will dictate the next pulse.

• Bitcoin’s weak structure and death dynamics continue to put disproportionate pressure on altcoins.

• Watch for volatility clusters around derivatives liquidation points: XRP has seen around $28 million liquidated in previous sessions, and further forced selling could accelerate moves.