Le XRP a bondi à 2,02 $ après que les acheteurs ont forcé une cassure nette à 1,96 $ sur un volume important, basculant un plafond clé en support et mettant l’accent sur la question de savoir si le jeton peut se maintenir au-dessus de 2,00 $ assez longtemps pour déclencher une deuxième étape à la hausse.

News context

The move comes as traders re-engage with large-cap stocks after a rough patch that repeatedly rejected XRP above the $2.00 mark. For XRP in particular, the $1.96 level has acted as a recurring decision point over the past few sessions: rallies that briefly passed it have often struggled to sustain, while failures at this level have attracted rapid selling.

This time, it was the quality of the breakout that made the story: rather than a slight pop triggered by stops, the rally occurred with sustained volume, suggesting that the largest participants were active. With positioning still sensitive in early January, XRP’s ability to stay above $2.00 could influence whether marginalized traders return or treat this move as another selling opportunity.

Technical analysis

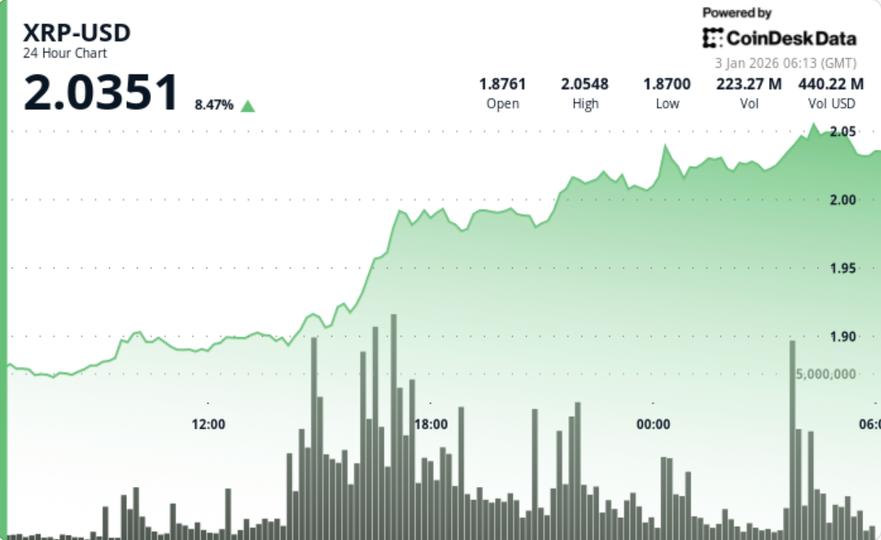

XRP surged 8.7% from $1.8766 to $2.0227 during the 24-hour session ending January 3, with a breakout gaining momentum at 17:00 UTC, when volume surged to 154.4 million – approximately 142% above the session average – and the price pushed decisively up to $1.96.

This level is the inflection point. The $1.96 breakout turned the previous high into a potential bottom, and XRP followed the $2.00 to $2.03 band rather than immediately going back below. Price then established a new pocket of support near $2.01 to $2.03, which traders will treat as the “must hold” zone if this breakout is to persist.

Late session action showed the first real test: XRP fell from a high of $2.031 to around $2.023, attracting $1.59 million in volume during the decline. Importantly, this pullback remained controlled – a retracement of around 0.4% – and did not turn into a cascade to $2.00. This is the profile traders want to see after a breakout: a digestion, not an immediate rejection.

Price Action Summary

- XRP rose from $1.8766 to $2.0227 (+8.7%) over 24 hours

- The key breakout occurred as XRP crossed $1.96 on a volume burst of 154.4 million.

- XRP established a new support zone of $2.01-$2.03 above the psychological level of $2.00

- The price pulled back slightly from $2.031 to $2.023, keeping the breakout structure intact.

What Traders Need to Know

This move is now about holding the flip, not chasing the breakout.

The levels are clean:

- If XRP holds $2.01 to $2.03 and keeps $2.00 intact: the breakout remains valid and the market can start working towards $2.03 to $2.05 and then towards the next resistance pocket above. Sustained trading above recent consolidation highs would indicate that buyers are still in control.

- If XRP loses $2.00 and falls below $2.01: This becomes a “no follow-through breakout” and the market is likely to retest $1.96 – now the key line between a bullish reset and a return to the previous range.

- If $1.96 fails the retest: The rally risks being treated as a liquidity event, reopening the decline toward the pre-breakout base.

Bottom line: $2.00 is the overall level, but $1.96 is the real limit. If the bulls defend both, the band can create a continuation move. Otherwise, it will return to the same range that the market just escaped from.